Ever wonder how the wealthy keep getting richer? It is all about smart money moves. Let us walk through 15 top strategies that successful people use to grow their wealth. Simple, practical, and straight to the point, these tips could be your first step toward financial growth.

They Spend Less Than They Make

It is not about having a ton of stuff. Wealthy people often skip out on buying the newest tech or flashy cars, even though they can afford them because they know every dollar they save is a dollar they can grow. They are always looking at the bigger picture, choosing to build wealth rather than just show it off.

They Pay Themselves First

Here is the deal: before they pay bills or splurge on anything, wealthy folks stash away a chunk of cash for themselves straight into savings or investments. It is like making sure you have got your future covered. Start with whatever you can, even if it is just a small percentage of your paycheck, and make it a habit.

They Make Their Money Work for Them

Sitting on a pile of cash in a savings account will not do much. Wealthy people put their money into places where it is going to grow, such as stocks, bonds, real estate, you name it. Yes, there is a risk, but that is where the growth is. They are not just saving; they are actively growing their wealth.

They Avoid Bad Debt

Credit cards and loans for things that lose value? That is a no-go for the financially savvy. They think of debt as a tool: useful when it is for something that will increase in value (like a home or maybe a business venture) and a trap when it is for splurging on the latest designer gear.

They Continuously Educate Themselves

Money matters keep changing, and keeping up can mean the difference between growing your wealth and watching it stagnate. Wealthy individuals make a point to keep learning—reading up on financial news, picking up new books, or even taking courses. It is about staying sharp so they can make smart decisions with their money.

They Set Clear Financial Goals

You have to know what you are shooting for, whether it is retiring by 50, buying that dream home, or setting up a college fund. Wealthy people write these goals down and make plans to hit them. They review and adjust these goals regularly to adapt to any changes in their financial situation or the economy.

They Look for Multiple Streams of Income

Relying on just your day job? That might not cut it. The wealthy often have their hands in several pots, rental properties, stock dividends, and side hustles. It is about cushioning yourself so that if one thing falls through, you have other income to fall back on. This diversification makes financial downturns easier to handle without panicking.

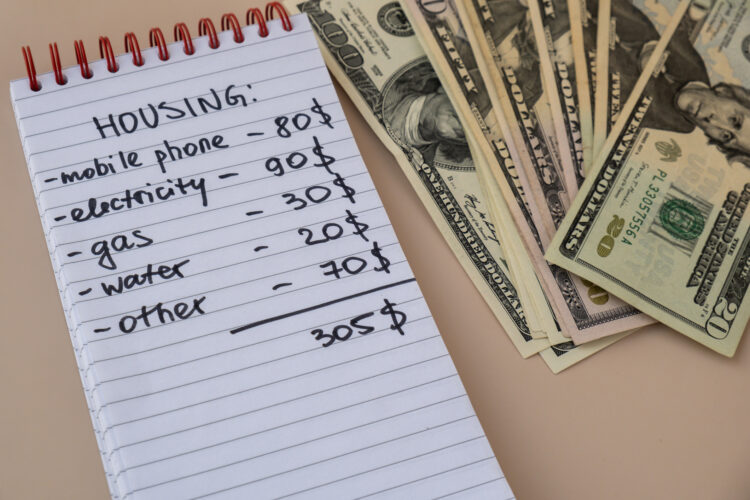

They Keep a Monthly Budget

Even millionaires watch where every dollar goes. Keeping a budget lets you see if you are overspending or if you can afford to invest more. It is not about pinching pennies; it is about making sure your money’s really working for you. And they adjust their budget as needed, which helps them stay on track with their financial goals.

They Protect Their Wealth

Imagine working hard to build your wealth, only to lose it in a lawsuit or a medical emergency. That is why insurance is key; it is a safeguard that ensures that you don’t lose everything when life throws a curveball. Wealthy people also often use legal structures like trusts or limited liability companies to further protect their assets.

They Practice Patience and Discipline

Building wealth is a long game. It is not about quick wins but being consistent. Wealthy folks stick to their strategies through ups and downs, knowing that time and patience pay off. They understand that wealth building is more about persistence and sticking to a plan than chasing the latest hot investment.

They Are Goal-Driven and Persistent

This is about keeping your eye on the prize and not giving up, no matter what gets in your way. Wealthy people reassess their strategies, keep themselves motivated, and push through the hurdles. They also celebrate small victories along the way, which keeps their motivation high.

They Prioritize Risk Management

Smart risk management is crucial. Wealthy people do not just take risks blindly; they think them through, diversify their bets, and always have a plan B. They also continuously educate themselves on new ways to mitigate risks, whether that is through newer insurance products, changing investment strategies, or adjusting their business plans.

They Outsource to Maximize Time

If something does not directly help them grow their wealth, wealthy people often delegate it. Why waste time on tasks others can do when you could be focusing on making more money? This also includes automating as much as possible, from bill payments to investing, to free up even more time for high-value activities.

They Opt for Smart Tax Moves

No one loves giving away a chunk of their earnings to taxes more than they have to. Wealthy individuals get savvy with their taxes, planning donations, investments, and expenditures to keep their tax bills as low as possible. They also keep themselves updated on tax law changes to make timely adjustments to their financial strategies.

They Prioritize Networking

Finally, who you know can be just as important as what you know. Wealthy people build networks that can offer advice, investment opportunities, and partnerships, expanding their chances of growing their wealth even further. They invest time in nurturing these relationships, knowing that a strong network can open doors that money alone might not.

Comments

Loading…