Money troubles don’t always show up in bank statements or credit scores. Sometimes, the clearest signs appear right inside someone’s home.

From broken appliances that never get fixed to piles of unpaid bills on the counter, these everyday clues can reveal when a family is struggling financially more than they let on.

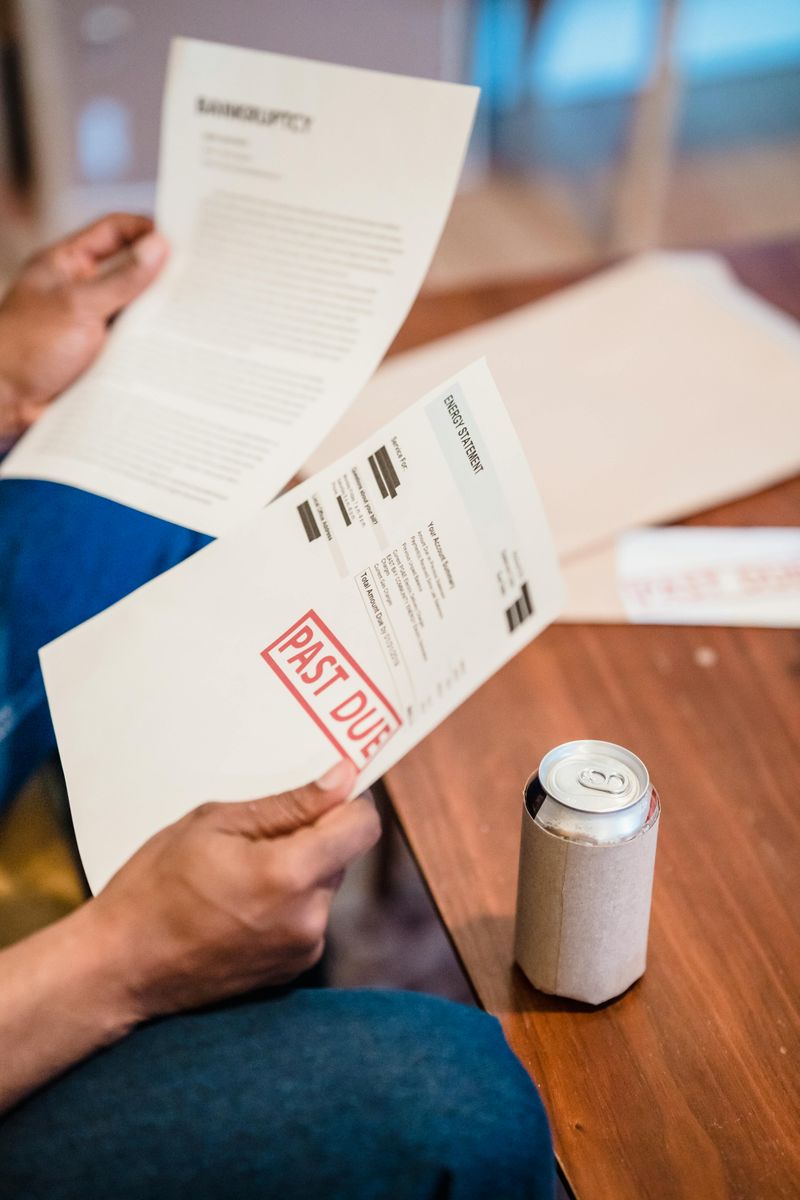

1. Stacked or Unpaid Bills Lying Around

Bills scattered across the kitchen table or stacked near the front door tell a story nobody wants to read.

When envelopes pile up unopened, it usually means someone is avoiding bad news.

Red stamps screaming “OVERDUE” or “FINAL NOTICE” are hard to miss.

Families facing money troubles often feel overwhelmed by the constant flow of bills they cannot pay.

Ignoring them doesn’t make them disappear, but it does provide temporary relief from stress.

Over time, this habit creates bigger problems like late fees and damaged credit scores.

Visitors might spot these piles and sense something is wrong, even if nobody talks about it openly.

2. Empty Pantry or Expired Food

Opening the pantry to find bare shelves is one of the most heartbreaking signs of financial hardship.

Families struggling with money often run out of groceries well before payday arrives.

What little food remains might be expired, stale, or pushed to the back and forgotten.

