Open enrollment dates for 2016 health insurance plans are upon us, and that means the country has but a few months to research, plan and find a health insurance plan that works for our families and our lives, as well as our budget. The problem with open enrollment dates is that not everyone is always aware that they are upon us, and not everyone is prepared for what is to come searching for a health insurance plan for the New Year.

The premise of entire Obamacare health plan was to make health insurance affordable for all; it sounds nice, right? Well, it’s not quite how it worked up. Those of us who were already paying for our own health insurance through private plans (myself, for example, as I am self-employed) were already paying higher-than-we-wanted but still reasonable rates for our health insurance. Last year, however, when my previous plan was taken off the market and it was time for me to shop for a new plan for myself and my family, I was shocked to see that my rate for the same type of plan with the same deductible and overall coverage was more than triple what I was already paying. What happened to affordable? It seems as if many people are thrilled with their $40 per month rates and their new insurance, but it seems to have come at a big cost to many of the middle-class and upper middle-class residents of the country. Now we are paying more so others can pay less; it’s not really what it needs to be.

But I digress; we have to have health insurance. We might not be able to afford the exorbitant fees, but that’s all right because the government will now charge us a huge fine on our income tax returns if we do not have health insurance. So basically, the plan is to make insurance more affordable, offer open enrollment dates throughout the year and then fine those who can no longer afford their insurance since they now have to pay more so that others can pay less; I’m not a mathematical genius, but this seems like a really poor math equation to me.

Either way, open enrollment dates are here; you have until January 31, 2016 to choose a health insurance plan for the New Year or hand over your first born to the IRS at the beginning of 2017 (probably your second born, too). It’s time to learn how to select the most comprehensive, most affordable (insert sarcastic laugh here) and most beneficial health insurance policy for 2016. Open enrollment dates have already begun, so you are running out of time.

Check Employer Wellness Programs

Did you know that many of the country’s biggest employers are now offering their employees the chance to take advantage of wellness programs designed to keep insurance costs down? There are some financial incentives and savings associated with health insurance policies to take advantage of here. Ask your employer if he or she offers a plan like this to help employees get healthier and pose less of a health risk. You might be able to join a program that will allow you to lose weight, stop smoking, stop drinking or even change your life as a whole so that you are able to get as healthy as possible. Open enrollment dates are a good time to ask about this so that you can plan your new health insurance policy adequately. It never hurts to ask, and you have no idea just how much this could benefit you during open enrollment dates. Remember; you might find out about this later, but if open enrollment dates are already closed, you will not be able to take advantage of changing your plan until the following set of open enrollment dates.

Check Your Current Plan

If you have health insurance through your employer, now is the time to check to see if your plan has changed at all since this year. Some might change, others might not. However, now that open enrollment dates are here, it’s a good idea to check in case your plan is no longer the most effective plan for you. Look for changes in the following areas:

- Take home pay

- Copays

- Out-of-Pocket expenses

- Coinsurance

- Deductibles

- In network providers

- Coverage

Think Ahead

Sometimes you forget that you have to think ahead. Let’s do some math here; if you are sure you want to have a baby in 2016, or get started on a pregnancy at least, make sure you choose a plan that works for that. For example, a high deductible plan is not going to end up being the best plan for you. Use this time during the open enrollment dates to choose a plan that will make the most sense. After having four kids, I can tell you that you want to pay more now; a low deductible plan that covers as much as possible is going to benefit you the most during pregnancy. Honestly, you never know what will happen.

Let’s use me as an example. Both my 7 and 4-year-olds were easy pregnancies and labors. I was pregnant, healthy and needed no special care. I went into labor fast and furious and was in and out of the hospital in under 30 hours after being admitted (I always beg and beg and beg). When my husband and I made the decision to try for baby number three, we assumed that all would go the same way. I’d get pregnant, I’d go into labor around 39 weeks as I’d done both times and we’d have a baby that arrived just a few hours after labor began in a few pushes and with very little effort. I’m a pro, right?

We assumed that since our babies both came healthy and perfect that we’d have the same kind of labor and that our bill would be about the same as it was the first two times, which was very little. We’d pay very little out of pocket with our low deductible plan and go home with a brand new, adorable baby.

