There are things in life that you never imagine happening to you – or to anyone. Unfortunately, they happen. These are things so awful and so disgusting that you can’t even imagine that there are people in the world willing to stoop so low, but there are. Sadly, as a parent you now have even more to worry about than your children finding out too much about the world online or hearing inappropriate language on primetime television. You now have to worry about your child’s financial future in a way that stems so much further than just college tuition and expenses. You now have to worry that some awful criminal is going to steal the identity of your child and use it to fund their own over-the-top extravagant lifestyle until they can no longer use your child and move on.

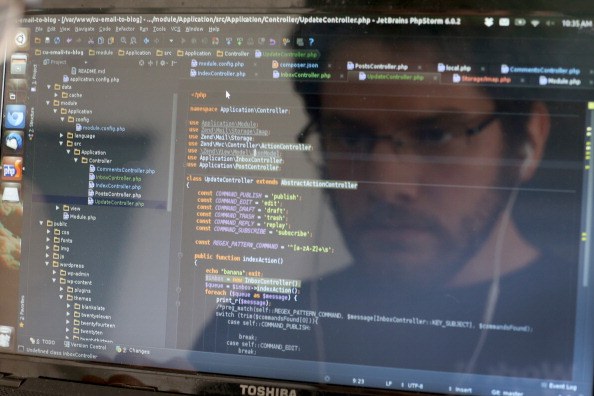

That’s right; you heard me. People are now stealing the identities of children so that they can open credit cards and other credit accounts in the name of those kids. And your job is to protect your kids since they are too young to do it themselves. It’s a sad world we live it, but you can never be too careful. Criminals all over the world have more sophisticated technology than ever before, and that makes it too easy for them to gain access to the personal information of just about anyone in the world; including innocent children. Children make great targets for identity thieves; too, because they do not check their credit reports, and they do not apply for credit often enough to make it obvious that there might be something questionable going on. By the time these small victims are old enough to realize their identities have been stolen, the thieves are virtually all but impossible to find or locate which means they’ve gotten away free and clear. Here is how you can help protect your child’s credit right now.

Check Your Child’s Credit Report

Here is the deal about this; kids do not have credit reports. There is no way you can check your child’s credit report unless your child has already been victimized through identity theft. It’s sad, but it does happen. What you can do is try to check your child’s report periodically. If one appears, it’s time to call the credit bureaus and put a freeze on this account. It’s also a good idea to go ahead and let the credit bureau know that this is not the account of a toddler, and they will take care of helping you handle this situation before it ever affects your child.

You can do this twice a year or more often if you want. The earlier you catch something, the easier it will be to fix the issue. However, most people do not check their reports aside from once or twice a year for good reason.

Freeze Your Child’s Credit

Your child cannot have his or her credit account frozen until he or she has already been the victim of identity theft. However, some states have a law that allows the parents of a child to open a credit account in their child’s name for the sole purpose of freezing the account. Once it’s frozen there is no way that credit can be issued to anyone in the name of your child unless the account is specifically thawed. It’s a consideration to help you protect the identity of your child now while his or her credit is still intact.

Know the Signs

There are some serious signs that can warn you that your child has been the victim of identity theft. One of the most common signs is calls for your child. The only people who should be calling your home for your child is family and close friends to wish them happy birthday or whatever. There should not be credit collection calls for small kids. If your child is receiving collections calls, don’t assume it’s a coincidence that someone else with the same name is being redirected to you. Assume the worst and get to the computer to check that credit report. You will need to be able to document any information on it and be able to verify the accounts on this report do not belong to your child.

Another common sign of a credit issue is that your child is turned down for insurance or government assistance because the social security number is already in use. If this happens, check that report to see what’s going on. You’ll also want to take note of any mail or information that comes from the Internal Revenue Service in the name of your child; he or she should not get any information from the IRS, especially regarding past-due tax bills and liability. Your child is a child; not an income tax filer.

Check the Mail

The number one sign of identity theft in a child is mail that comes addressed to him or her. If you see that your child is beginning to get credit card offers or other offers for credit in the mail, it’s a good idea to check the credit report of your child to find out what’s going on. Your child should not receive information like this in the mail. It’s one of the most obvious warning signs.

Protect Your Child

Aside from checking your child’s credit report every few months and freezing his or her credit if you can, there is really nothing you can do to protect your child other than the basics. Do not keep his or her social security card in your handbag. Keep it in a safe deposit box. Do not keep your child’s personal information anywhere public enough for anyone else to access it, even if it is in your house. Be careful, too, when providing others with your child’s personal information. Not everyone who takes this information is trustworthy, and that’s sad. Monitor your kids’ credit and take immediate action if anything should begin to look suspicious.

Photo by Joe Raedle/Getty Images

Comments

Loading…