15 Money Habits That Keep You Broke (Even If You Have a Good Job)

A solid paycheck should mean breathing room, yet plenty of people with “good jobs” still feel like they are one surprise bill away from panic.

It is rarely because they are lazy or bad at math.

More often, it is because money is quietly slipping through habits that feel normal, justified, or even responsible on the surface.

The tricky part is that these patterns do not always look like reckless spending.

They can show up as “small” upgrades, convenience choices, or payments that seem manageable in the moment.

Over time, those decisions build a life that is expensive to maintain and hard to escape.

If you have ever wondered why your bank balance never reflects your income, these habits may be the reason.

The good news is that once you can name the pattern, you can change it.

1. Lifestyle creep every time you get a raise (your spending grows faster than your income)

A raise can feel like permission to level up, and that is where the trap starts.

When your take-home pay increases, it is easy to upgrade apartments, cars, wardrobes, vacations, or daily routines without realizing you just rebuilt your baseline expenses.

The problem is that fixed costs become “sticky,” meaning they are hard to reduce later without discomfort or major lifestyle changes.

Suddenly, you are earning more but saving the same, or even less, because every extra dollar was assigned a job in your spending life.

This habit keeps you broke because it prevents wealth-building from ever gaining momentum, especially if you are also carrying debt.

A smart fix is to pre-decide where raises go before they land, such as increasing retirement contributions, building an emergency fund, and allowing only a small percentage for lifestyle upgrades.

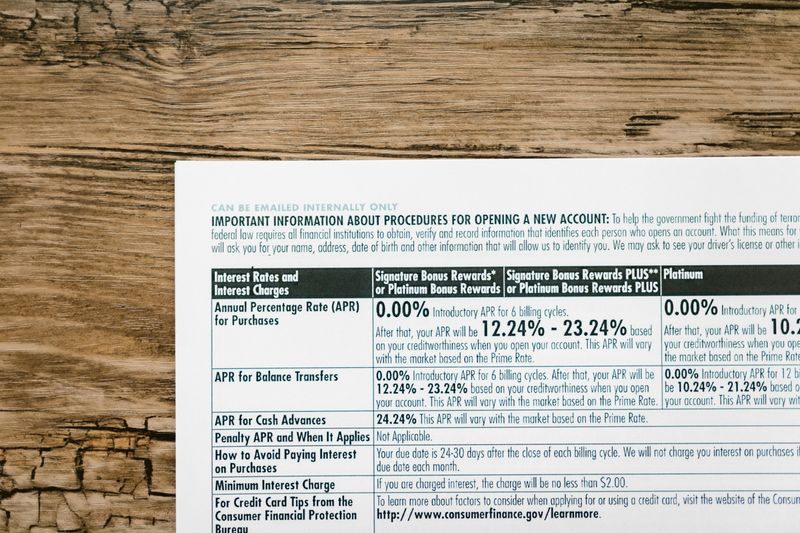

2. Treating your credit card limit like “available money”

Credit cards are convenient, protective, and rewarding, which is exactly why they can become dangerous in the wrong mindset.

If you view your limit as spending power instead of a short-term tool, you will naturally buy more than your cash flow can support.

Even when you pay the bill each month, that “I can handle it” attitude often leads to higher totals than you would choose if you were watching money leave your checking account in real time.

The real damage shows up when one month gets tight and you start carrying a balance, because interest turns yesterday’s purchases into long-term expenses.

This habit keeps you broke by blurring the line between wants and affordability.

A better approach is to treat credit like a payment method, not a funding source, and to set a personal limit below your actual limit based on your budget.

3. Paying only the minimum on high-interest debt

Minimum payments are designed to keep you paying, not to help you finish.

When you only send the smallest required amount, most of your payment can go toward interest instead of principal, which stretches repayment into years.

That timeline matters because high-interest debt quietly blocks every other goal, including saving, investing, and even enjoying your income without guilt.

The longer you carry a balance, the more expensive your purchases become, and the more likely you are to keep using credit to cover everyday expenses.

This habit keeps you broke by making your future money responsible for your past spending.

The most effective solution is to pick a payoff strategy you can stick with, such as the avalanche method (highest interest first) or snowball method (smallest balance first), and then automate an extra amount so progress happens even when motivation is low.

4. Financing everything (phones, furniture, cars—monthly payments stacking up)

Monthly payments can make almost anything feel affordable, which is why they are so easy to accumulate.

