15 Small Expenses That Add Up to Big Trouble Over Time

We all have those little spending habits that seem harmless at the moment. A coffee here, a subscription there – no big deal, right? But these tiny expenses can silently drain your bank account over months and years. Before you know it, these small money leaks transform into financial sinkholes that could have funded something meaningful in your life.

1. Daily Coffee Shop Visits

That morning latte might be the highlight of your commute, but at $5 a day, you’re looking at $1,825 annually. Think about it – that’s a weekend getaway or a decent emergency fund starter. Many coffee lovers don’t realize they could save over $1,500 yearly by brewing at home and using a quality travel mug.

Even cutting back to just weekends as a treat would keep hundreds in your pocket. The real cost isn’t just the coffee – it’s the opportunity lost to grow that money elsewhere. That same amount invested over ten years could grow to fund something truly important in your life.

2. Unused Gym Memberships

Signing up for fitness with January enthusiasm is common, but many memberships collect dust by March. At $50-100 monthly, an unused gym membership silently drains $600-1,200 yearly from your accounts. Gym owners count on this pattern – they sell more memberships than their facilities could actually handle, knowing many people won’t show up.

Statistics show about 67% of gym memberships go unused after the first few months. Consider pay-per-visit options or home workouts instead. Free fitness apps and YouTube channels offer excellent routines without the recurring charges that hit your account whether you exercise or not.

3. Food Delivery Service Fees

The convenience of food delivery comes with a hefty price tag beyond the meal cost. Between delivery fees, service charges, and inflated menu prices, you’re paying 30-50% more than dining in or picking up yourself. A typical $15 restaurant meal balloons to $25+ after all fees and tips.

Ordering twice weekly adds up to over $1,000 in extra charges annually – money that disappears without adding any nutritional value to your meals. Many users don’t fully calculate these costs because they’re broken into small, seemingly reasonable charges. Planning ahead for pickup or cooking at home even one additional night per week can save hundreds yearly.

4. Bottled Water Purchases

Grabbing bottled water might seem like a small expense at $1-2 per bottle, but regular buyers can spend upwards of $500 yearly on something that flows nearly free from their taps. The environmental impact compounds this financial waste. A quality reusable water bottle paired with a filter costs about $30-50 initially and can last for years.

Some workplaces and schools now offer filtered water stations specifically for refilling bottles. Beyond personal savings, reducing bottled water consumption helps address the plastic crisis. Only about 9% of plastic bottles get recycled, with the rest ending up in landfills or oceans – an environmental cost we all ultimately pay.

5. Streaming Service Overload

The golden age of streaming has turned into a budget nightmare for many households. With Netflix, Hulu, Disney+, HBO Max, Apple TV+, and others charging $8-18 monthly each, many families carry 4+ services simultaneously. Most subscribers don’t fully utilize what they’re paying for. Viewing statistics show the average person only watches 1-2 services regularly while others sit idle for months.

That’s potentially hundreds of dollars annually for content you rarely enjoy. Try rotating services instead of maintaining multiple subscriptions year-round. Subscribe to one platform for a month, binge your favorite shows, then switch to another the following month – you’ll get all the content for a fraction of the cost.

6. ATM Fees From Out-of-Network Machines

Those quick cash withdrawals from convenient but out-of-network ATMs come with a double penalty. You’ll typically pay the ATM owner $3-5 plus your own bank’s $2-3 fee – totaling $5-8 per transaction. Someone withdrawing cash weekly from these machines spends $250-400 annually just on access to their own money.

This expense delivers zero value and is entirely avoidable with minimal planning. Banks actually count on this behavior as a revenue source. Take time to locate your bank’s ATMs or partner networks, consider cash-back options at stores when making purchases, or switch to a bank that reimburses ATM fees if you frequently need cash in areas without your bank’s presence.

7. Impulse Purchases at Checkout Lines

Retail stores strategically place tempting low-cost items near registers for a reason. Those small $2-5 impulse buys during regular shopping trips can easily add $10-15 weekly to your expenses without providing real value. The psychology is brilliant – retailers know you’ve already committed to spending money, so adding a small item feels insignificant.

But these unplanned purchases can total $500-800 yearly that wasn’t budgeted for or truly needed. Make a shopping list and commit to sticking with it. When you feel the urge to grab something at checkout, ask yourself if you would have made a special trip just for that item. If not, it’s probably something you can live without.

