Retirement should be a time of relaxation, security, and well-earned freedom—but for many, it becomes a period of unexpected stress and financial strain.

The problem often lies not in how much someone earns, but in how they plan (or fail to plan) for the future. While some mistakes are understandable, others can derail years of hard work.

Poor timing, misinformation, and unrealistic expectations are just a few of the culprits that leave retirees struggling to maintain their lifestyle. The good news? Most of these pitfalls are preventable with foresight and discipline.

Below are 20 of the biggest retirement planning mistakes people make, as well as how you can avoid falling into the same traps.

1. Underestimating How Much Money They’ll Need

Retirement can be a time of financial surprise if not planned properly. Many retirees find that their social security benefits and savings are not sufficient, especially when inflation, healthcare costs, and increased longevity come into play. A small nest egg may seem adequate initially, but unexpected expenses can quickly deplete savings.

Healthcare costs are a significant concern, often unplanned for by many. As life expectancy increases, people may find themselves living 25-30 years post-retirement, stretching their savings thin. Planning for these variables is crucial to avoid financial stress during retirement.

Foresight and careful planning are key to ensuring a comfortable retirement. Estimating future needs, considering inflation, and planning for potential healthcare costs can prevent financial shortfalls. Consulting with a financial planner can provide valuable insights into anticipating and managing retirement expenses.

2. Not Starting Early Enough

Even a few years of delay in retirement savings can substantially diminish the power of compound interest. Young professionals often prioritize immediate financial needs over long-term planning, but this can lead to a less secure future.

Starting early allows individuals to take advantage of compound growth, which can significantly enhance retirement savings over time. The difference in savings between starting at age 25 versus age 35 can be staggering.

Making small contributions early in one’s career can lead to large rewards later. By prioritizing retirement savings from a young age, individuals can enjoy a more secure and comfortable retirement.

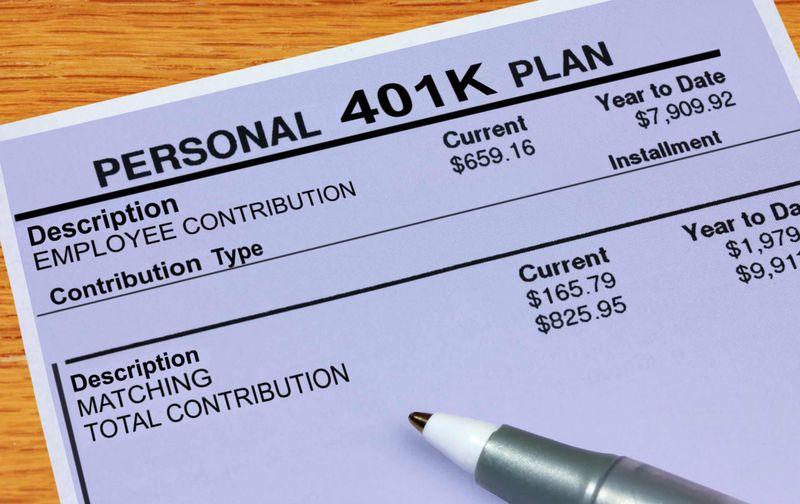

3. Failing to Max Out Employer Matches

One of the most common mistakes is not taking full advantage of employer matching contributions in retirement accounts. This oversight is essentially leaving free money on the table.

Employer matches can significantly boost retirement savings without any additional effort from the employee. Many fail to contribute enough to receive the full match, thus missing out on valuable financial growth opportunities.

Understanding your employer’s matching policy and contributing enough to maximize this benefit can substantially increase retirement savings. It’s a simple yet effective strategy to secure a more comfortable future.

4. Banking on Social Security Alone

Relying solely on Social Security for retirement income can lead to financial struggles. Many people are unaware that Social Security was never meant to be a person’s only source of retirement income.

The benefits from Social Security may cover only a fraction of living expenses, leaving retirees to face financial challenges. This dependence can result in a lower standard of living and financial hardship.

Diversifying income sources and planning for additional savings is vital. By not relying solely on Social Security, retirees can ensure a more stable and enjoyable retirement.

5. Ignoring Healthcare Costs

Healthcare expenses are often one of the most significant and overlooked costs in retirement planning. Many retirees are unprepared for the high costs of medical care and long-term care needs.

