12 Spending Habits That Keep You Living Paycheck to Paycheck

Living paycheck to paycheck can feel like being stuck on a financial treadmill—working hard but never moving forward. One unexpected bill or a night out can throw your whole month off balance. But more often than not, it’s not the big splurges that sabotage your savings—it’s the quiet, everyday habits draining your wallet behind the scenes. From mindless spending to lifestyle creep, these seemingly small decisions add up fast. If you’re tired of watching your paycheck vanish without a trace, it’s time to pinpoint the real culprits. Here are 12 spending habits quietly keeping you financially stuck—and how to break free.

1. Ignoring Small Daily Expenses

Those little purchases add up faster than you think. A $5 coffee each workday becomes $100 monthly – that’s $1,200 yearly just for morning caffeine!

Most people underestimate how much they spend on small items. Tracking your spending for just one week can be eye-opening. You might discover you’re spending hundreds on vending machine snacks, convenience store stops, and app purchases.

The solution isn’t necessarily eliminating these purchases completely. Instead, become conscious of them and set reasonable limits. Even cutting these expenses in half could free up significant money for savings or debt reduction.

2. Living Without a Budget

Money without a plan vanishes mysteriously. Creating a budget isn’t about restriction—it’s about giving every dollar a purpose before you’re tempted to spend it elsewhere.

Many avoid budgeting because they fear facing financial reality or think it’s too complicated. The truth is, even a simple budget tracking income versus essential expenses can transform your financial life. When you see exactly where your money goes, you gain control.

Start with basic categories: housing, food, transportation, utilities, and savings. Once you understand your spending patterns, you can make informed decisions rather than wondering where your paycheck disappeared to each month.

3. Paying Only Minimum Balances

Making minimum payments on credit cards feels manageable but creates a costly trap. A $3,000 balance with 18% interest paid at minimum rates could take over 15 years to eliminate and cost thousands extra!

Credit card companies love minimum payments because they maximize interest profits. While paying minimums keeps your account current, it does almost nothing to reduce the principal balance. Your debt becomes a permanent fixture in your budget.

Breaking this cycle requires paying more than minimums whenever possible. Even adding $20 above the minimum payment can dramatically reduce your repayment timeline and total interest paid. Prioritize highest-interest debts first for fastest financial relief.

4. Falling Prey to Lifestyle Inflation

Got a raise? Most people immediately upgrade their lifestyle to match. This natural tendency to increase spending when income rises prevents financial progress.

Lifestyle inflation explains why people earning six figures can still live paycheck to paycheck. Each promotion brings a nicer car, bigger home, or fancier restaurants—consuming every dollar of new income. The opportunity to build wealth disappears.

Smart earners celebrate income increases differently. They maintain their current lifestyle and direct at least half of any raise toward financial goals. This balanced approach allows some lifestyle improvement while building financial security. Remember: true wealth comes from the gap between income and spending, not income alone.

5. Using Credit for Everyday Purchases

Reaching for credit cards to buy groceries, gas, and other essentials creates a dangerous spiral. When you charge basic needs, you’re borrowing from future paychecks—with interest!

This habit often begins innocently, perhaps to earn rewards points. However, it quickly becomes problematic when balances aren’t paid in full monthly. Before long, you’re paying for last month’s necessities plus interest while charging this month’s needs.

Cash and debit purchases create natural spending limits and psychological awareness of costs. Reserve credit for true emergencies or planned purchases you can pay off immediately. Your future self will thank you for not mortgaging daily life through high-interest debt.

6. Neglecting Emergency Savings

Life throws unexpected challenges our way—cars break down, roofs leak, medical issues arise. Without emergency savings, these normal life events become financial disasters requiring loans or credit cards.

Many Americans can’t handle a $400 emergency without borrowing. This vulnerability guarantees financial instability since emergencies are inevitable. Each unexpected expense becomes a setback that takes months or years to recover from.

Building even a small emergency fund creates financial resilience. Start with a goal of $1,000, then work toward one month’s expenses. Having this buffer prevents minor setbacks from derailing your financial progress and breaking the paycheck-to-paycheck cycle. Emergency funds provide both financial security and peace of mind.

7. Keeping All Money in One Account

When savings and spending money share the same account, savings rarely survive. That enticing balance makes every purchase seem affordable, even when you’re actually spending money meant for other purposes.

The psychological barrier of separate accounts is powerful. Money in a dedicated savings account feels different—like it’s already been “spent” on your future goals. This simple separation makes impulse purchases less likely and savings more successful.

Modern banking makes creating multiple accounts easy and usually free. Consider separate accounts for emergency funds, short-term savings goals, and long-term investments. Some people even find success with multiple checking accounts—one for fixed expenses and another with a limited balance for discretionary spending.

8. Wandering Without Financial Goals

Money without purpose tends to disappear on whatever catches your attention. Setting specific financial goals transforms random dollars into meaningful progress toward what truly matters to you.

Financial goals provide motivation to make different choices. Saving for “someday” feels vague and easy to postpone. Saving for “a European vacation next summer” or “a down payment on a house in three years” creates clarity and urgency that changes behavior.