Fresh produce becomes a luxury when every dollar counts toward keeping the lights on.

Kids might ask for snacks only to hear there’s nothing available.

Parents feel the weight of this reality every single day.

Food insecurity affects millions of households, and an empty pantry is its most visible symptom at home.

3. Outdated or Broken Appliances Not Replaced

That refrigerator humming louder than a lawnmower?

It’s probably been broken for months.

When money is tight, replacing major appliances drops to the bottom of the priority list.

Families learn to work around malfunctions instead of fixing them properly.

A washing machine that only works on one cycle becomes the new normal.

Duct tape and makeshift repairs hold things together temporarily.

The cost of a new appliance feels impossible when rent is already late.

These outdated machines waste energy and money, but the upfront cost of replacement seems too steep to manage right now.

4. Overcrowded Furniture or Cluttered Spaces

Walking through a home crammed with furniture and belongings can feel suffocating.

Sometimes clutter results from downsizing after losing a bigger place or moving in with relatives to save money.

Multiple families sharing one space means everyone’s stuff gets squeezed into tight quarters.

There’s no room to breathe, let alone organize properly.

Selling items might bring quick cash, but people hold onto things hoping their situation improves.

Boxes remain unpacked because moving again feels inevitable.

This chaos reflects instability and the constant shuffle of trying to make ends meet in smaller, cheaper living arrangements.

5. Neglected Home Maintenance

Peeling paint, cracked walls, and leaky faucets don’t get fixed when money disappears faster than it arrives.

Home maintenance requires funds that struggling families simply don’t have available.

Small problems grow into major issues when left unaddressed.

A tiny roof leak becomes water damage, but calling a repair person costs hundreds of dollars.

Homeowners feel embarrassed about the deterioration but lack options to fix it.

Renters worry about complaints leading to eviction if they cannot afford their share of repairs.

Neglect becomes visible everywhere, from overgrown yards to broken windows covered with cardboard instead of glass.

6. DIY or Improvised Fixes Everywhere

Duct tape becomes the universal solution when professional repairs aren’t affordable.

Broken chair legs get propped up with books, and cardboard patches cover holes in walls.

Creativity flourishes out of necessity when money runs short.

People learn to improvise fixes using whatever materials they can find around the house.

These temporary solutions rarely work well or last long, but they provide immediate relief from problems.

A wire hanger holding up curtains or aluminum foil boosting WiFi signals shows resourcefulness born from desperation.

While some DIY projects save money wisely, constant improvisation throughout a home signals deeper financial struggles underneath the surface.

7. Overloaded Power Strips or Unpaid Utilities

Power strips overflowing with plugs and extension cords snaking across floors create serious fire hazards.

This dangerous setup often results from unpaid utility bills forcing creative electrical solutions.

When electricity gets shut off in part of the house, families run cords from working outlets to power essential items.

They prioritize keeping the refrigerator running over proper electrical safety.

Utility companies send disconnection notices that get added to the pile of unpaid bills.

Families face impossible choices between paying for power or buying groceries.

These tangled cord disasters reveal the desperate measures people take to maintain basic services during financial crises.

8. High-Interest Debt Notices Lying Around

Payday loan envelopes and credit card warnings scattered around the house paint a grim financial picture.

These high-interest traps promise quick relief but deliver long-term suffering instead.

Desperate families turn to predatory lenders when traditional options disappear.

Interest rates reach triple digits, making it nearly impossible to escape the debt cycle once caught.

Each new loan pays off the previous one, creating an endless loop of borrowing.

Collection agency letters arrive daily, adding stress to already overwhelming situations.

These notices represent the darkest corner of money troubles, where hope fades and financial recovery seems impossibly far away from reality.

9. Constantly Borrowed Items from Neighbors

Knocking on the neighbor’s door to borrow sugar, toilet paper, or laundry detergent becomes routine when money runs out before the month ends.

What starts as occasional requests turns into regular dependency.

Families feel embarrassed asking repeatedly but have no other options available.

Basic household supplies become luxuries they cannot consistently afford.

Neighbors might help gladly at first, but frequent borrowing strains relationships over time.

People avoid eye contact in hallways, knowing another request is probably coming soon.

This pattern reveals how financial struggles extend beyond big bills into everyday necessities that most people take completely for granted.

Comments

Loading…