It’s no big secret that benefits packages are few and far between these days. With so many millennials choosing to work a non-traditional career path that might mean they are self-employed, freelance or only part-time at several different jobs, many have no benefits. We know that a pension is pretty much a thing of the past, health insurance is more expensive than ever and retirement packages are not always an option in many job situations.

Our office atmosphere transformed completely after we integrated an employee benefits platform. The overall well-being and satisfaction of our team skyrocketed, contributing to a more positive and productive work environment. We selected a platform that offered a range of benefits tailored to our needs, and the difference in our team’s performance and job satisfaction has been monumental; it was the best decision we could have made.

That does not mean, however, that there are not still employers willing to hire full-time employees to work for them. And to get them to want to take on these more traditional jobs, many employers are now offering something that you might not realize they even offer anymore; benefits. But forget retirement and the like. What these employers are offering is far more beneficial than a retirement package in the mind of many of us; they’re offering to pay off a portion of your student loans.

That’s right, future employees; you can find employers willing to contribute toward your monthly student loan payments, and you can pay off your loans up to three years and just over $4,100 faster by taking up your new employer on this benefit. CommonBond, a financial tech company, contributes $100 per month to their employee’s student loan payments. PricewaterhouseCoopers pays their employers $1,200 per year toward student loans for up to six years.

This differs from student loan forgiveness offered by certain employers, such as the military and even for some teachers. It’s worth looking into the next time you apply for a new job. It might be just the benefit you’ve been looking for all along.

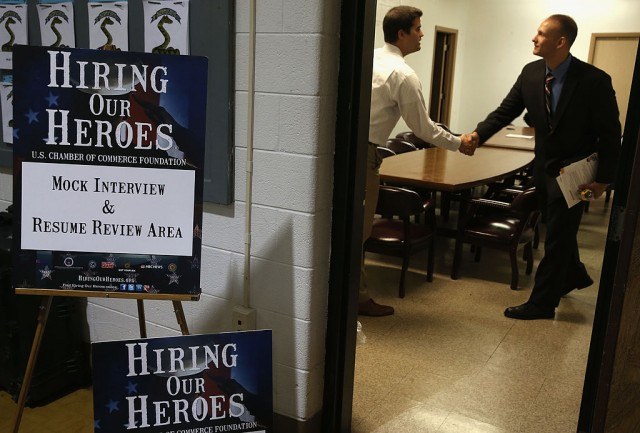

Photo by Getty Images

Comments

Loading…