Effective goals are specific, measurable, achievable, relevant, and time-bound (SMART). Write them down, break them into monthly targets, and track your progress. This simple practice creates accountability and makes financial decisions easier—anything that doesn’t support your goals becomes an obvious distraction.

9. Surrendering to Impulse Purchases

Marketing experts design stores and websites specifically to trigger impulse buys. Those unplanned purchases can wreck even the best budget, leaving essential expenses shortchanged.

Impulse buying often stems from emotional needs rather than practical ones. Stress shopping, retail therapy, and FOMO (fear of missing out) on trends lead to closets full of rarely-used items. Each impulse purchase provides a brief dopamine rush followed by buyer’s remorse.

Breaking this habit requires creating space between wanting and buying. The 24-hour rule helps: wait a full day before purchasing non-essential items. For larger purchases, extend this to a week or month. This cooling-off period allows the emotional trigger to fade, revealing whether you truly need the item.

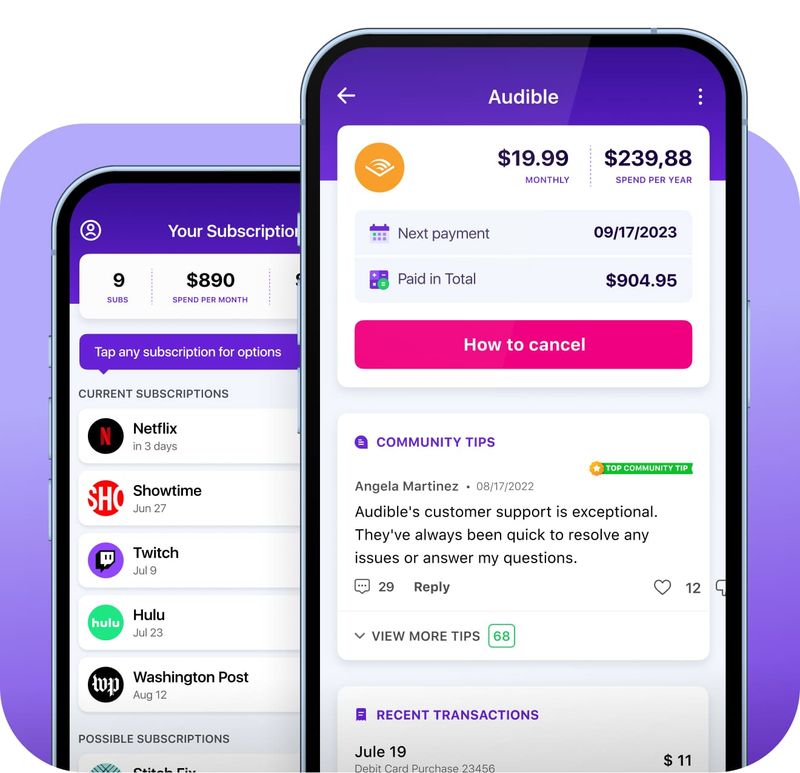

10. Funding Forgotten Subscriptions

The subscription economy thrives on our tendency to sign up and forget. Streaming services, gym memberships, box subscriptions, and apps silently withdraw money monthly whether you use them or not.

Most people drastically underestimate how many subscriptions they have. A quick bank statement review often reveals 5-10 recurring charges, some for services you barely remember joining. These “forgotten” subscriptions can easily cost hundreds monthly.

Take inventory of all subscriptions quarterly. Cancel those you rarely use or don’t value enough to justify their cost. For remaining services, consider rotating subscriptions instead of maintaining them simultaneously. Many subscription companies make cancellation deliberately difficult—but the savings make the effort worthwhile.

11. Avoiding Financial Education

Money skills aren’t taught in most schools, leaving many adults navigating finances through trial and error. This knowledge gap leads to costly mistakes that could be easily avoided with basic financial literacy.

Many feel intimidated by financial topics or believe investing and money management are only for the wealthy. The reality is that financial knowledge benefits everyone, regardless of income level. Understanding concepts like compound interest, credit scores, and tax-advantaged accounts can dramatically improve your financial situation.

Fortunately, quality financial education is more accessible than ever. Free resources abound through library books, podcasts, reputable websites, and community workshops. Even spending just 30 minutes weekly learning about money can transform your financial future.

12. Mentally Spending Future Paychecks

Counting on money before it arrives creates a dangerous financial time warp. When you mentally allocate next week’s paycheck to today’s wants, you’re setting yourself up for perpetual shortfalls.

This habit often manifests as statements like “I’ll pay for this when I get paid Friday” or “I can afford this once my commission check comes.” The problem? Unexpected expenses inevitably arise, and that future paycheck arrives already overcommitted. The cycle continues as you constantly borrow from future income.

Financial stability comes from living on last month’s income, not next week’s possibilities. Building even a small buffer—one week’s expenses saved—creates breathing room that breaks the cycle of financial time-traveling and reduces money stress significantly.

Comments

Loading…