10 Strategies for Paying Off Debt Faster

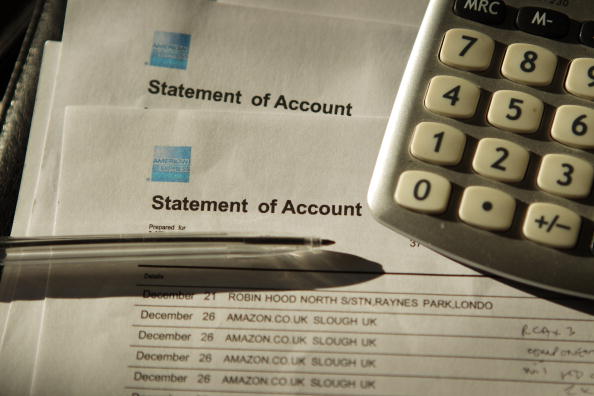

Tackling debt issues head-on can feel like an overwhelming undertaking, akin to climbing a mountain that never seems to end! However, conquering debt is not only about paying off what you owe. If you’re unsure about how to start, follow these ten helpful tips to regain control of your financial destiny. Target the Credit Card […] More