A financed phone, a payment-plan couch, a car loan, and a few “no interest” offers might not seem like much individually, but together they can swallow your paycheck before you even touch groceries or savings.

The bigger issue is that financing normalizes constant obligations, so your budget becomes rigid and your flexibility disappears.

When something unexpected happens, there is no room to absorb it because your income is already promised to past purchases.

This habit keeps you broke by turning wants into fixed costs and locking you into a life you have to keep earning to maintain.

A helpful reset is to cap your total monthly payments, avoid “buy now, pay later” for non-essentials, and save for upgrades in cash whenever possible, even if it means waiting longer.

5. Not tracking spending because you “basically know” where it goes

Many people feel confident they understand their spending, yet most budgets fail because small, frequent purchases are easy to underestimate.

When you do not track, you rely on memory and vibes, which tend to ignore the sneaky categories that drain you, like convenience food, online shopping, and random fees.

It also becomes harder to spot patterns, such as spending more on stressful weeks or buying duplicates because you forgot what you already had.

Without clear numbers, you may think you are “doing fine” until a bill hits and your account says otherwise.

This habit keeps you broke by removing feedback, and feedback is how you improve.

You do not need a complicated spreadsheet to fix it.

A simple method is to review transactions weekly, label them into broad categories, and choose one area to tighten each month, because consistent awareness beats perfection every time.

6. Impulse buying to cope with stress or boredom (little “treats” add up fast)

Retail therapy often looks harmless, especially when the purchases are small and spaced out.

The problem is that emotional spending solves a temporary feeling with a permanent cost, and it can become a loop that is hard to break.

If a rough day leads to “just a little treat,” your brain starts linking discomfort with spending relief, which makes you more likely to repeat the behavior.

Over time, your budget ends up paying for stress management instead of building the life you actually want.

This habit keeps you broke because it turns emotions into recurring expenses and crowds out savings goals.

A better strategy is to build a pause between the feeling and the purchase, such as a 24-hour rule for non-essentials or a wishlist you revisit weekly.

Replacing the dopamine hit with non-spending comfort, like a walk, a bath, or a phone call, also helps retrain the pattern.

7. Eating out and delivery as the default (convenience becomes a budget killer)

Convenience is not just a lifestyle choice; it is a line item that can quietly become enormous.

When takeout, coffee runs, and delivery fees become your normal routine, you are paying a premium for time and ease multiple times a week.

It is not only the food cost either.

Delivery apps add service fees, tips, and inflated menu prices, which means you might spend the equivalent of a full grocery trip on two meals.

This habit keeps you broke because it creates a high-cost default that repeats automatically, even on weeks when money feels tight.

The fix does not have to be extreme or joyless.

Pick a realistic target, like eating out twice a week instead of five times, and plan quick meals you will actually cook.

Keeping a few “emergency” frozen options at home can also prevent the last-minute order when energy is low.

8. Subscription hoarding (apps, streaming, memberships you rarely use)

Subscriptions are sneaky because they feel small, automatic, and easy to justify, especially when each one is only “ten or fifteen bucks.”

The trouble is that they stack, and once they become background noise, you stop noticing how much you are paying for things you barely use.

Streaming platforms, apps, memberships, beauty boxes, and software trials can add up to a serious monthly bill that competes with your savings.

This habit keeps you broke because it creates ongoing expenses without ongoing value, and autopay keeps it hidden.

A practical solution is to do a subscription audit every few months by scrolling your bank statements and listing everything recurring.

Cancel anything you have not used in the last month, and rotate services instead of keeping them all.

If you truly love a subscription, make it earn its spot by using it regularly.

9. Shopping sales without a plan (“saving” money on things you didn’t need)

A discount can make unnecessary purchases feel responsible, which is exactly why sales are so powerful.

When you buy something “because it’s on sale,” you are still spending money you did not plan to spend, and you are often buying items that would not have been tempting at full price.

This habit keeps you broke because it turns marketing into a budget strategy and fills your life with clutter you paid for.

It can also create a false sense of being “good with money” because saving fifty dollars feels like a win, even if you spent one hundred you did not need to.

The fix is to shop with intention, not excitement.

Create a running list of items you genuinely need, and only buy them when they reach a price you already decided was worthwhile.

Waiting 48 hours before purchasing sale items helps, too, because urgency is part of the trick.

10. Not building an emergency fund (so every surprise becomes debt)

Life does not wait for your budget to be ready, which is why an emergency fund matters even more than a perfect financial plan.