Without proper planning, these expenses can rapidly deplete retirement savings. Medicare does not cover all medical expenses, and gaps can lead to unexpected financial burdens.

Considering various healthcare plans and saving for potential medical costs can help mitigate this risk. Planning for long-term care and understanding Medicare options can provide peace of mind and financial security.

6. Assuming They Can Work Forever

The belief that one can work indefinitely into retirement age is often met with reality checks such as health issues or company layoffs. Many plan to continue working to support their lifestyle, but unforeseen circumstances can abruptly alter these plans.

Health problems or job loss can force early retirement, leaving individuals financially unprepared. Relying solely on continued employment can be risky and unrealistic.

Planning for retirement without the assumption of endless work years can lead to better financial security. Building a robust savings plan ensures a more stable future, regardless of employment status.

7. Cashing Out Retirement Accounts Early

Early withdrawals from retirement accounts can seem tempting but come with expensive penalties and taxes. This decision can also significantly reduce the future earning potential of retirement savings.

Many individuals cash out early to meet immediate financial needs, not realizing the long-term consequences. The compounded growth that could have been achieved is lost, putting retirement security at risk.

Understanding the rules and penalties for early withdrawals can help individuals make better financial decisions. Maintaining discipline and avoiding early cash-outs ensures stronger financial health in retirement.

8. Not Creating a Written Retirement Plan

Without a clear and written retirement plan, individuals often find themselves making poor financial decisions. A vague understanding of goals can lead to uncertainty and anxiety about the future.

A written plan helps outline specific goals, strategies, and actions needed to achieve a secure retirement. It serves as a roadmap to guide financial decisions and track progress.

Taking the time to document a comprehensive retirement plan can provide clarity and confidence. Working with a financial advisor can further refine the plan and adjust it as needs and circumstances change.

9. Underestimating Longevity

Many people underestimate how long they will live, leading to inadequate retirement savings. Planning for only a decade or two can result in financial strain as life expectancy continues to rise.

The possibility of living 25–30 years in retirement is becoming more common, requiring more substantial savings to cover these extra years. Longevity risk can drain resources faster than anticipated.

Considering extended life expectancy when planning can help ensure financial security. Preparing for longer retirement years allows individuals to maintain their lifestyle and peace of mind.

10. Over-Investing in Employer Stock

Investing heavily in employer stock can create significant financial risk if the company faces downturns. Many employees feel loyal and confident in their company’s success, leading to over-investment.

Tying too much of one’s retirement portfolio to a single company can lead to severe losses if the company struggles. Diversification is key to reducing investment risk.

Balancing investments and diversifying can protect retirement savings from unforeseen company issues. It’s crucial to evaluate the risks and ensure a balanced portfolio for long-term growth.

11. Poor Asset Allocation

Striking the right balance in asset allocation is vital for protecting and growing retirement savings. Being too conservative or too aggressive with investments can erode savings over time.

An overly aggressive approach may expose retirees to significant risks, especially in volatile markets, while being too conservative can result in missed growth opportunities.

Regularly reviewing and adjusting asset allocation in line with risk tolerance and financial goals ensures a more secure retirement portfolio. Seeking professional advice can aid in making informed decisions.

12. Neglecting to Rebalance Portfolios

Failing to regularly rebalance investment portfolios can lead to unwanted risk exposure or missed growth opportunities. As markets fluctuate, the original allocation may become skewed, affecting overall performance.

Regular rebalancing ensures that the portfolio remains aligned with an individual’s risk tolerance and financial goals. Ignoring this can result in an overexposure to certain asset classes.

Setting a schedule for rebalancing and staying disciplined in maintaining the desired allocation can protect against market volatility. This practice supports a more secure financial future.

13. Not Factoring in Inflation

Inflation is a gradual risk that can significantly affect retirement savings. Many people overlook how it erodes purchasing power over time, leaving them financially vulnerable.

A dollar today won’t have the same value in the future, and failing to plan for inflation can result in inadequate savings. This oversight leads to a reduced ability to maintain a desired lifestyle.

Incorporating inflation projections into retirement planning ensures that savings will last and meet future needs. Understanding inflation’s impact helps individuals build a more resilient financial plan.

14. Forgetting About Taxes in Retirement

Taxes don’t disappear in retirement; in fact, they can become a significant burden if not planned for. Many retirees are surprised by the taxes on withdrawals from retirement accounts.

