10 Ways to Be Frugal Without Feeling Cheap

Living frugally doesn’t mean depriving yourself or feeling like you’re missing out. It’s about making smart choices with your money so you can spend on what truly matters to you. By developing thoughtful spending habits, you can build savings and financial security while still enjoying life. These ten strategies will help you save money without the feeling of sacrifice that often comes with penny-pinching.

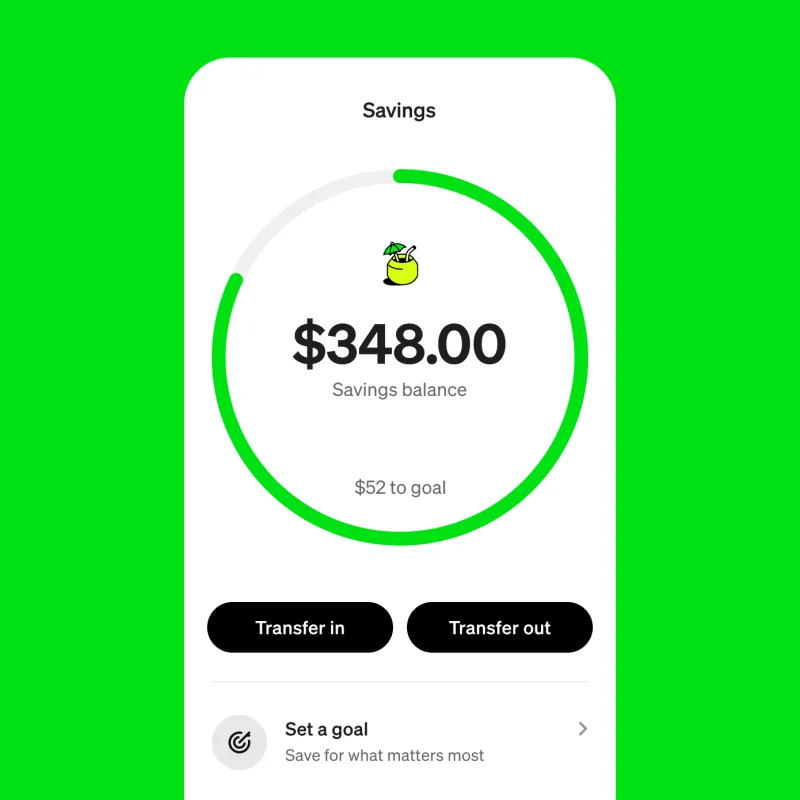

1. Set Up Money Transfers That Happen Automatically

Money that you never see is money you won’t miss. Creating automatic transfers to your savings account works like magic because the funds disappear before temptation strikes. Think of it as paying your future self first.

Many banks offer this service for free, and you can start with just $20 per paycheck. As you adjust to living with slightly less in your checking account, gradually increase the amount.

The beauty of automation is that it requires zero willpower once it’s set up. Your savings grow steadily in the background while you go about your life, creating financial security without daily sacrifice.

2. Turn Cooking at Home Into a Fun Project

The average American family spends over $3,000 annually on restaurant meals. Planning your meals around ingredients you already have transforms cooking from a chore into a creative challenge.

Start by taking inventory of your pantry and freezer, then build meals around those items. Weekend batch cooking saves both time and money—prepare large portions of soups, casseroles, or grilled chicken that can become multiple meals throughout the week.

Bonus tip: Keep a running list of successful recipes your family enjoys. Having a personalized “greatest hits” cookbook makes meal planning easier and reduces the temptation to order expensive takeout when you’re tired.

3. Make Technology Work For Your Wallet

Free money is waiting for you through cashback apps and loyalty programs. Apps like Ibotta and Rakuten give you rebates on purchases you’d make anyway, while store loyalty programs offer exclusive discounts and rewards.

The key is using these tools strategically. Download 2-3 apps that align with where you already shop, rather than chasing deals at stores you wouldn’t normally visit. Link your credit card to programs like Dosh that offer automatic cashback with no extra steps.

Many people earn $300-500 annually through these programs without changing their shopping habits. That’s a nice dinner out or holiday gift fund earned passively!

4. Swap Famous Labels for Store Brands

Did you know many store-brand products are made in the exact same factories as their name-brand counterparts? Blind taste tests consistently show people can’t tell the difference between generic and premium versions of staples like pasta, medicines, and cleaning supplies.

Start experimenting with one store-brand item each shopping trip. Keep the ones you like, return to name brands for the few products where you notice a quality difference.

This simple switch can cut your grocery bill by 15-25% without sacrificing quality. That savings adds up to hundreds of dollars annually that you can redirect toward experiences or goals that truly matter to you.

