15 Purchases That Are Almost Always a Bad Financial Decision

We all work hard for our money, but sometimes our spending habits don’t reflect that effort. Making smart financial choices isn’t just about earning more—it’s about spending wisely on things that truly add value to your life. The following purchases might seem tempting in the moment, but they often lead to buyer’s remorse and unnecessary financial strain.

1. Brand-New Cars

That new car smell comes with a hefty hidden cost. The moment you drive off the dealership lot, your shiny vehicle loses 20-30% of its value. This depreciation hit happens almost instantly, making it one of the most dramatic financial drops in any purchase you’ll make.

Many new car buyers find themselves underwater on loans, owing more than the car is worth for years. Manufacturer warranties and that pristine condition rarely justify the premium you’re paying.

A smarter approach? Buy certified pre-owned vehicles that are 2-3 years old. Previous owners have already absorbed the steepest depreciation, while you still get a reliable car with modern features and often remaining warranty coverage.

2. Extended Warranties

Sales representatives push these policies aggressively because they’re incredibly profitable—for them, not you. Statistics show most consumers never use their extended warranties or recover less in repairs than they paid for coverage. Meanwhile, companies bank on this psychological insurance against problems that rarely materialize.

Many products already come with manufacturer warranties covering likely early failures. Credit cards often extend existing warranty protection automatically, making additional coverage redundant.

Instead of paying for peace of mind that rarely pays off, research reliable brands before purchasing. Build an emergency fund to cover potential repairs—you’ll likely come out ahead financially while having funds available for any emergency, not just product failures.

3. Timeshares

High-pressure sales tactics and promises of dream vacations lure thousands into timeshare contracts annually. The reality? Ongoing maintenance fees that increase yearly, regardless of whether you use the property. Many owners discover too late that booking their preferred times becomes nearly impossible due to availability issues.

Reselling proves nightmarishly difficult—many timeshares fetch pennies on the dollar if they sell at all. Some desperate owners even pay companies just to take these obligations off their hands.

For vacation flexibility without the lifetime commitment, consider renting properties through services like Airbnb or VRBO. You’ll enjoy greater location variety, pay only when you travel, and avoid the financial ball-and-chain that timeshares represent to most owners.

4. Trendy Fashion Items

Remember fidget spinner keychains? Or those chunky sneakers everyone had to have? Trendy items command premium prices precisely when demand peaks, then quickly become yesterday’s news. Fashion cycles now change faster than ever, with social media accelerating the rise and fall of must-have items.

The environmental impact compounds the financial waste. Fast fashion creates mountains of barely-worn clothing heading to landfills after just a few wears. Your closet space becomes cluttered with items that no longer spark joy or match current trends.

Building a wardrobe around quality basics in classic styles provides better long-term value. When you do splurge on trends, consider thrift stores or rental services that let you experiment without commitment. Your wallet and the planet will thank you.

5. High-Interest Credit Card Debt

That $50 dinner actually costs $75 when you carry it on a credit card charging 20% interest for a year. High-interest debt transforms every purchase into a significantly more expensive one through the magic of compound interest—working against you instead of for you.

Many consumers fall into the minimum payment trap, not realizing they’re signing up for years of payments. A $1,000 balance with 18% interest takes over 7 years to pay off making only minimum payments, ultimately costing over $2,000.

Break this cycle by paying balances in full each month. For existing debt, consider balance transfer offers with 0% introductory rates while aggressively paying down principal. Cut expenses temporarily if needed—freedom from high-interest debt provides an immediate, guaranteed return on investment.

6. Lottery Tickets

You’re more likely to be struck by lightning or become a movie star than win a major lottery jackpot. The odds against winning Powerball? About 1 in 292 million. For perspective, if you bought a ticket every week, you’d need to play for over 5 million years to statistically expect one jackpot win.

Lottery tickets represent a hidden tax disproportionately paid by lower-income households. Regular players often spend thousands annually chasing dreams that statistics say will never materialize.