Without a cash buffer, every unexpected expense becomes a crisis that you have to solve with credit cards, loans, or pulling from long-term savings.

That creates a cycle where you are constantly paying off the last emergency while bracing for the next one, and your income never gets to move forward.

This habit keeps you broke because it forces you to borrow at the worst possible times, often at high interest, and it makes financial progress fragile.

The solution is to start smaller than you think and build consistency.

Aim for a starter fund of one month of essentials, then grow toward three to six months.

Automating even a modest weekly transfer helps, because emergencies are inevitable, but debt does not have to be.

11. Ignoring high-fee banking (overdraft fees, ATM fees, account fees)

Bank fees are one of the most frustrating ways to lose money because they offer almost nothing in return.

Overdraft charges, monthly maintenance fees, out-of-network ATM fees, and low-balance penalties can quietly take hundreds of dollars a year from people who are already trying to stretch their paychecks.

This habit keeps you broke because it punishes you for being close to zero, and it can start a domino effect where one fee triggers another.

If your account dips below a threshold, you pay a fee, which drops the balance further, which increases the chance of more fees.

The fix is usually simpler than people expect.

Switch to a bank or credit union with no monthly fees, set up low-balance alerts, and opt out of overdraft coverage so a card gets declined instead of charging you.

Even one change can stop the bleeding and give you breathing room.

12. Letting small “leaks” slide (late fees, interest, unused services, daily coffees)

Not every budget problem comes from big purchases, because little costs can drain you through sheer repetition.

Late fees, interest charges, convenience fees, unused services, and daily habit spending might not feel catastrophic in the moment, but they add up quickly and create a sense that you are always behind.

This habit keeps you broke because leaks are hard to notice, and when you do not notice them, you cannot fix them.

It is also mentally exhausting to keep losing money in small amounts, because it feels like you are trying without getting ahead.

A helpful approach is to hunt for leaks like you would hunt for a lost item, with focus and intention.

Review your last month of transactions and circle every fee, interest charge, or “random” expense.

Then pick the top three to eliminate.

Automating bill payments, setting calendar reminders, and consolidating accounts can prevent future leaks without adding stress.

13. Shopping without a grocery list (and wasting food) (rebuying what you already have)

Grocery spending can spiral quickly when you shop based on cravings, convenience, or whatever looks good in the moment.

Without a list, it is easy to buy duplicates, forget essentials, and end up with a cart full of “maybe” items that do not turn into meals.

Then food spoils, and you essentially throw money away while still ordering takeout because there is “nothing to eat.”

This habit keeps you broke because it hits twice: you overspend at the store and then spend again replacing what you wasted.

The fix is to make groceries serve a plan instead of a mood.

Build a short meal list for the week, check what you already have, and write a shopping list that matches those meals.

Keeping a “use this first” shelf in your fridge and planning one leftover night also reduces waste.

When food gets used, your paycheck stretches further without feeling restrictive.

14. Not negotiating anything (salary, insurance, internet, medical bills, interest rates)

Many bills are not as fixed as they seem, but people treat them like unchangeable facts.

If you never negotiate, you might overpay for insurance, internet, cell service, medical bills, credit card interest, or even your own salary.

This habit keeps you broke because you keep accepting the first number you are offered, and companies count on that silence.

Negotiation can feel awkward, yet it often takes less time than people imagine, and the savings can be substantial over a year.

The best part is that it does not require cutting your quality of life, which makes it one of the highest-impact habits to change.

Start with one category, such as calling your internet provider to ask for a promotional rate or shopping insurance quotes before renewal.

For debt, request a lower APR, and for medical bills, ask about discounts, payment plans, or itemized statements.

Treat negotiation like a normal money skill, because it is.

15. Saving “whatever is left” instead of paying yourself first (there’s never anything left)

When saving is treated as an afterthought, it usually becomes a casualty.

If you wait until the end of the month to save what is left, you will often find that life expanded to fill the available money, leaving little or nothing behind.

This habit keeps you broke because it makes saving dependent on willpower and perfect months, which rarely happen.

It also prevents you from building the cushion that makes everything else easier, such as handling emergencies and paying down debt faster.

The fix is to make saving automatic and non-negotiable, even if the amount is small at first.

Set an automatic transfer to savings the day after payday, and treat it like a bill you owe your future self.

If you are working on debt, you can “pay yourself first” by sending that automatic amount to extra principal payments instead.

The key is that the decision happens once, and the habit carries it forward.

Comments

Loading…