We all dream of what we can achieve if we save just enough money, but building healthy savings can feel impossible. Thankfully, it doesn’t have to be! Here are 15 actionable tips to jumpstart your savings journey. Learn, and you will turn your savings goals into reality.

Set Specific Savings Goals

A clear idea of what you’re saving for will help you stay motivated. Is it a down payment on a house, a dream vacation, or an emergency fund? Set a specific goal and track your progress.

Track Your Expenses

Awareness is the first step to change. Knowing where your funds go each month will help you identify areas where you can cut back. Many budgeting apps and tools are available to help you track your spending.

Automate Your Savings

Arrange for transfers from your checking to a savings account to happen automatically on payday to make saving effortless. This way, you’ll pay yourself first and won’t be tempted to spend that money throughout the month.

Create a Sinking Fund

A sinking fund is a designated savings account for a specific, one-time expense. It could be for anything from annual car insurance to holiday gifts for family. Having separate savings for these occasional but inevitable expenditures will stop them from derailing your budget.

Cut Unnecessary Expenses

Be ruthless with your bills. Look for areas where you can trim without sacrificing your quality of life. Do you need both cable TV and multiple streaming services? Could you downgrade your phone plan or find a cheaper internet provider? Every little bit you cut adds up.

Cook at Home

Eating out is expensive. Plan your meals for the week and cook them yourself. What you’ll spend will be a fraction of the cost of eating out. If you can’t cook, now is the time to learn this life-saving skill.

Challenge Yourself with a No-Spend Day (or Weekend)

Can you go 24 hours (or a whole weekend) without using any money? It is a great way to reset your spending habits and become more mindful of your purchases. Plan free activities like hiking, reading a book at the library, or having a game night with friends.

Renegotiate Your Bills

No one will advocate for you if you don’t do it yourself. Call your cable company, internet provider, or cell phone provider and negotiate a reduced rate. Be polite but firm, and be prepared to mention that you’re a loyal customer considering switching to a competitor.

Shop Around for Insurance

Don’t just accept auto-renewal on your insurance policies. Get quotes from multiple companies before you renew your car or homeowners insurance. A little comparison shopping can save you hundreds of dollars a year.

Take Advantage of Free Entertainment

There’s a world of fun beyond squandering. Check the local library for books, movies, and events you won’t need to pay for. Many parks and museums have free admission days or discounted evenings. Look for concerts or festivals in your area that aren’t charging fees.

Cancel Unused Subscriptions

Audit your subscriptions ruthlessly. Are you still paying for that magazine subscription you haven’t read in a year? Do you need multiple streaming services when you only have time for one? Unsubscribe from anything you don’t use regularly.

Sell Unwanted Items

Declutter and make some extra bucks. Sell clothes, furniture, or electronics you no longer need online through marketplaces or at a garage sale. Give yourself a clean slate and a financial boost.

Embrace DIY Projects

Challenge yourself! Before you hire a professional for a home improvement project, research online tutorials or consult books. You might be surprised at what you can accomplish and how much you’ll save on labor costs.

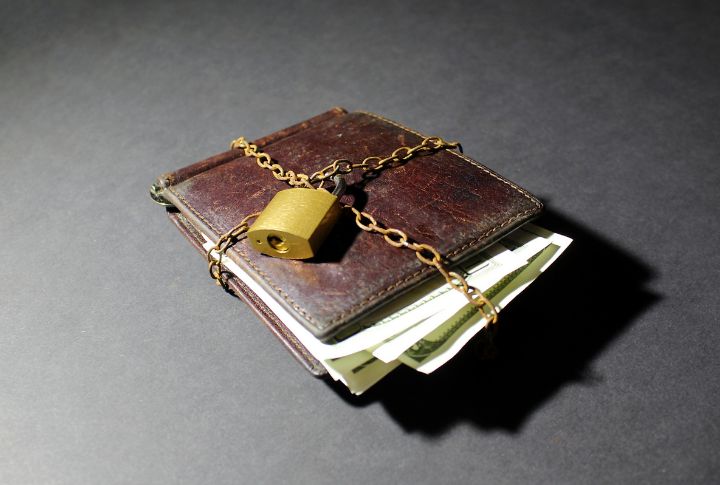

Use Cash for Everyday Expenses

Try a cash-only experiment for certain items. Using notes can make you more mindful of your spending because you see the money physically leaving your wallet. It can be helpful for groceries or impulse purchases.

Utilize Loyalty Programs and Cashback Rewards

Many stores and credit cards offer loyalty programs or cashback rewards that can translate to significant savings over time. Look for programs that align with your regular purchases and maximize your points or cashback.

Comments

Loading…