Calculating your net worth might seem straightforward—just subtract what you owe from what you own. But the truth is, many people overlook key details or make simple errors that can lead to a misleading financial picture. In this post, we break down 10 of the most common mistakes people make when calculating their net worth, from overvaluing assets to forgetting hidden debts. Whether you’re building a budget, planning for retirement, or just trying to get a clearer view of your finances, understanding these pitfalls will help you measure your wealth more accurately—and make smarter financial decisions moving forward.

1. Excluding Certain Assets or Liabilities

Overlooking assets like real estate or liabilities such as credit card debt can skew your net worth. Imagine writing a financial novel and forgetting essential chapters. Ignoring these components gives a fragmented financial picture, leaving you in a fog. A complete list of assets and liabilities ensures an accurate view. A forgotten mortgage here, a missed investment there, and suddenly your net worth is a fictional masterpiece. Regularly update and review all aspects to maintain an accurate narrative. This approach helps avoid surprises and keeps your financial story clear.

2. Overestimating Asset Values

Valuing illiquid assets like real estate too generously turns your financial balance into a fantasy tale. Consider them as characters in your fiscal story, each with a realistic role. Too much fiction, and the tale lacks credibility. Assigning conservative valuations keeps the narrative grounded. Overinflating these values can mislead, suggesting a wealth that’s merely smoke and mirrors. By using realistic market values, your fiscal tale remains truthful, offering insights rather than illusions. Keep your financial chapters believable and actionable with accurate asset appraisals.

3. Underestimating Liabilities

Ignoring liabilities like personal loans is akin to forgetting villains in a story—they exist, and their impact is real. Every debt, from personal loans to unpaid bills, weighs heavily on your financial plot. Underestimating them creates a misleading optimistic balance. Acknowledging all liabilities ensures your financial narrative stands firm, without unwelcome surprises. Align your liabilities honestly with your assets for a full picture. Doing so provides a stronger, more accurate financial storyline, ready to withstand any fiscal plot twists.

4. Ignoring Market Fluctuations

Market fluctuations are the plot twists in your financial story. Ignoring them leaves you unprepared for the sudden turns. Asset values change with market conditions, impacting your net worth narrative. An outdated assessment can lead to financial missteps. Regularly updating your evaluations ensures your story aligns with current realities. Embrace these fluctuations as key plot elements that provide depth and context to your financial tale. Staying informed keeps your financial narrative dynamic, ready to adapt to changes with confidence.

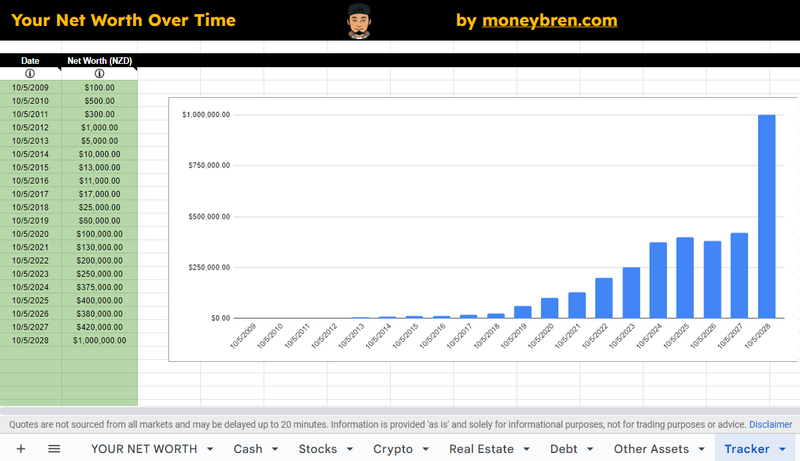

5. Neglecting to Update Regularly

Like reading an outdated novel, a stale net worth assessment misleads. Financial life is dynamic, and regular updates ensure your story stays relevant. Monthly reviews capture changes, opportunities, and challenges, preventing surprises. An obsolete financial narrative can hinder growth. By regularly updating, you align your financial tale with reality, ensuring a clear and actionable perspective. Consistent review is key, akin to editing a manuscript, to reflect true progress and adapt strategies. Keep your financial story fresh and insightful with timely updates.

