The 10 Retirement Expenses You Must Cut (If You Want Your Money to Last)

Retirement should feel like freedom, not a monthly money mystery.

You worked hard to get here, so every dollar deserves a job that actually serves your life.

Cut the waste, keep the joy, and make your savings last longer than your bucket list.

Let’s trim the budget where it sneaks away fastest and redirect that cash into peace of mind.

1. High-interest debt (credit cards/loans)

You already paid for yesterday.

You should not keep paying again with sky-high interest.

Credit card balances and personal loans drain cash flow, turning small purchases into long-term headaches.

Attack balances with a focused plan.

Start with the highest interest rate or use a quick-win approach to build momentum.

Consider a low-interest balance transfer or a nonprofit credit counseling program if rates feel crushing.

Automate payments so you are never hit with fees.

Pause new spending while you pay it down, then celebrate the breathing room.

The less interest you pay, the more you can spend on experiences that actually matter.

2. Car payments (downsizing vehicles)

Cars quietly chew through retirement cash.

Monthly payments, insurance, maintenance, and fuel all add up fast.

If the vehicle is more car than you need, consider a strategic downsizing.

Trade the pricey SUV for a reliable, paid-off sedan or hybrid.

You may save on gas, repairs, and insurance in one move.

Ask for insurance quotes before switching to see the full impact.

Keep a sinking fund for repairs instead of financing a new ride.

Use public transit, rideshare, or car share when it makes sense.

The goal is simple: mobility without the money pit.

3. Oversized housing costs (too much house/fees)

Big house, big bills.

Heating and cooling unused rooms is like tipping a utility company for nothing.

Property taxes, insurance, HOA fees, and maintenance can quietly wreck a fixed budget.

Downsizing is not giving up comfort.

It is buying back freedom, time, and cash flow.

A smaller place can mean lower taxes, cheaper utilities, and less upkeep.

Run the numbers with realtor estimates and moving costs.

Factor in closing fees and potential rent versus own comparisons.

Then choose the home that matches your life now, not a past chapter.

4. Unused subscriptions (streaming, apps, boxes)

Those small monthly charges pretend to be harmless.

Add them up and you might find a car payment hiding in your apps.

Streaming, cloud storage, fitness subscriptions, and mystery boxes often auto-renew forever.

Audit your bank and card statements for the last year.

Cancel duplicates, trials, and the services you barely touch.

Rotate streaming platforms based on what you actually watch.

Use shared family plans where allowed and negotiate loyalty discounts.

Set calendar reminders before renewal dates.

Every canceled subscription is a raise you gave yourself.

5. Cable + pricey internet bundles

Bundled packages love to lock you into bloated bills.

You often pay for channels you never watch and speeds you do not need.

That money could fund travel or hobbies instead.

Call your provider and ask for a retention deal.

If they balk, switch to internet-only and add a low-cost streaming setup.

Use a modest speed that matches your actual usage.

Consider an over-the-air antenna for local news and sports.

Combine free trials with monthly rotations to avoid paying for everything at once.

You control the remote and the budget.

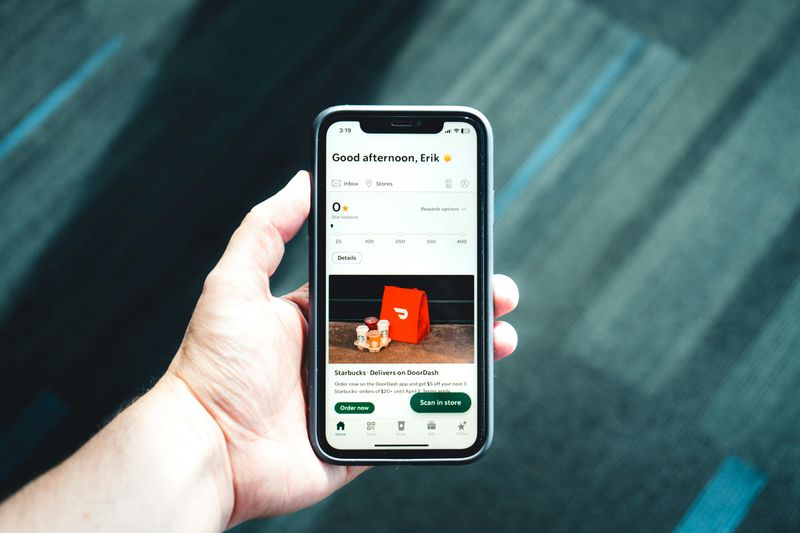

6. Restaurant meals and delivery

Convenience tastes great but gets expensive fast.

Delivery fees, tips, and inflated menu prices can triple the bill.

A few nights a week turns into a serious budget leak.

Plan simple meals you actually enjoy cooking.

Batch cook soups, sheet-pan dinners, or slow-cooker staples.

Keep a few grab-and-go options to prevent emergency takeout.

Set a restaurant budget for true treats and use coupons or early-bird deals.

Invite friends for potlucks that cost less and feel richer.

Your wallet and your health will both thank you.

7. Brand-name groceries & convenience foods

Labels do not feed you.

Ingredients do.

Store brands often match quality for far less, especially on staples like oats, beans, spices, and cleaning supplies.

Shop with a list and compare unit prices.

Buy in bulk for shelf-stable items you truly use.

Build a pantry that supports quick, healthy cooking so you skip pricey convenience food.

Cook once, eat twice by planning leftovers.

Use loyalty apps and midweek sales to time purchases.

You will eat just as well while your grocery bill slims down.

8. Overpriced cell phone plans

Unlimited everything sounds nice until the bill arrives.

Many retirees pay for data they never use.

Coverage can be identical with low-cost carriers that rent the same towers.

Check your actual monthly data and downgrade accordingly.

Explore MVNOs with senior discounts and autopay savings.

Keep your number and bring your own phone to cut costs even more.

Ask for loyalty credits or switch when promos appear.

Set data limits to avoid surprise charges.

A smaller plan can deliver the same service without the premium price.

9. Insurance you no longer need or are overpaying for

Insurance protects, but over-insuring punishes your budget.

As life changes, coverage should too.

You might not need as much life insurance, or you could raise deductibles to lower premiums.

Shop quotes every year or two.

Bundle smartly and ask about safe-driver, retiree, and home security discounts.

Review beneficiaries and eliminate riders you no longer need.

Consider long-term care strategies early so options stay affordable.

Confirm umbrella coverage limits match your assets.

Pay only for risks that truly threaten your retirement.

10. Impulse online shopping (Amazon/late-night buys)

Late-night scrolling is the budget’s sneakiest enemy.

One-click checkouts feel painless until the statement lands.

Those little dopamine hits do not spark lasting happiness.

Use a 24-hour rule before buying anything unplanned.

Remove stored cards, turn off one-click, and unsubscribe from flashy promo emails.

Keep a wish list and revisit once a month with a firm budget.

Replace the habit with a hobby that scratches the same itch.

Track your no-spend streaks and celebrate the wins.

Money you do not waste becomes money you actually enjoy.

Comments

Loading…