How to Save $500 a Month Without Changing Your Lifestyle

You don’t need to live off instant noodles or give up your morning latte to save money. In fact, most people can free up $500 a month just by making a few smart, low-effort changes that barely affect their day-to-day life. It’s not about depriving yourself—it’s about getting a little savvier with the money you’re already spending.

Think of this as a financial tune-up, not a lifestyle overhaul. A few phone calls, small tweaks, and smarter habits can make your budget feel brand new. You’ll still enjoy your favorite things—just with a bit more cash left over at the end of the month.

1. Audit and Cancel Unused Subscriptions

It’s easy to lose track of all the monthly charges silently eating away at your wallet. Streaming services, apps, fitness memberships, and “free trial” subscriptions you forgot to cancel can quietly add up to $50–$100 or more each month.

Spend ten minutes scrolling through your bank statements or using a budgeting app like Truebill or Rocket Money to spot those sneaky recurring payments. You’ll be surprised how many you barely use—or completely forgot about.

Canceling them doesn’t change your life at all—you won’t miss what you weren’t using. The best part? You’ll instantly feel more in control of your finances, and your checking account will thank you for it.

2. Call and Negotiate Your Bills

Companies don’t want to lose you as a customer—and they’re often willing to lower your bill if you just ask. Whether it’s your internet, phone plan, or insurance, you might be paying more than new customers for the exact same service.

A quick, confident phone call can make a big difference. Simply say you’re considering switching providers, and ask if there are any current promotions or loyalty discounts. The customer service rep will usually find something “just for you.”

This tiny bit of effort could save $20, $50, or even $100 per month—all for less than ten minutes of your time. That’s about the easiest raise you’ll ever give yourself.

3. Switch to Store Brands for Everyday Items

You’d be shocked how often the same factory produces both the name-brand and the generic version of your favorite products. The only difference? The label—and the price tag.

When you swap name-brand groceries, cleaning supplies, or over-the-counter meds for store brands, you’ll rarely notice a difference in quality. What you will notice is a lighter grocery bill—usually 20% to 40% lower.

Try switching just a few of your go-to items first—like cereal, paper towels, or detergent—and see how it feels. Once you realize how little you’re giving up, you’ll start making the switch across the board and pocket an easy $50 a month.

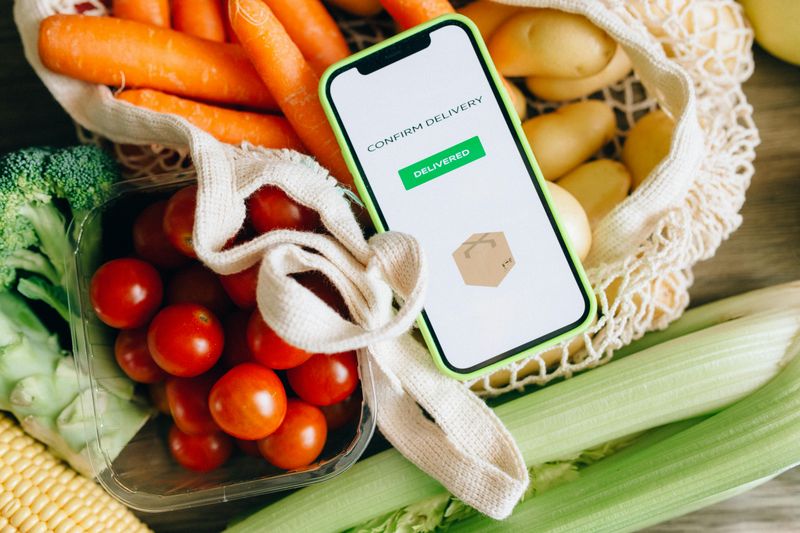

4. Use Grocery Pick-Up or Online Orders

Stepping into a grocery store hungry or bored is practically begging to overspend. All those “limited-time deals” and tempting displays are designed to make you buy things you never planned on.

Ordering online or using grocery pick-up keeps you focused. You can stick to your list, see your total in real time, and delete items before you check out. Plus, you’ll never get stuck behind someone arguing over coupons again.

This small switch can easily save $40–$60 per trip, not to mention your time and sanity. No more impulse snacks or “oh, that looks good” moments that make your total skyrocket.

