10 Credit Card Perks You Won’t Find When Paying With Cash

Paying with cash might feel satisfying in the moment, but it’s quietly costing you far more than you think. While cash disappears from your wallet without a trace, credit cards offer a treasure trove of perks that do more than just delay payment—they elevate it. From rewards that stack up effortlessly to protections that have your back when things go wrong, swiping smart can be a serious financial game-changer. Whether you’re booking a trip, buying groceries, or handling an emergency, credit cards bring value to every transaction. Here are 10 powerful perks cash just can’t compete with—starting now.

1. Credit Score Boost

Your financial reputation matters more than you might think. Every time you use your credit card responsibly and pay on time, you’re building a stronger credit history that lenders, landlords, and even some employers check.

A good score can save you thousands on mortgages and car loans through lower interest rates. Some people even get denied apartments because of poor credit! Cash payments, while straightforward, never show up on your credit report.

They’re essentially invisible financial transactions that do nothing to demonstrate your reliability with money, leaving you without this crucial financial foundation.

2. Zero-Liability Fraud Protection

Imagine your wallet gets stolen with $500 cash inside. That money? Gone forever. But if your credit card disappears, a quick phone call freezes your account and prevents unauthorized purchases.

Most major card issuers offer zero-liability policies, meaning you won’t pay a cent for fraudulent charges. The protection works for online shopping too, where digital thieves lurk.

Card companies use sophisticated AI systems that flag unusual spending patterns. They might text you about suspicious activity before you even notice your card is missing! Cash simply can’t compete with this level of security.

3. Automatic Spending Trackers

Remember trying to save receipts and manually track every dollar spent? Credit cards eliminate this headache by creating digital records of every purchase automatically.

Modern card apps categorize spending into neat groups like “groceries,” “entertainment,” and “gas,” making budget management almost effortless. Many even generate colorful charts showing exactly where your money goes each month.

Cash spending is notoriously hard to track – those small purchases add up invisibly. With credit cards, you’ll spot spending patterns you never noticed before, helping identify easy ways to save money without feeling deprived.

4. Rewards That Pay You Back

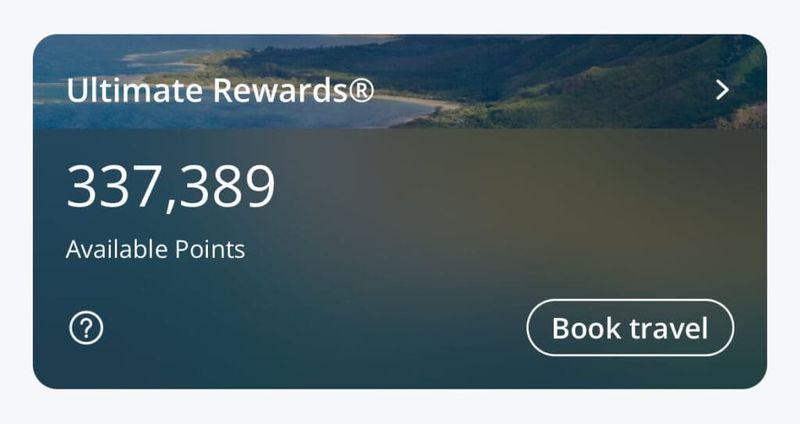

Cash doesn’t thank you for using it, but credit cards literally pay you to spend money you’d spend anyway. Depending on your card, every purchase might earn cash back, travel miles, or points redeemable for merchandise.

Many cards offer enhanced rewards in specific categories – 5% back on groceries, 3% on gas, or double points at restaurants. Strategic card users earn hundreds or even thousands in rewards annually without changing their spending habits.

Some savvy travelers fund entire vacations using accumulated points and miles. Meanwhile, cash users miss out completely on these financial bonuses that essentially discount everything they buy.

5. Hassle-Free International Travel

Foreign currency exchange booths charge hefty fees and carrying cash abroad invites theft. Credit cards simplify international travel by handling currency conversion automatically.

Many travel-focused cards charge zero foreign transaction fees, saving you 3-5% on every purchase abroad. They’re accepted virtually everywhere, from luxury hotels in Paris to tiny cafés in Tokyo. Cards also provide emergency assistance services when traveling.

Lost in Barcelona with no Spanish skills? Your card’s concierge service might help with translation, directions, or even booking last-minute accommodations when your plans change unexpectedly.

6. Interest-Free Grace Period

Most people don’t realize credit cards offer a hidden, interest-free loan every month. When you make purchases, you typically have 21-30 days before payment is due – without paying a penny in interest if you clear your balance.

This timing advantage helps with cash flow management. Buy groceries on the 1st, but your paycheck doesn’t arrive until the 15th? No problem with a credit card.

Smart users strategically time large purchases right after their statement closes, potentially giving themselves nearly two months before payment is due. Cash requires immediate payment, offering no flexibility for timing your expenses around your income schedule.

7. Emergency Spending Power

Life throws unexpected expenses our way – car repairs, medical bills, or sudden travel needs. Cash users are limited to whatever money they physically possess, often leading to difficult choices during emergencies.

Credit cards provide immediate purchasing power when you need it most. Your car breaks down in a strange town? A credit card gets you back on the road without waiting for bank transfers or finding an ATM.

For online purchases, credit cards are practically essential. Try booking a hotel or rental car with cash – nearly impossible! Cards offer convenience for everyday spending and crucial financial flexibility when unexpected situations arise.

8. Generous Sign-Up Bonuses

Card issuers compete fiercely for your business, offering incredible welcome bonuses just for becoming a customer. Some premium cards provide $500+ in cash back or 100,000+ travel points after meeting initial spending requirements.

These bonuses often exceed the annual fee many times over, especially in the first year. One popular travel card offers enough points for a round-trip flight to Europe just for signing up and spending $4,000 in three months.

Cash users miss these opportunities completely. Think about it – no store has ever handed you $500 just for walking in and spending money you planned to spend anyway!

9. Complimentary Travel Insurance

Many premium credit cards include insurance benefits that would cost hundreds if purchased separately. Rental car coverage alone saves $15-25 daily when declining the rental company’s expensive policies.

Other common protections include trip cancellation insurance, lost luggage reimbursement, and even emergency medical evacuation coverage for international travelers. One cardholder had a $20,000 emergency helicopter evacuation in South America fully covered by their card benefits!

Travel delay insurance can reimburse meals and accommodations when flights get cancelled. Cash payments provide zero protection – meaning you’re on your own if anything goes wrong during your travels.

10. Purchase Protection & Extended Warranties

Accidentally drop your new phone the day after buying it? Many credit cards will reimburse you if purchases are damaged or stolen within 90-120 days. This benefit alone can save hundreds on replacement costs.

Extended warranty protection automatically doubles manufacturer warranties up to an additional year on eligible purchases. No need to pay extra for those pushy store warranty plans!

Some cards even offer price protection, refunding the difference if an item you bought goes on sale shortly after purchase. Cash transactions provide none of these safeguards, leaving you unprotected against damage, defects, or price drops after buying.

Comments

Loading…