Save smart and not the hard way; the 50/30/20 convention is a beautiful starting point, but it’s not a one-size-fits-all solution. There are more ways to do so. This means that you can take control of your finances with multiple strategies that have proven to work efficiently. Here are the options you have.

Prioritize Needs Over Wants

Distinguish between essential expenses and discretionary spending. Be honest: Do you really need that daily latte, or can you cut back? By cutting unnecessary expenses or impulse purchases, you free up more funds to allocate to savings and investment.

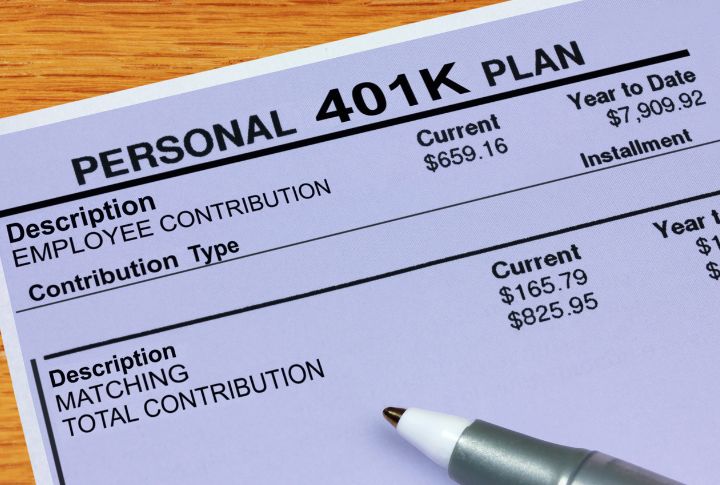

Take Advantage of Employer Matching

When your employer contributes a matching contribution to your retirement reserve, it’s a fantastic opportunity to increase your savings without any extra effort. You’re doubling your savings power by contributing enough to receive the entire match.

Use the 52-Week Savings Challenge.

Each week, set aside a specific amount corresponding to the week number (e.g., a dollar on week 1, two dollars on week 2, and so on). By following this challenge, you gradually increase your savings discipline and watch your savings grow steadily.

Automate Your Savings

have an automatic transfer system to your savings accounts whenever you get paid. This makes saving a consistent habit less likely to be forgotten or skipped. When you set systems in place before touching the money, it becomes a life-saving hack!

Consider Used or Refurbished Items

When you opt for pre-owned or refurbished goods, you will always get the best deal because they are usually a fraction of the cost of new items. It’s a savvy way to save money while still getting items that serve their purpose effectively.

Save Your Change

This strategy is like gathering tiny treasures that add to your savings over time! Storing your spare change regularly creates a simple yet effective way to improve your savings without noticing it. Save them a jar or piggy bank.

Try Budget-Friendly Joys

Finding joy doesn’t always have to be expensive. Explore budget-friendly activities that bring happiness. Whether it’s a hike in the park or cooking a new recipe, there are countless ways to enjoy life while keeping your finances in check.

Save Your Windfalls

When you receive unexpected money, such as a bonus, tax refund, or gift, consider putting a portion of it toward your financial goals. This can increase your savings and help you achieve your objectives faster.

Avoid Lifestyle Creep

When you resist the temptation to increase your expenses every time you earn more, you can save and invest the extra money. It’s an intelligent way to ensure that as your income rises, your savings grow, too.

Use Rewards and Cashback Wisely

Leverage credit card rewards, cashback offers, and loyalty programs to reduce expenses on everyday purchases. By strategically using these benefits, you can earn discounts or cash back on necessary items, lowering your overall spending.

Comments

Loading…