Financial anxiety isn’t just about the numbers in your bank account — it’s about the uncertainty that surrounds them. When you don’t feel in control of your finances, even small expenses can trigger panic, self-doubt, or avoidance.

But the good news is that you don’t have to overhaul your entire life to start feeling better. With the right strategies — the kind that shift your mindset and give you a sense of control — you can start easing financial anxiety today.

These tools aren’t complicated, expensive, or time-consuming. They’re simple, powerful actions and habits that build emotional resilience, reduce stress, and help you feel more secure with your money.

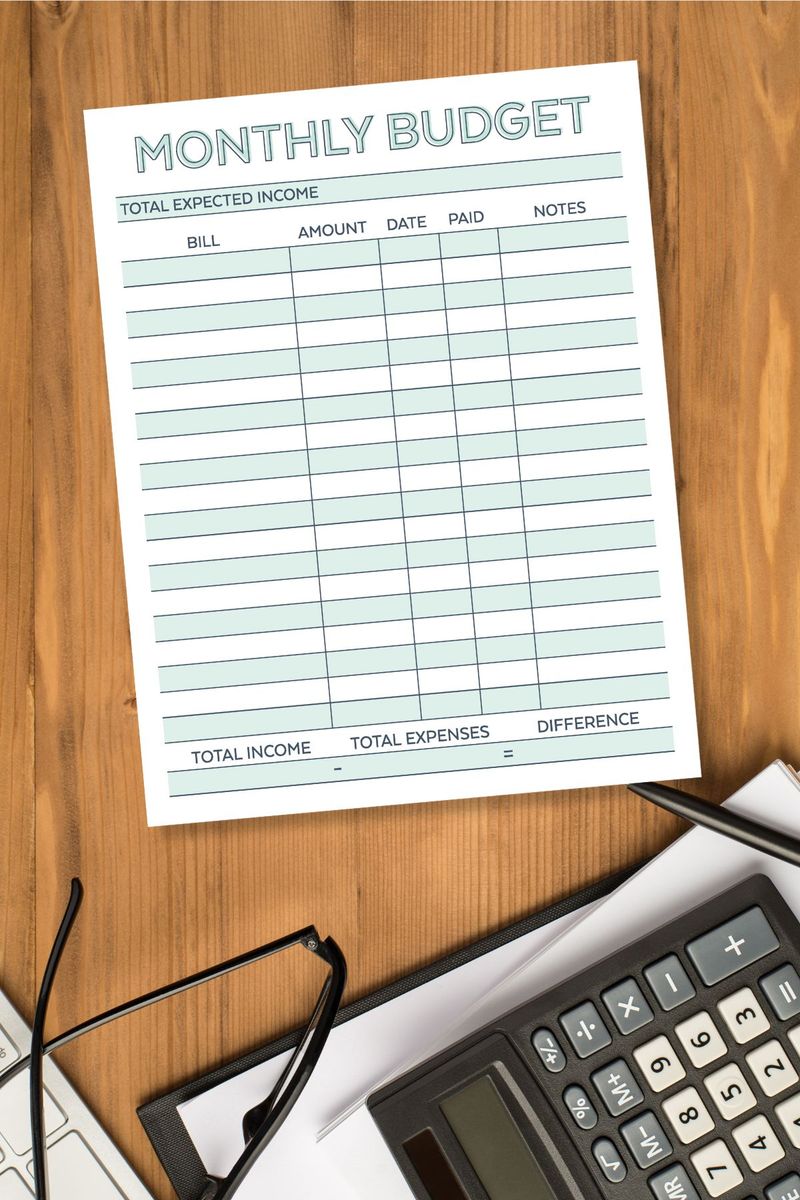

1. Build a “Bare Minimum” Budget

Creating a survival-level budget isn’t as daunting as it sounds. Instead of a detailed monthly breakdown, focus on the basics: housing, food, utilities, and essential transportation. Knowing what you must earn to cover these essentials brings clarity amidst financial chaos.

This approach reduces overwhelming financial thoughts into manageable facts. It’s not about depriving yourself but understanding the core of your financial needs. This budget forms a safety net to fall back on.

In moments of anxiety, revisit this budget to remind yourself of what truly matters. It’s about finding peace in simplicity when everything feels uncertain.

2. Schedule Weekly “Money Check-ins”

Transforming your finances into a weekly routine can be surprisingly liberating. Dedicate 15–30 minutes each week to review your spending, pay bills, and plan ahead. Establishing this rhythm turns financial management into a habit rather than a crisis.

By facing your finances regularly, the ambiguity of your money situation diminishes. Anxiety flourishes in avoidance, but structure offers clarity. It’s the regularity that chips away the fear.

As financial concerns arise, these check-ins serve as a structured balm. They prevent money matters from becoming overwhelming, grounding your monetary experience in reality rather than fear.

3. Practice “Financial Journaling”

Writing about money can unlock insights buried beneath anxiety. Spend 5–10 minutes daily or weekly reflecting on your feelings about money, recent decisions, and goals. This practice separates you from fear-based thinking through pen and paper.