Failing to account for taxes can lead to unexpected financial strain and reduced disposable income. Understanding the tax implications of various accounts is crucial for effective planning.

Strategizing withdrawals and considering tax-efficient investments can help manage this burden. Planning for taxes ensures a smoother transition to retirement living and financial stability.

15. Taking on Too Much Debt Late in Life

Retiring with substantial debt can severely strain fixed income. Mortgages, credit cards, and even student loans can become overwhelming, reducing financial freedom.

Carrying significant debt into retirement may lead to financial stress and limit lifestyle choices. High-interest debts can quickly eat into savings, making it difficult to cover essential expenses.

Paying down debts before retirement helps alleviate these pressures and allows for a more comfortable lifestyle. Prioritizing debt reduction as part of the retirement plan ensures greater financial security.

16. Supporting Adult Children Financially

Helping adult children financially can endanger retirement security. Many retirees find themselves dipping into savings to support their children, jeopardizing their financial independence.

While it may be well-intentioned, this support can lead to reduced savings and limited resources for oneself. The financial strain can affect the ability to enjoy a secure retirement.

Encouraging financial independence in adult children and setting boundaries helps protect retirement funds. This ensures that retirees can maintain their financial stability and enjoy their golden years.

17. Not Considering Housing Options

Housing decisions have a major impact on retirement savings. Failing to downsize or relocate to a more affordable area can rapidly deplete savings.

Many retirees hold on to larger homes than necessary, leading to inflated living costs. Maintenance, property taxes, and utility expenses can quickly add up.

Exploring different housing options and considering downsizing can free up resources for other retirement needs. Making informed housing choices supports long-term financial security and peace of mind.

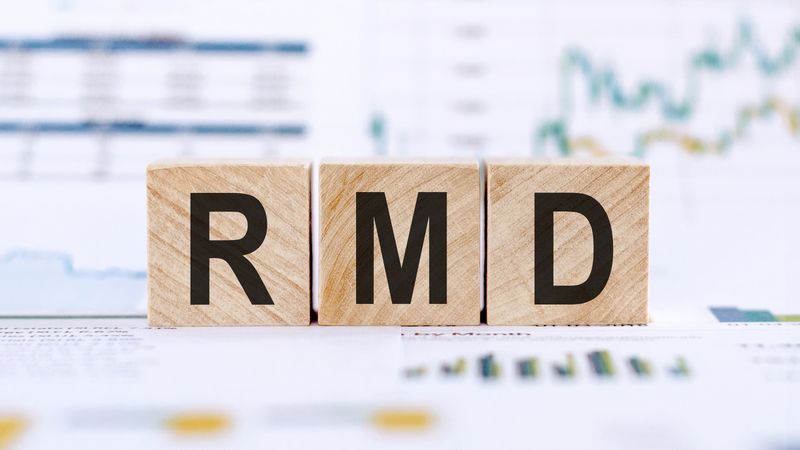

18. Ignoring Required Minimum Distributions (RMDs)

Missing Required Minimum Distributions (RMDs) can result in significant penalties. Retirees over the age of 73 (as of 2025) must take these withdrawals from certain retirement accounts.

Failing to take RMDs leads to a hefty penalty of up to 50% on the required amount. It can also disrupt financial planning and cash flow.

Understanding RMD rules and integrating them into the retirement strategy is crucial. Keeping track of deadlines and consulting with a financial advisor ensures compliance and financial efficiency.

19. Not Planning for Widowhood

The sudden loss of a spouse can lead to severe financial hardship. Many couples fail to plan for the possibility of widowhood, leaving the surviving spouse vulnerable.

Income and benefits can drop significantly, creating a challenging financial situation. Without proper planning, maintaining the same standard of living can become difficult.

Incorporating widowhood scenarios into retirement planning helps protect against these risks. Ensuring adequate insurance and financial resources supports a smoother transition during difficult times.

20. Failing to Seek Professional Advice

Many underestimate the value of professional advice when planning retirement. DIY planning can lead to missed opportunities, tax mistakes, and the underestimation of risks.

Financial advisors provide insights and strategies tailored to individual needs, ensuring a more secure financial future. They can identify gaps in planning and offer solutions to enhance retirement readiness.

Seeking expert guidance helps retirees make informed decisions and optimize their financial plans. It provides peace of mind and confidence in navigating the complexities of retirement.

Comments

Loading…