If you enjoy the momentary fantasy, treat lottery tickets as pure entertainment with a strict budget. Never view them as investments or financial strategies. That same money invested in low-cost index funds historically returns about 7% annually—not as exciting as dreaming of millions, but infinitely more reliable.

7. Luxury Kitchen Gadgets

Bread machines, pasta makers, ice cream churners—kitchen cabinets everywhere house these aspirational purchases gathering dust. The initial excitement of homemade everything quickly fades when confronted with the reality of prep work, cleaning time, and storage hassles.

Specialty gadgets often promise to transform your cooking life, but most homes already contain the basic tools needed for nearly any recipe. That avocado slicer or banana hanger might seem clever in the store but rarely justifies its cost or kitchen real estate.

Before buying any kitchen tool, honestly assess how frequently you’ll use it. Wait 30 days after spotting something that catches your eye—if you’re still thinking about it and have specific plans for regular use, it might be worth the investment. Otherwise, stick with versatile tools that earn their keep through daily use.

8. Excessive Subscriptions

Monthly subscriptions seem harmless at $9.99 here and $14.99 there, but they quickly multiply into budget-draining vampires. The average American spends over $200 monthly on subscriptions, often forgetting what they’re even paying for. Streaming services, meal kits, beauty boxes, fitness apps—they all compete for your recurring dollars.

Companies love subscription models because they count on your forgetfulness and inertia. Many services make cancellation deliberately complicated, hoping you’ll give up and continue paying.

Take an hour to audit all your subscriptions quarterly. Ask yourself: “Would I buy this again today?” If not, cancel immediately. Consider subscription-sharing with family where permitted, and rotate streaming services instead of maintaining multiple accounts year-round. Your financial freedom is worth more than unlimited access to every possible service.

9. Latest Tech Upgrades

Smartphone manufacturers want you believing last year’s perfectly functional device is suddenly obsolete. Marketing creates artificial urgency around marginal improvements—slightly better cameras, fractionally faster processors, or minor design tweaks that rarely impact daily use.

Early adopters pay premium prices for these minimal advancements, essentially funding research and development for features that will become standard and affordable later. Meanwhile, perfectly good devices end up in drawers or contribute to growing e-waste problems.

Extend your upgrade cycle by maintaining your current devices properly. Clean ports, replace batteries when needed, and use protective cases. When upgrades become necessary due to security or compatibility issues, consider certified refurbished options or models one generation behind the latest. You’ll save hundreds while enjoying nearly identical functionality.

10. Fancy Weddings

The average American wedding now costs over $30,000—roughly equivalent to a down payment on a home in many areas. Yet studies show expensive weddings correlate with higher divorce rates, not marital bliss. Couples often begin married life under financial stress for a single day’s celebration.

Wedding industry marketing creates impossible standards, convincing couples that perfect love requires perfect centerpieces and premium open bars. Vendor prices mysteriously increase when the word “wedding” is mentioned compared to identical services for other events.

Consider what truly matters—celebrating your commitment with loved ones. Prioritize experiences over appearances, and allocate funds toward lasting investments like housing, emergency savings, or retirement accounts. Years later, guests will remember the joy and connection, not the expensive details that stretched your budget beyond reason.

11. Designer Furniture

That $5,000 sofa with the famous designer’s name attached might look identical to the $1,500 version without the label. Furniture markups can reach 400% when brand prestige enters the equation, with little corresponding increase in quality or durability.

Showrooms create emotional connections to these status symbols through careful staging and lighting. Sales tactics emphasize exclusivity and limited availability to justify premium pricing for what are often similar materials and construction methods.

Focus on construction quality rather than designer labels. Solid wood frames, eight-way hand-tied springs, and high-density foam provide longevity regardless of the name on the tag. Consider floor models, open-box items, or quality secondhand pieces that have already proven their durability. Well-made mid-range furniture often provides better value while still offering style and comfort.