6. Overlooking Illiquid Assets

Illiquid assets, like hidden treasures, enrich your financial narrative. Ignoring them leads to an incomplete story. Real estate, collectibles—each adds depth, often overlooked due to liquidity issues. Including them paints a fuller picture of your wealth. These assets may not be cash-ready, but their value is undeniable, enhancing your net worth. Acknowledging them provides a comprehensive view, avoiding the trap of an incomplete tale. Ensure your financial story accounts for all valuable chapters, bringing your net worth into clearer focus.

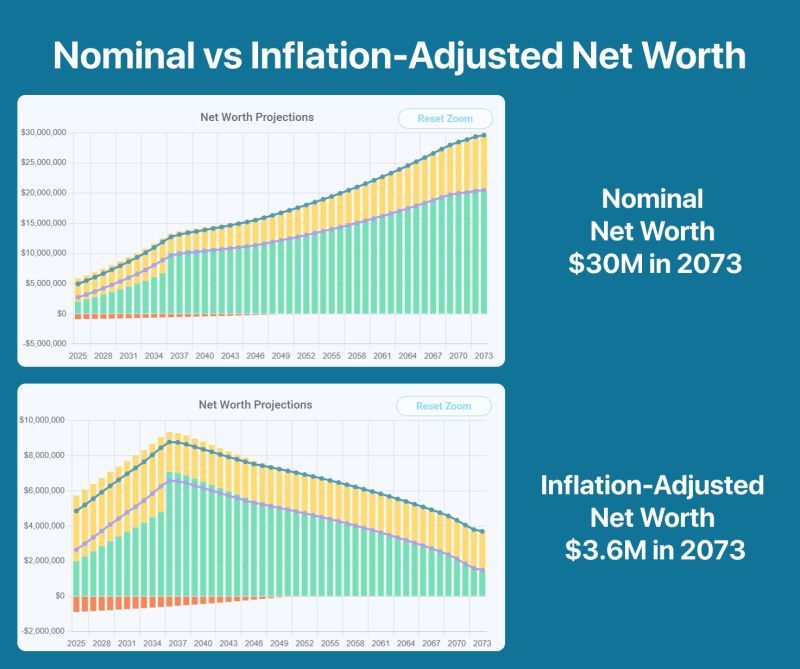

7. Failing to Adjust for Inflation

Inflation is the silent editor, altering your financial script over time. Failing to account for it inflates illusions of wealth. As costs rise, the purchasing power of your assets shrinks. Adjusting for inflation ensures your net worth reflects real-world value, providing clarity. Like a plot twist, inflation can change the narrative direction, impacting financial decisions. Acknowledging this ensures your story aligns with reality, avoiding missteps based on outdated figures. Calculate net worth with an inflation-adjusted lens for a true representation.

8. Not Considering Tax Implications

Ignoring tax implications is like missing a crucial subplot in your financial narrative. Taxes on assets can alter your net worth significantly. Consider them to avoid a skewed financial view. An unanticipated tax bill can be a costly twist in your story. By accounting for potential taxes, your financial tale remains accurate and insightful. Understanding tax impact ensures you’re prepared for fiscal surprises, maintaining a truthful narrative. A comprehensive view, including tax considerations, strengthens your financial foundation.

9. Comparing to Others

Comparing your financial journey to others is like reading another’s story—interesting but not yours. Each path is unique, and comparisons often lead to dissatisfaction or overconfidence. Focus on your financial goals, ensuring your narrative remains authentic. Tracking personal progress allows for meaningful insights and decisions. Like a protagonist in their own tale, you’re the hero of your story. Avoid the distractions of others’ paths, and your financial journey will be true and fulfilling. Stay focused on your goals for a genuine narrative.

10. Not Seeking Professional Advice

Overlooking professional financial advice is like writing without an editor—prone to errors. Financial advisors bring perspective and expertise, enriching your narrative. Their guidance helps avoid costly mistakes, offering strategies for growth. Engaging professionals can transform your financial plot, ensuring accuracy and success. As experts in financial storytelling, they offer insights that refine your narrative. Don’t miss the chance to enhance your financial tale with professional support. A well-guided story leads to informed decisions and prosperous outcomes.

Comments

Loading…