Journaling externalizes financial fears, transforming rumination into reflection. It’s not just about numbers but the emotions tied to them. Identifying patterns can lead to profound self-discovery.

Consider this journaling as a journey into your financial psyche. It’s a pathway to understanding and peace, allowing you to confront monetary anxieties with a newfound perspective.

4. Shift Focus to What You Can Control

Amidst economic uncertainty, control what you can. While you can’t influence inflation or job markets, you can decide on daily spending, financial conversations, and learning opportunities. Listing “things within my financial control” refocuses energy productively.

This practice redirects anxious energy into actionable steps. It’s about empowerment through recognition of what’s in your hands. Revisiting this list during stress grounds you in practical reality.

The shift from helplessness to control is transformative. It channels anxiety into manageable, proactive actions, fostering resilience and confidence in facing financial challenges.

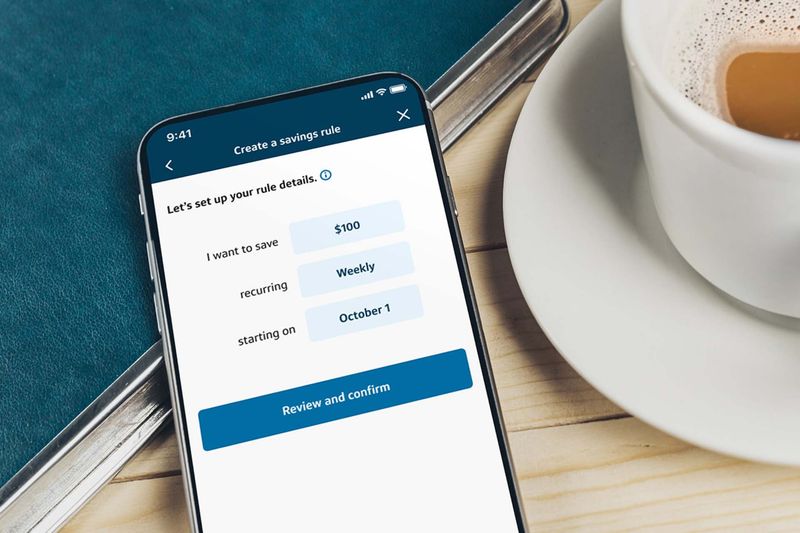

5. Automate What You Can

Automation isn’t just a convenience; it’s a pathway to peace. Set up automatic transfers to savings, bill payments, or retirement accounts, even if it’s just a small amount weekly. This reduces decision fatigue and quietly builds consistency.

Fewer decisions translate to less stress and anxiety. Automation ensures that financial goals progress in the background without constant attention. It’s about creating a quiet rhythm that aligns with your financial ambitions.

Leverage technology to handle routine financial tasks. It’s a step towards a smoother financial journey, allowing you to focus on what truly matters without getting bogged down in daily decisions.

6. Reframe Your Financial Self-Talk

Changing how you talk about money can transform your financial experience. Instead of dwelling on debts, focus on incremental progress. Replace negative statements with constructive affirmations like “I’m making progress, one payment at a time.”

The language you use shapes your financial perception. Constructive self-talk replaces catastrophizing, fostering a healthier relationship with money. Keep affirmations visible to reinforce positive thinking.

By altering your internal dialogue, financial confidence grows. It’s psychological, yet immensely practical, changing emotions around money and guiding you toward a more optimistic financial future.

7. Create a “Wins” Tracker

Every financial success, no matter how small, deserves acknowledgment. Document positive actions like skipping takeout, paying off debt, or reviewing your budget. Over time, these wins build a narrative of success.

Celebrate each achievement to reinforce progress and confidence. Recognizing small victories shifts focus from shortcomings to accomplishments, changing your financial story.

A wins tracker rewrites financial history. It transforms anxieties into a celebration of progress, creating a positive feedback loop that encourages continued success.

8. Limit “Doomscrolling” Financial News

Obsessing over financial headlines fuels fear. Set boundaries: limit checking to once daily or weekly, and focus on personal implications rather than drama. Protect your mental space from panic you can’t control.

Reducing exposure to constant financial news calms the mind. It’s about absorbing information mindfully, focusing on what truly matters.

Reclaim mental peace by controlling media consumption. It liberates you from unnecessary panic, focusing attention on actionable insights rather than sensational headlines.

9. Talk to Someone (Even If It’s Not a Financial Advisor)

Discussing money shouldn’t be isolating. Sharing concerns with a partner, friend, or support group can alleviate financial stress. Vocalizing worries diminishes their power, breaking the isolation often tied to money matters.

Connection breaks the anxiety spiral, offering perspective and understanding. Financial stress is heavy, but you don’t have to carry it alone. It’s about finding solace in shared experiences.

Even informal conversations can illuminate solutions. They provide emotional support, transforming financial struggles into a collective journey rather than an individual burden.

Comments

Loading…