5. Automate Your Savings

Saving money feels hard—until you make it automatic. When you transfer a set amount to a high-yield savings account right after payday, you remove temptation before it even starts.

You don’t have to remember to save or decide how much to move—it just happens quietly in the background. Before you know it, you’ve built an emergency cushion without any extra effort.

Even setting aside $100 a week adds up fast. The trick is to treat your savings like a bill you can’t skip. That way, you’re paying your future self first—and you won’t even miss the money.

6. Cut Energy Waste at Home

Every little flick of a switch adds up. Most people waste more on energy than they realize, from forgotten lights to overworked water heaters.

Start by lowering your water heater to 120°F, unplugging electronics when they’re not in use, and turning off lights when you leave a room. It’s simple, but you could save $30–$50 every month without feeling any difference in comfort.

Want to level up? A smart thermostat learns your habits and adjusts your heating or cooling automatically. That’s high-tech savings for people who’d rather not think about it.

7. Meal Prep Once a Week

Cooking at home doesn’t mean you have to spend hours slaving over the stove. Set aside a couple of hours each week to prep easy meals or ingredients—you’ll thank yourself later.

When dinner’s already halfway done, you’re far less likely to cave to the convenience of takeout. It’s shocking how quickly those $15–$20 food deliveries add up over a month.

Meal prepping also reduces food waste. You’ll use what you have instead of letting it spoil in the fridge. The result? You’ll eat better, waste less, and keep an extra $100+ in your pocket each month.

8. Use Cashback and Rewards Apps

You’re already shopping—so you might as well get paid for it. Cashback and rewards apps like Rakuten, Honey, Ibotta, or Upside give you real money back for purchases you’d make anyway.

They work by giving you a small percentage of your total purchase back when you shop through their links or upload receipts. It might not sound like much, but it adds up fast over time.

Imagine earning $5 here and $10 there just for being smart about your spending. It’s basically free money for clicking one extra button before checkout.

9. Refinance or Consolidate High-Interest Debt

High-interest rates are like a leak in your financial bucket—money just keeps dripping out every month. Refinancing or consolidating credit cards, student loans, or car payments can plug that hole fast.

By lowering your interest rate, more of your payment actually goes toward reducing the balance instead of feeding the lender. Even a few percentage points can mean saving $100–$200 a month.

Call your bank, shop around online, or use a reputable financial service to explore your options. It’s one of the most powerful moves you can make to save money and stress.

10. Keep Your Car Efficient

Your car’s small details can have a big impact on your budget. Underinflated tires, for example, can burn more gas and wear out faster—both costly over time.

A quick check every few weeks keeps your tires in good shape and your fuel efficiency up. Add in a clean air filter and regular oil changes, and you’ll extend the life of your vehicle, too.

Don’t forget gas rewards programs from grocery stores or credit cards. Combining those perks can save $20–$40 a month without you even noticing.

11. Avoid ATM and Transaction Fees

Those “small” $3–$5 ATM fees might not seem like a big deal—but if you hit the wrong machine a few times a week, that’s $20 or more gone each month for absolutely nothing.

A little planning goes a long way. Withdraw larger amounts less often, and always use your bank’s in-network ATMs. Many banks even have maps in their mobile apps to help you find free ones.

It’s one of the easiest ways to stop wasting money. After all, you shouldn’t have to pay to access your own cash.

12. Buy in Bulk (But Smartly)

Buying in bulk can save a ton of money—but only if you’re strategic about it. Stocking up on nonperishables like paper goods, cleaning supplies, or coffee means you’re spending less in the long run.

The key is to stick to what you actually use. Don’t buy a 50-pound bag of rice if it’ll go stale before you finish it. Bulk buying should feel like a win, not a storage problem.

Look for warehouse clubs, Amazon Subscribe & Save, or sales at your local grocery store. Over time, those small savings add up without changing your habits.

13. Make “No-Spend” Weekends a Habit

You don’t have to hermit yourself indoors to save money—just get creative about free fun. Try hiking, visiting a museum on a free-admission day, or hosting a game night at home.

Pick one weekend a month where you don’t spend on extras. It’s a reset that helps you enjoy what you already have and appreciate experiences over purchases.

Most people find they actually look forward to these weekends once they start. You save $50–$100 easily, and you’ll feel richer in more ways than one.

Comments

Loading…