8. Extended Warranties on Electronics

Sales associates push extended warranties hard because they’re incredibly profitable for retailers – not because they’re good deals for consumers. Most electronics either fail early (covered by manufacturer warranty) or last well beyond the extended coverage period. A typical extended warranty might cost $50-200 per item. Multiply this across several purchases yearly, and you’re spending hundreds on protection you’ll rarely use.

Consumer Reports research shows extended warranties generally return only about 20 cents in benefits for every dollar spent. Instead of buying warranties, consider setting aside the same money in a dedicated “repair fund.” This way, you self-insure across all your purchases and keep the money if nothing breaks, rather than padding retailer profit margins.

9. Forgotten Subscriptions and Memberships

Free trial subscriptions that convert to paid memberships are counting on your forgetfulness. Many consumers pay $10-30 monthly for services they signed up for years ago and barely remember having. The subscription economy thrives on this “set and forget” billing. Studies show the average American spends $273 monthly on subscriptions, with 84% underestimating what they actually pay.

App subscriptions, magazine renewals, and membership fees often continue long after they stop providing value. Review your credit card and bank statements quarterly specifically looking for recurring charges. Use subscription tracking apps like Truebill or Trim to identify and cancel unused services, potentially saving hundreds or even thousands yearly.

10. Buying Lunch at Work Daily

The workday lunch run seems reasonable until you calculate the annual impact. A modest $12 lunch five days weekly becomes $3,120 yearly – enough for a nice vacation or significant debt reduction. Brown-bagging lunch doesn’t mean sad sandwiches anymore. Modern lunch containers keep foods hot or cold, and meal prepping has become increasingly popular for both financial and health reasons.

The average homemade lunch costs $3-5, saving you around $2,000 annually. Try starting with bringing lunch just 2-3 days weekly. You’ll still enjoy restaurant meals occasionally while significantly reducing expenses. Bonus benefit: homemade lunches are typically healthier and can help avoid the post-lunch energy crash.

11. Late Payment Fees and Penalties

Missing payment deadlines leads to fees that might seem small individually but create significant financial drag over time. Credit cards typically charge $25-40 per late payment, while utilities and other services add $5-30 each time you miss a due date. A household with occasional tardiness on bills might face $20-50 monthly in completely avoidable fees.

That’s potentially $600 yearly vanishing without providing any value whatsoever – not to mention the credit score damage that can increase future borrowing costs. Set up automatic payments for minimum amounts due to avoid late fees entirely. If cash flow timing is an issue, contact service providers to adjust billing dates to better align with your paycheck schedule – many companies are flexible about this.

12. Bank Account Maintenance Fees

Monthly maintenance fees on checking accounts silently drain $5-25 monthly from millions of Americans. These fees often kick in when accounts fall below minimum balance requirements, resulting in $60-300 yearly charges for simply keeping your money in the bank. Banking has become increasingly competitive, making these fees completely unnecessary for most consumers.

Numerous online banks and credit unions offer truly free checking accounts with no minimum balance requirements or monthly fees. Review your bank statements specifically looking for these charges. If you’re paying fees, either negotiate with your current bank (they’ll often waive fees to keep customers) or switch institutions. The hour it takes to make this change can save hundreds over the coming years.

13. Brand-Name Products vs. Generic Alternatives

Marketing convinces many consumers that brand names are superior, but this often isn’t true. From medications to household cleaners, generic versions frequently contain identical ingredients at 20-50% lower prices. Over-the-counter medications offer the clearest example. The FDA requires generic medications to have the same active ingredients, strength, and effectiveness as their brand-name counterparts.

Yet consumers pay premium prices simply for familiar packaging. Try switching just five regularly purchased items to their generic equivalents. For a typical household, this simple change can save $300-500 annually without any noticeable difference in quality or effectiveness. Start with medications, cleaning supplies, and basic pantry staples for the biggest impact.

14. Buying Individual Items Instead of Bulk

Purchasing smaller quantities of regularly used items creates a convenience premium you pay repeatedly. Paper products, cleaning supplies, and non-perishable foods can cost 30-50% more per unit when bought in small quantities. Storage limitations make bulk buying challenging for some households. However, even apartment dwellers can identify 5-10 non-perishable items they use consistently and stock up during sales.

Focus on products with long shelf lives like toilet paper, detergent, rice, or canned goods. Beyond warehouse clubs, watch for supermarket sales on regular items. When your frequently used products hit their price low point (typically every 6-8 weeks), buy enough to last until the next sale cycle. This strategy alone can save a typical household $500+ yearly.

