7 Hidden Mistakes People Make with Cash Stuffing That Sabotage Their Budget

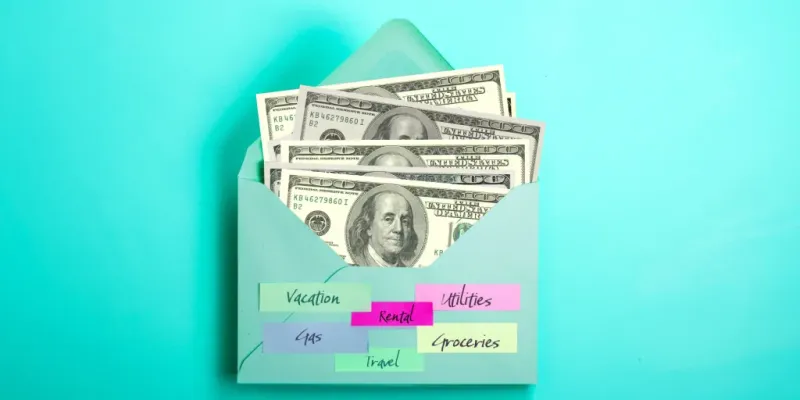

Cash stuffing has become the go-to budgeting trend for people craving structure, control, and a little tactile satisfaction. But while stuffing cash into color-coded envelopes feels like a financial win, it’s not foolproof. Beneath the surface of this wildly popular method lie some sneaky mistakes that can quietly derail even the most disciplined saver. From ignoring digital expenses to dipping into the wrong envelope “just this once,” the cracks can add up fast. Whether you’re new to the method or already a cash-stuffing convert, make sure these 7 hidden missteps aren’t silently sabotaging your budget behind the scenes.

1. Leaving Cash in Unsafe Places

Your hard-earned money deserves better than being stuffed under the mattress or tossed carelessly into a drawer. One of the most common and risky mistakes in cash stuffing is storing envelopes in unsecured or easily accessible places.

Leaving cash in your car, bag, or out in the open at home makes it vulnerable to theft, misplacement, or accidental loss. All it takes is a moment of distraction or an unexpected visitor for that money to disappear.

To protect your budget, always use a fireproof safe, lockbox, or another secure, discreet location. Even inside your home, be cautious about who has access.

2. Forgetting About Digital Expenses

Remember signing up for that streaming service three months ago? The one that quietly charges your card each month? Many cash stuffers create beautiful envelope systems but completely overlook their automatic digital payments.

The physical nature of cash stuffing creates a disconnect with the digital world. Netflix, cloud storage, phone bills, and other subscriptions continue pulling funds from your accounts regardless of your envelope system. Smart cash stuffers create a separate envelope specifically for digital expenses or maintain a buffer in their checking account to cover these charges.

Consider using a subscription tracking app to identify all your recurring payments, then either convert them to manual payments or ensure you’ve accounted for them in your cash system.

3. Borrowing From Other Categories

“I’ll just take $20 from my savings envelope for this cute shirt, and I’ll replace it next payday.” Sound familiar? This seemingly innocent habit forms one of the most destructive patterns in cash stuffing.

Borrowing between envelopes creates a slippery slope where your carefully planned budget boundaries become meaningless. Once you start, it becomes psychologically easier to do it again and again, until your entire system lacks integrity.

When you’re tempted to raid another envelope, ask yourself if you’d be willing to take on credit card debt for this purchase. If not, it’s probably not worth borrowing from your other categories. Instead, start a specific “wants” envelope for those spontaneous purchases that tempt you to break your rules.

4. Neglecting Interest-Earning Opportunities

Cash might feel safe in your hands, but it’s quietly losing value the longer it stays tucked in envelopes. While your budget may look picture-perfect, inflation is steadily chipping away at your money’s real worth—and you’re missing out on the interest it could be earning elsewhere.

Holding too much cash means you’re giving up easy opportunities to grow your savings. Instead, keep just 1–2 weeks of spending money in cash and move sinking funds or long-term savings into high-yield accounts.

This way, your money keeps working for you—even when it’s waiting to be spent. Smart saving isn’t just about visibility—it’s about velocity.

5. Starting With Too Many Categories

The Instagram cash stuffing community is filled with eye-catching setups—dozens of neatly labeled envelopes, matching binders, and color-coded trackers.

It’s easy to feel inspired, but jumping into an overly complex system too quickly can lead to overwhelm and burnout. Many beginners make the mistake of creating 20+ categories right away, only to find the process exhausting and unsustainable within weeks.

Instead, start with just 4–6 core categories like groceries, gas, entertainment, and personal spending. Once those become second nature, you can expand gradually. Sustainable budgeting comes from building habits over time—not chasing perfection from the start.

6. Skipping the Expense Tracking

Stuffing cash into pretty envelopes feels satisfying, but it’s only half the budgeting equation. Many people distribute their cash with enthusiasm but never track where those dollars actually go once they leave the envelope.

Without recording your spending, you miss crucial insights about your habits. You might empty your $400 grocery envelope every month without realizing that $100 is consistently going to takeout coffee from the café inside the supermarket.

Keep a small notebook in each envelope or use a tracking app to record every purchase. Review these records monthly to identify patterns and opportunities for adjustment. This practice transforms cash stuffing from a money organization system into a powerful tool for changing your relationship with spending.

7. Missing Irregular Expenses

Car registration comes due, and suddenly you’re scrambling to find $200. Your cash system worked perfectly for your monthly expenses, but these annual or quarterly costs blindsided you completely. Irregular expenses are budget-busters precisely because they’re easy to forget until they’re urgently due.

Annual subscriptions, seasonal expenses like holiday gifts, insurance premiums, and maintenance costs don’t fit neatly into monthly thinking. Create specific sinking fund envelopes for these predictable but irregular expenses.

Calculate the annual total for each category, divide by 12, and set aside that amount monthly. For example, if you spend $600 on holiday gifts each year, your “Holiday” envelope needs $50 monthly contributions. This approach transforms unexpected financial hits into planned, manageable expenses.

Comments

Loading…