16 Lesser-Known Passive Income Ideas That Can Earn Up to $50K Annually

Tired of trading hours for dollars? Imagine earning $50,000 a year while you sleep, travel, or focus on what truly matters. Passive income isn’t just a buzzword—it’s a powerful wealth-building strategy hiding in plain sight. From vending machines and stock videos to EV chargers and white-label apps, these under-the-radar income streams are quietly generating serious cash for smart investors and side-hustlers alike. Whether you’re looking to supplement your salary or eventually ditch the 9-to-5, these 16 little-known ideas prove you don’t need to reinvent the wheel to build real financial freedom. Ready to discover your next money-maker? Let’s go.

1. Vending Machines

Money literally drops into your account when you own strategically placed vending machines. The beauty lies in their simplicity – stock them weekly, collect cash, and repeat. Modern machines even alert you when inventory runs low!

The most profitable locations? Schools, busy office complexes, and manufacturing facilities where hungry workers have limited food options. A single well-placed machine can generate $300-500 monthly, meaning just 8-10 machines could reach that $50K yearly target.

Smart operators focus on healthy options and cashless payment technology to maximize earnings in today’s health-conscious, cash-free world.

2. Creating and Licensing Music

Melody makers rejoice! Composing production music for commercials, YouTube videos, and corporate presentations creates a royalty stream that flows for years. Unlike mainstream music, these tracks don’t need to top charts to be profitable.

Music libraries like Epidemic Sound and AudioJungle connect composers with businesses willing to pay licensing fees. The secret to success? Volume and versatility. Creating hundreds of tracks across different moods and styles maximizes your earning potential.

One catchy jingle used in a national commercial campaign might earn more than your annual salary, while dozens of background tracks steadily accumulate smaller payments month after month.

3. Car Wash Automation Systems

Squeaky clean profits flow from automated car wash systems that operate 24/7 with minimal supervision. Modern facilities use license plate recognition technology to offer monthly subscription packages, turning occasional customers into reliable recurring revenue.

The initial investment ranges from $200,000-500,000, but with profit margins approaching 60-70% after expenses, these operations can generate substantial passive income. Location is everything – busy commuter routes near affluent neighborhoods deliver the best returns.

Smart owners add revenue streams with optional services like interior cleaning stations, vacuum systems, and even dog washing stations to maximize each customer’s value.

4. White-Label Mobile Apps

Crafty developers are making bank by creating versatile app templates that businesses can customize with their own branding. Think fitness trackers for gyms, appointment schedulers for salons, or loyalty programs for restaurants – all using the same core code.

Monthly subscription models range from $50-500 per business client, depending on features and support levels. The magic happens when you reach scale – 100 clients paying $200 monthly creates a reliable $20,000 monthly revenue stream!

Maintenance costs stay relatively fixed regardless of client count, making this business model increasingly profitable as your customer base expands. The most successful white-label developers focus on niche industries with specific software needs.

5. Automated Storage Unit Facilities

Americans love their stuff but hate storing it. Enter the humble self-storage facility – a concrete gold mine that practically runs itself. Modern facilities feature keypad entry, security cameras, and online payment systems that eliminate the need for full-time staff.

A 100-unit facility charging an average of $100 monthly per unit at 85% occupancy generates $102,000 yearly. After expenses like property taxes, insurance, and maintenance, owners typically clear $65,000-80,000 annually.

Climate-controlled units command premium prices, while boat and RV storage spaces offer seasonal bonuses. The best part? Tenants rarely leave, with the average storage rental lasting 14 months.