What we did not see coming was the announcement that I was pregnant with twins at my 18-week ultrasound. We did not see going into labor at 36 weeks and 6 days, and we did not see me giving birth to two babies in less than five minutes who weighed less than 8 pounds together. We did not see a 3-pound baby in our lives; we did not see a week-long stay in the NICU with two tiny babies. We did not see hospital bills for more than $50,000 rolling in. We did not see that; and we did not plan for that with our slightly higher deductible plan.

Think ahead when choosing your new insurance package during these open enrollment dates. You don’t know what might happen, but you need to know that anything can happen so that you are always adequately prepared.

Prescription Coverage

Another big point of contention with many health insurance policies is that so many people forget that they have to pay attention to things like their prescription drug coverage. Sure, you might pick up some antibiotics here and there for an ear infection or sore throat, and that’s it. But what happens if someone in your family develops a health issue that requires everyday drugs? Here’s an example; a friend of ours is trying to have her third baby. She went off her birth control and never got a period. Every month she experienced the same symptoms of pregnancy she’d had in the past, and every month a test told her she was not expecting.

She finally decided to go to the doctor, because she had a gut feeling that something was wrong. After many tests, it’s discovered that she has a small tumor in her brain. She will need medication every day for the rest of her life because of the position and the type of tumor that it is. It is pressing on her optic nerve and if it grows, it could cause her to lose her eyesight. However, her doctor doesn’t recommend removing it since it’s a very aggressive tumor and almost always grows right back. The medication is designed to shrink it and keep it at bay to save her eyesight. However, she is now taking medication that costs her hundreds of dollars every week. Fortunately, her health insurance and her financial situation allows for this kind of very unexpected expense to pose no issue for her, but it might be a different story for someone else.

Ask Questions

You don’t have to purchase an individual health insurance plan during the current open enrollment dates if your employer has a plan that you feel is more appropriate for your family. Additionally, you are not required to purchase health insurance for 2016 through your employer if you feel an individual plan is better for you and your family. You are in the driver’s seat of your own health insurance destiny, and that means finding and creating your own plan as you see fit.

This is why it is so important to ask questions. If you don’t understand something, ask for help. It’s better to ask the question and ask it again until you understand what is covered with any given plan, what is not covered with any given plan and what you can expect with any given plan than it is to think it’s not a good idea to ask and suffer later. Ask the questions, get the answers and make the most educated and informed decision possible during the current health insurance open enrollment dates.

Open Enrollment Dates

There are few dates that you must remember during the open enrollment dates that have already begun:

November 1, 2015

- First day of open enrollment dates for 2016 health insurance coverage

December 15, 2015

- Final day to change plans or enroll in a new plan for new health insurance coverage that begins January 1, 2016

January 1, 016

- 2016 health insurance coverage begins for all persons who enrolled for health insurance during open enrollment dates through December 15

January 15, 2016

- Final day to enroll or change health insurance plans if you want coverage to begin February 1

January 31, 2016

- Open enrollment dates for 2016 health insurance coverage ends

Be sure you understand these dates, what they mean and what you can afford before you finalize your decisions for a health insurance policy for 2016. This is the policy you will have all year, so you must make an intelligent decision when choosing this plan.

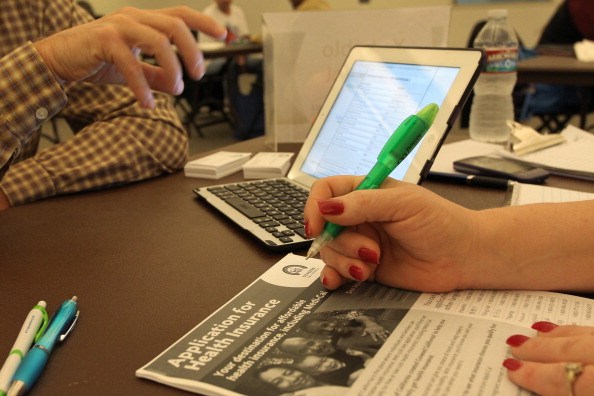

Photo by Getty Images

Comments

Loading…