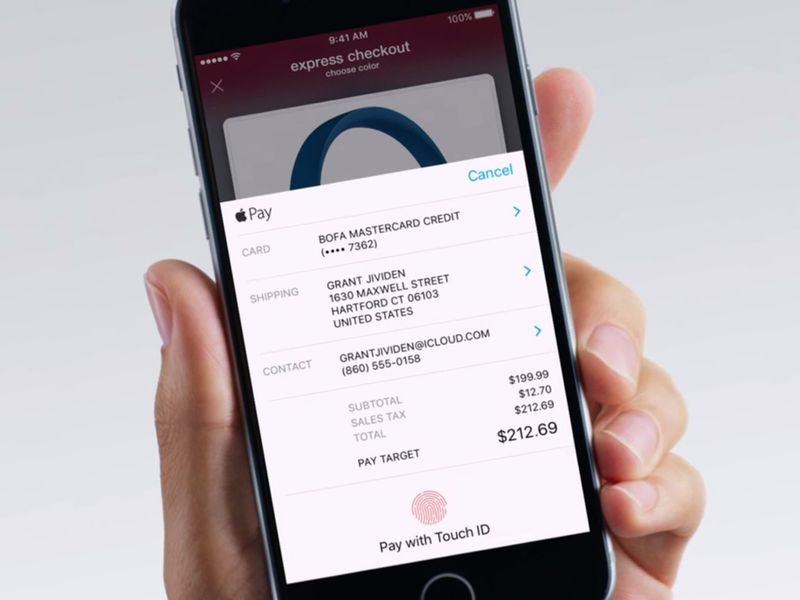

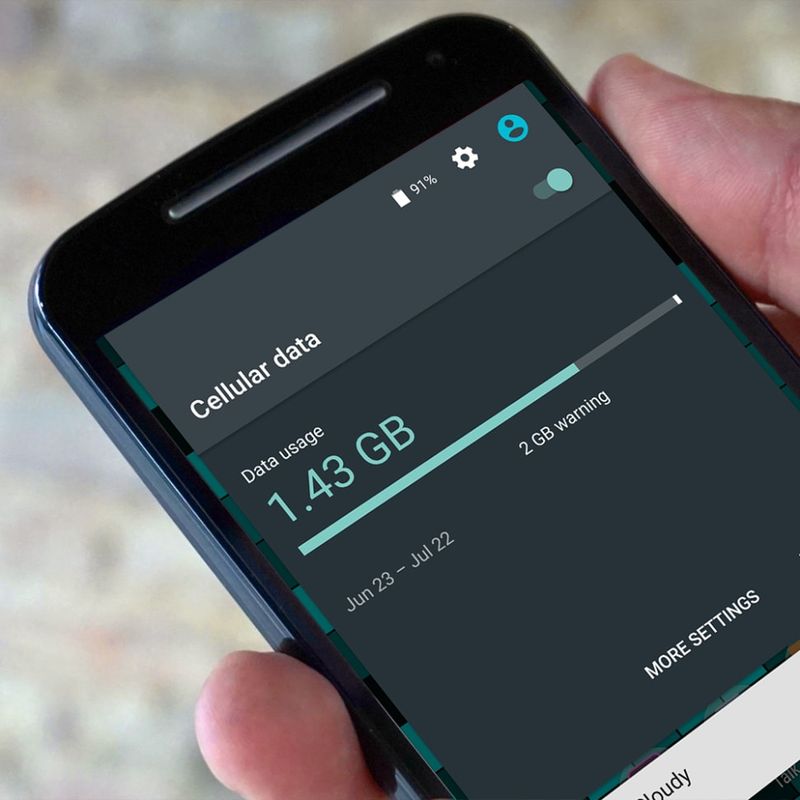

15. Excessive Cell Phone Data Plans

Many consumers pay for unlimited data they never fully use. Cell carriers rely on this tendency, knowing most users actually need only 2-6GB monthly while paying for much more expensive unlimited plans. Check your actual data usage in your phone’s settings or carrier app. If you’re consistently using less than half your allotted data, you’re likely overpaying by $15-45 monthly.

That’s potentially $540 yearly that could be redirected to savings or debt reduction. WiFi availability at home, work, and many public places means your cellular data needs may be much lower than you think. Consider family plans or MVNO carriers (mobile virtual network operators) that use the same networks as major carriers but charge significantly less.

Comments

Loading…