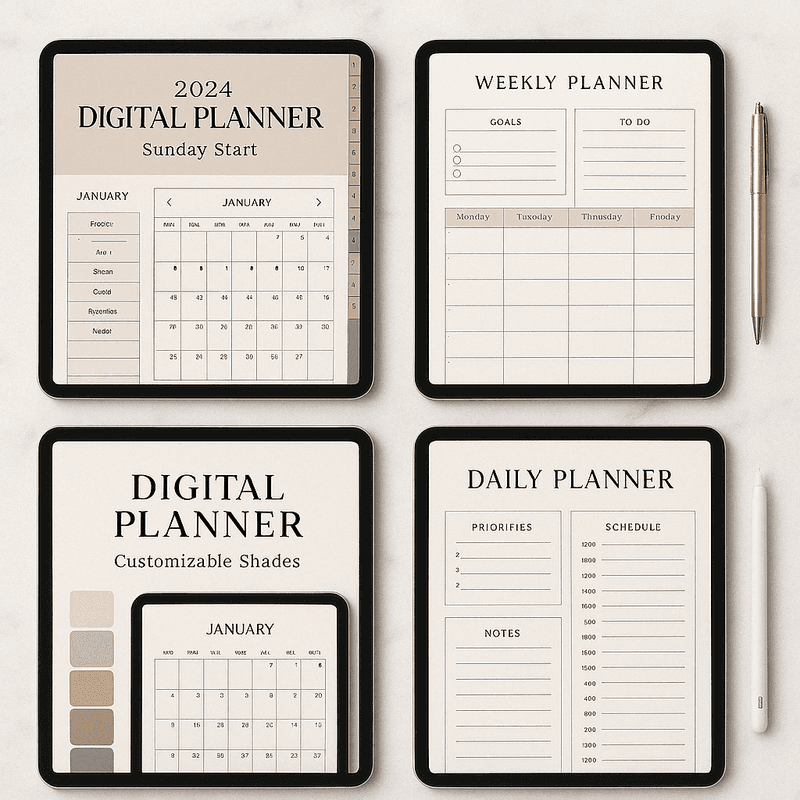

6. Digital Planners and Templates

Creative minds are cashing in by designing beautiful digital planners and templates that sell while they sleep. These digital goods cost nothing to duplicate yet sell for $5-25 each on platforms like Etsy, Shopify, and Creative Market.

The numbers add up quickly – selling just 15 planners daily at $10 each creates a $54,750 yearly income stream. Seasonal products like holiday planners, tax organizers, and academic calendars create predictable sales spikes throughout the year.

Successful creators expand their offerings with complementary products like sticker packs, habit trackers, and budget templates. The most profitable niches include wedding planning, homeschooling resources, and business organization tools.

7. Data Center REITs

Cloud computing isn’t just changing how we work – it’s creating wealth opportunities through specialized Real Estate Investment Trusts (REITs) that own the physical buildings housing our digital world. These data center REITs typically yield 3-5% annually in dividends while appreciating in value as digital demand grows.

Companies like Digital Realty Trust and Equinix own massive server farms that power everything from Netflix to online banking. Their tenant leases typically span 5-10 years with built-in price escalations, creating predictable income streams.

A $1 million investment could generate $40,000-50,000 yearly in dividends alone, while the underlying assets continue appreciating as our data-hungry world expands.

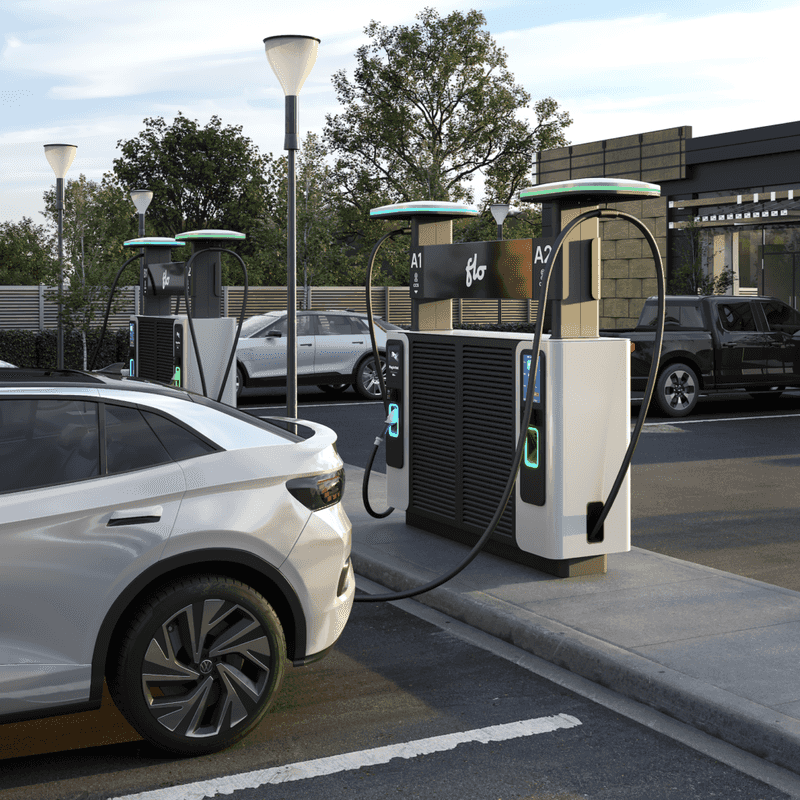

8. EV Charging Stations

Forward-thinking entrepreneurs are plugging into profits by installing electric vehicle charging stations at strategic locations. The business model is brilliantly simple – drivers pay $0.30-0.50 per kilowatt-hour while property owners receive a percentage for hosting the equipment.

Popular locations include shopping centers, hotels, and apartment complexes where vehicles park for extended periods. Government incentives often cover 50-80% of installation costs, dramatically improving ROI.

A network of 20 dual-port stations averaging 8 charging sessions daily can generate $55,000+ annually after expenses. With EV adoption accelerating worldwide, early investors are positioning themselves for decades of growing passive income as gas stations gradually become obsolete.

9. Stock Video Footage Licensing

Amateur videographers are turning everyday moments into money-making assets by capturing and licensing stock footage. Stunning timelapses of city skylines, drone shots of natural landscapes, or simple business meetings can sell repeatedly for years.

