Are you interested in learning how to save money? Do you want to improve your financial situation? It is important to put some money aside each month in order to invest in your future. However for some people this is a lot easier said than done. The benefits of having some savings are that if a business proposition or opportunity to travel comes along then you will already have enough money put aside to follow your dreams. Alternatively you may be planning to buy a house in the future and need to save up for the deposit. This article will review the top five money saving books to improve your finances.

The Money Diet: The ultimate guide to shedding pounds off your bills and saving money on everything! – Martin Lewis

This book will tell you all you need to know about money, with a no nonsense approach. It provides great money saving advice which can be implemented into everyday life. Learn how to organizing credit cards, find the cheapest deals for your bills and also get the best mortgage deals. This book will teach you how to make sure you’re not wasting money in any way. This book is a recently updated version of the original best seller. It provides 100 extra pages with even more money saving advice. You will there for be able to completely transform not only your attitude to money, but your spending habits and ultimately your whole life. If you like this book, you can find more like this on this website. Martin Lewis provides step by step advice which is very clear and easy to follow. Topics covered include mobile phones, package holidays and pensions, credit cards and insurance as well as getting cheap books, CDs and DVDs.

Perfect Money Saving – Smita Talati

Perfect Money Saving is like a boot camp for your finances. All the essentials are included allowing you to be more in control of your finances. This book covers everything from cheaper mortgages to how to make homemade presents. It gives easy to follow advice on how to cut your costs. With Smita Taati’s approach you won’t have to give up the things you enjoy. There are sections on debt management as well as advice about where to get great bargains on everything from clothes, books to electricity bills. This book really will help you to make your money work harder for you. All the techniques used in this book are tried and tested.

The Money Tree: Money, how to make it, save it and grow it – Martin Bamford

If you want to improve your money management then this is the book for you. Many people get confused by the issue of money and how to spend it wisely. How many of us can truly say that we are good at making, saving and managing money. This book will give you top tips from the experts about how to improve your finances. This book is packed with great tips and advice and is laid out in an easy to read format which will allow you to master your personal finances.

Money Magic: Seven simple steps to true financial freedom – Alvin Hall

Alvin Hall has often been described as the nation’s favourite money man and he is back with this great book to give readers money saving advice. This book is part of the quick reads series and is very simple and easy to follow.

If you worry about paying your bills or are finding it difficult to save then this is the book for you. If you don’t earn much money then this book will help you to budget and make you money work for you, in better ways. The book uses an easy to read seven steps to success approach which includes no jargon or buzz words. You will be asked to track your money habits which I found was really useful in finding out where my money was going each month. Did you know there are different money personalities? Find out which one you are. Alvin Hall has years of experience of helping people to manage their finances his approach will help you to reach your goals of financial freedom.

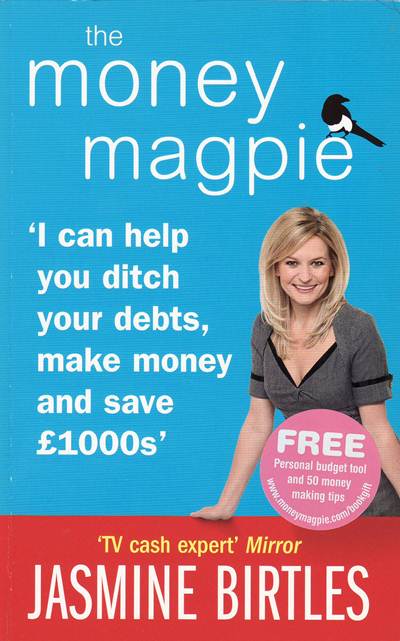

The Money Magpie – Jasmine Birtles

With this book anyone can be better off, you just need to learn how. Jasmine Birtles is a great author who will show you how. This book has loads of practical financial advice as well as brilliant money saving ideas. You will be able to spend less and make more in no time. With Jasmines approach you may even have some money left over to invest. The book includes useful self assessment quizzes to help you to see where you are spending money. It allows you to come up with a long term plan for increasing wealth that fits into your lifestyle.

Comments

Loading…