5. Discover Hidden Gems Through Secondhand Shopping

Thrift stores in wealthy neighborhoods often overflow with barely-used designer items at fraction-of-retail prices. Online platforms like Poshmark and ThredUP have transformed secondhand shopping from dusty hunting to curated browsing.

The environmental impact is significant too—each secondhand purchase keeps items from landfills while reducing manufacturing demand. Make it a two-way street by selling items you no longer use through consignment shops or marketplace apps.

Fashion lovers find this approach particularly rewarding. The money saved allows occasional splurges on truly special pieces, while the treasure-hunt aspect makes building a wardrobe feel like an adventure rather than a budget constraint.

6. Create Your Own Resource-Sharing Network

Sharing economy isn’t just for rideshares—it can transform your personal finances. Splitting streaming subscriptions with friends gives everyone access to multiple platforms while each person pays for just one. Neighborhood tool libraries eliminate the need for everyone to own rarely-used equipment.

Start small by creating a group chat with nearby friends to coordinate grocery runs, reducing individual gas usage. For parents, rotating babysitting duties with other families provides free childcare while building community.

These arrangements work best when everyone contributes equally over time. The financial benefits are significant, but many people find the social connections that develop become even more valuable than the money saved.

7. Choose Lasting Quality Over Quick Bargains

Sometimes spending more upfront actually saves money in the long run. A $200 pair of well-made boots that lasts eight years costs far less than replacing $50 boots every season.

Research becomes your superpower here. Before major purchases, read reviews focusing on durability and longevity rather than just price. Brands with solid repair policies or lifetime warranties often indicate confidence in their products’ quality.

Apply this principle selectively to items you use frequently—everyday shoes, kitchen knives, winter coats. For rarely-used items, the budget version might make more sense. This balanced approach feels luxurious rather than restrictive because you’re surrounding yourself with fewer but better things.

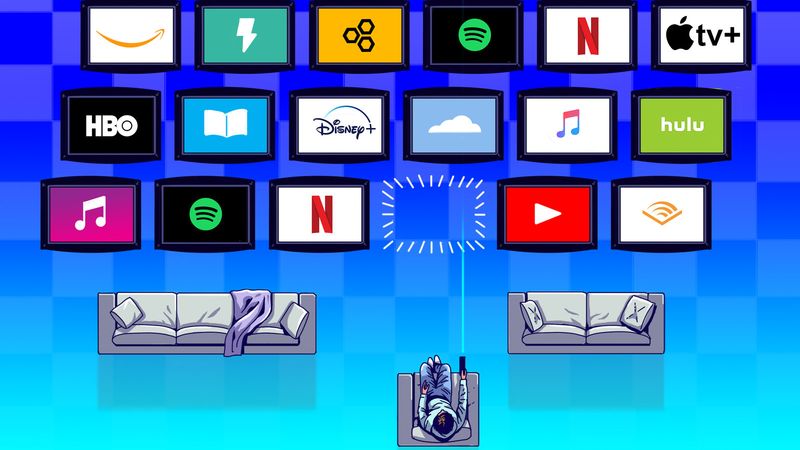

8. Perform a Subscription Detox

The average American spends $219 monthly on subscriptions, often forgetting about many of them. Subscription services count on this “set and forget” mentality to maintain their profits.

Set a quarterly calendar reminder to review all recurring charges. For each service, ask yourself: “Would I sign up for this today at this price?” If the answer is no, cancel without guilt.

For services you value but use infrequently, consider sharing accounts with family members or switching to annual plans which often offer substantial discounts. This mindful approach to subscriptions isn’t about depriving yourself—it’s about ensuring your money aligns with what you genuinely value right now.

9. Embrace the Power of Occasional Money Fasts

No-spend days reset your relationship with money by breaking unconscious spending habits. Start with just one day a week where you commit to spending zero cash—no coffee shops, online shopping, or impulse buys.

These money fasts quickly reveal your spending triggers and patterns. Many people discover they shop when bored or stressed, insights that lead to better financial choices. Keep a list of free activities you enjoy to replace shopping during these periods.

The practice isn’t about permanent deprivation. Rather, it creates mindfulness around spending that carries over to regular days, helping you distinguish between purchases that bring lasting satisfaction versus momentary distraction.

10. Practice Strategic Generosity

Being frugal doesn’t mean being stingy where it matters. Setting aside money specifically for tipping service workers, celebrating friends’ milestones, or supporting causes you care about prevents frugality from feeling cheap or selfish.

Create a separate “generosity fund” in your budget for these expenses. Knowing you’ve planned for these moments allows you to give freely without financial stress or guilt.

This intentional approach transforms giving from a budget-buster to a value-aligned choice. Research shows that spending money on others often brings more happiness than spending on ourselves, making strategic generosity both financially and emotionally intelligent.

Comments

Loading…