Premium platforms like Shutterstock and Adobe Stock pay $25-300 each time someone licenses your footage. The key to success lies in volume and quality – professional videographers often maintain libraries of 3,000+ clips generating consistent monthly income.

Emerging niches like vertical video for mobile content and authentic lifestyle footage command premium prices. One perfectly executed 4K video of a trending topic might sell hundreds of times, while even modest libraries of 500 clips can generate $4,000-5,000 monthly.

10. Mineral Rights and Royalties

Beneath the surface of America’s farmland lies hidden wealth in the form of mineral rights. Savvy investors purchase these rights – separate from land ownership – and earn royalties whenever natural resources are extracted.

Oil and gas royalties typically pay 12.5-25% of production value, with payments continuing for decades as long as wells remain productive. Even non-producing mineral rights in promising areas can be leased to exploration companies for upfront bonuses.

Specialized marketplaces like EnergyNet connect buyers with sellers, while mineral rights management companies handle paperwork for a small fee. A diversified portfolio of mineral interests across multiple producing regions can generate stable six-figure income with minimal involvement.

11. Card-Based Laundromat Franchises

Modern laundromats bear little resemblance to their coin-operated ancestors. Today’s facilities feature card payment systems, smartphone apps, and remote monitoring – eliminating cash handling and reducing theft while collecting valuable customer data.

A medium-sized laundromat with 30 machines generates $5,000-8,000 monthly in revenue while requiring just 10-15 hours weekly for maintenance and oversight. Smart operators boost profits with add-on services like wash-and-fold, delivery options, and vending machines.

Franchise models like Speed Queen and Laundrylux offer turnkey operations with established systems and marketing support. The most successful locations serve apartment-dense neighborhoods where residents lack in-unit laundry facilities.

12. Corporate Training Courses

Industry experts are packaging their knowledge into digital training programs that corporations purchase repeatedly for employee development. Unlike consumer courses that sell for $50-200, corporate training commands $3,000-10,000 per company or charges per-employee licensing fees.

The most profitable niches address specific business challenges like compliance requirements, management skills, or technical certifications. Once created, these courses require minimal updates yet continue selling for years.

Savvy course creators partner with professional organizations to secure endorsements that boost credibility and reach. A portfolio of 5-10 specialized courses licensed to mid-sized companies can easily generate $100,000+ annually with just quarterly content refreshes.

13. Billboard Advertising Spaces

Roadside real estate generates remarkable returns when transformed into billboard advertising space. These silent salespeople work 24/7, requiring just occasional maintenance while delivering monthly rental checks from advertisers.

Urban billboards command $1,500-5,000 monthly, while rural highway locations still fetch $500-1,500. Digital billboards, though requiring larger initial investment, rotate multiple advertisers and generate 3-5 times more revenue than traditional static displays.

The business model is refreshingly straightforward – secure location permits, install structures, then lease space to local businesses or national brands through advertising agencies. A portfolio of 15-20 strategically placed billboards can generate $60,000-100,000 annually with minimal ongoing effort.

14. Printable Educational Materials

Former teachers are banking significant income by creating downloadable classroom resources that sell thousands of times with zero production costs. Worksheets, lesson plans, and activity packs priced at $3-15 each become perpetual income streams on platforms like Teachers Pay Teachers.

The most successful creators focus on high-demand subjects like special education, STEM activities, and seasonal materials. Top sellers on these platforms earn $80,000+ annually, with some reaching six figures from their digital product libraries.

Strategic creators build product bundles that encourage larger purchases while reducing their creation workload. The business scales beautifully – the effort to create a resource that sells 10 times is identical to one that sells 10,000 times.

15. Automated Pet Wash Stations

America’s 90 million dog owners spend over $100 billion yearly on their furry friends. Self-service pet wash stations tap into this market by offering convenient facilities that spare owners the back-breaking labor and messy cleanup of home bathing.

These automated stations cost $15,000-30,000 to install but generate $2,000-4,000 monthly with minimal oversight. Most charge $10-15 per wash cycle and include shampoo, conditioner, and dryers activated through simple digital interfaces.

Strategic locations near dog parks, pet stores, and apartment complexes maximize usage. Many owners expand with multiple units or complementary services like dog treat vending machines. The business requires just weekly maintenance and supply restocking, making it truly passive.

16. Peer-to-Peer Lending

Financial middlemen are being bypassed by peer-to-peer lending platforms that connect investors directly with borrowers. These platforms handle credit checks, payments, and collections while investors earn substantially higher returns than traditional savings accounts.

Diversification is crucial – spreading $100,000 across 400+ small loans minimizes the impact of any defaults. Returns typically range from 5-9% annually, with some investors achieving 12%+ by focusing on higher-risk borrower categories.

Platforms like Prosper and Funding Circle automate the entire process, from loan selection to reinvestment of payments. The truly passive approach involves using auto-invest features that deploy capital based on pre-selected criteria, creating a hands-off income stream that grows through compounding.

Comments

Loading…