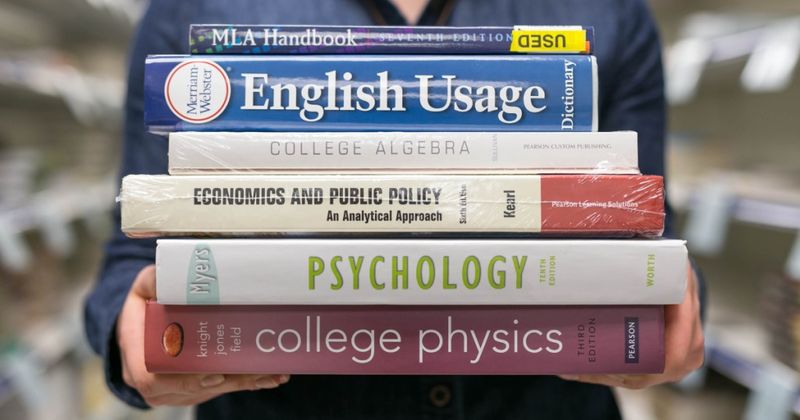

12. New College Textbooks

College students face textbook sticker shock each semester, with prices increasing at three times the rate of inflation since the 1970s. A single new textbook can cost $300, despite containing largely the same information as previous editions. Publishers release new versions frequently with minimal changes, rendering older editions artificially obsolete.

The captive market creates perfect conditions for price gouging. Students need specific assigned texts to complete coursework, regardless of cost. Digital versions often cost nearly as much as physical copies while adding restrictions like expiration dates.

Explore alternatives like international editions (identical content, fraction of the price), rental programs, or university library reserves. Buy used when possible, share with classmates, or check if older editions contain substantially the same material. Many professors will indicate when previous versions are acceptable if asked directly.

13. Impulse Purchases

Stores strategically place tempting items near checkout lanes for a reason—they profit from emotional buying decisions. That pack of gum, magazine, or gadget you didn’t know existed until spotting it in the store represents marketing triumph over mindful spending.

Retailers create artificial urgency through limited-time offers and fear of missing out. Online shopping compounds the problem with algorithmic recommendations and one-click purchasing that bypasses our brain’s natural deliberation process.

Implement a personal waiting period before non-essential purchases—24 hours for small items, 30 days for larger ones. Ask yourself: “Would I walk across town specifically to buy this item?” If not, it’s likely an impulse rather than a need. Creating this mental space between desire and purchase often reveals which items truly deserve your hard-earned money.

14. Exotic Pets

Sugar gliders, hedgehogs, and miniature foxes may seem adorably unique, but these trendy exotic pets come with hidden financial and ethical costs. Specialized diets can run hundreds monthly, while exotic veterinarians charge premium rates for animals they rarely treat. Many exotics need custom habitats with precise temperature and humidity controls that drive up utility bills.

The novelty often wears off when owners discover these animals’ natural behaviors—nocturnal activity, territorial marking, or complex social needs that can’t be met in captivity. Abandoned exotics overwhelm rescues and sanctuaries when the reality doesn’t match Instagram expectations.

Consider adopting domestic animals better suited to home environments. Cats and dogs have evolved alongside humans for thousands of years, with predictable care needs and temperaments. Your wallet, lifestyle, and the animals themselves will benefit from this more responsible choice.

15. Bottled Water

Americans spend billions annually on bottled water that costs 2,000 times more than tap water. The environmental impact is equally staggering—17 million barrels of oil go into producing plastic water bottles yearly, with most ending up in landfills despite recycling efforts.

Marketing creates perception of superior purity, yet studies repeatedly show bottled water is often no safer than properly regulated municipal water. Some brands simply bottle tap water with minimal additional treatment while charging premium prices for clever packaging.

Invest in a quality water filter and reusable bottle instead. Even accounting for filter replacement costs, you’ll save hundreds annually while reducing plastic waste. For those concerned about tap water quality, home testing kits can identify specific issues that targeted filtration systems address more economically than endless bottle purchases.

Comments

Loading…