13 Money Habits That Could Be the Key to Unlocking Lifelong Financial Freedom

What if the path to financial freedom wasn’t paved with lottery tickets or get-rich-quick schemes, but with simple, consistent habits anyone can build? These 13 money habits won’t just help you stretch your paycheck—they’ll reshape your entire financial future. From automating savings to living below your means, these small but mighty changes stack up over time, turning everyday decisions into long-term wealth. Whether you’re climbing out of debt, saving for a dream home, or chasing early retirement, these habits offer a blueprint to get there. Ready to take control of your money—and your future? Let’s break it down.

1. Set Clear Financial Goals

Money without direction tends to disappear. When you establish specific financial targets—like saving for a home down payment or building a $10,000 emergency fund—your spending decisions become more focused.

Write down both short-term goals (this year) and long-term dreams (retirement or college funds). Review these goals monthly to stay motivated when temptations arise.

The most successful savers actually visualize their goals regularly, making abstract numbers feel real and meaningful. Your brain works harder to achieve goals it can picture clearly!

2. Create a Realistic Budget

Budgeting isn’t about restriction—it’s about awareness. Track where your money actually goes for a month before making any changes. Many people are shocked to discover they spend hundreds on forgotten subscriptions or impulse purchases.

A good budget has flexibility built in. Divide expenses into needs, wants, and savings, then adjust percentages until they work for your life.

Paper, spreadsheet, or app—the best budget is one you’ll actually use. Choose a tracking method that matches your personality and schedule regular 15-minute check-ins to stay on track.

3. Tackle High-Interest Debt First

Credit card interest can silently steal thousands from your future. The average American household carries over $6,000 in credit card debt, often paying 18-25% interest yearly. Imagine investing that interest payment instead!

The fastest path to freedom often starts with listing all debts by interest rate, then attacking the highest rate first while making minimum payments on others. This “avalanche method” minimizes total interest paid.

Small victories matter too. Some people prefer the “snowball method”—paying off the smallest balances first for psychological wins that build momentum toward bigger debts.

4. Automate Your Savings

Willpower is overrated when it comes to saving money. Even financial experts rely on automation to build wealth consistently. Set up automatic transfers that move money to savings accounts the day after payday—before you have a chance to spend it.

Start with just 1% of your income if you’re new to saving. Gradually increase by 1% every few months until you reach 15-20%. You’ll barely notice these small adjustments.

Multiple savings accounts labeled for specific goals (vacation, home repairs, holidays) prevent the common mistake of dipping into your emergency fund for non-emergencies.

5. Master the Art of Negotiation

Money saved through negotiation is completely tax-free! Cable bills, insurance premiums, and even medical costs often have flexibility that only reveals itself when you ask. A simple “Is this the best you can do?” can save hundreds yearly.

Salary negotiations might feel uncomfortable but have enormous lifetime value. A $5,000 increase early in your career, with standard raises, can mean over $100,000 more earnings over your working life.

Research is your strongest negotiation tool. Whether buying a car or requesting a raise, knowing typical prices or salary ranges gives you confidence and specific numbers to reference.

6. Cultivate Financial Knowledge

Financial education pays dividends for life. Just 30 minutes weekly reading about money concepts can dramatically improve your decision-making ability. Libraries offer free access to financial books and resources that would cost hundreds to purchase.

Follow the money habits of people you admire rather than those who merely appear wealthy. Many flashy spenders are deeply in debt, while truly wealthy individuals often live modestly and prioritize growing assets over displaying status.

Money podcasts turn commute time into learning time. Listening while driving or exercising makes financial education fit into even the busiest schedule without requiring extra hours in your day.

7. Practice Preventive Maintenance

Regular maintenance prevents expensive emergency repairs. Oil changes cost $50 while engine replacements run thousands. Home HVAC tune-ups cost $100 while system failures cost $5,000+. Small, scheduled expenses prevent budget-destroying surprises.

Create a simple maintenance calendar with reminders for home, vehicle, and health checkups. Digital calendar alerts ensure you never miss important service intervals that protect your biggest assets.

The same principle applies to health maintenance. Regular dental cleanings prevent costly root canals. Annual physicals catch health issues before they become expensive emergencies. Your body is ultimately your most valuable financial asset!

8. Begin Investing Early and Consistently

Time transforms tiny investments into substantial wealth. A 25-year-old investing just $100 monthly could have over $150,000 by age 65, even with conservative returns. Starting at 45 with the same amount might yield only $40,000.

Employer retirement matches are literally free money. Contributing enough to get the full match is like giving yourself an immediate 50-100% return before any market growth.

Fear of market drops keeps many people from investing, but history shows that regular investing through ups and downs (dollar-cost averaging) outperforms waiting for the “perfect time” to invest.

9. Embrace Living Below Your Means

Financial breathing room creates both security and opportunity. When you consistently spend less than you earn, you build resilience against emergencies while gaining freedom to pursue better jobs, education, or investments without fear.

The happiest people focus spending on experiences and relationships rather than status items. Research shows material purchases provide fleeting happiness, while memories and connections create lasting satisfaction.

Housing costs typically consume the largest portion of most budgets. Choosing a home that costs less than what mortgage lenders approve you for creates a domino effect of financial flexibility throughout your entire budget.

10. Monitor Your Credit Score Regularly

Your credit score influences more than loan approvals—it affects insurance rates, rental applications, and even job opportunities. Free monitoring services like Credit Karma or annual free reports from AnnualCreditReport.com make tracking easy.

Payment history makes up 35% of your score. Setting up automatic minimum payments ensures you never accidentally damage this crucial component, even if you’re traveling or busy.

Credit utilization (how much of your available credit you’re using) impacts 30% of your score. Keeping balances below 30% of your limit—ideally below 10%—can boost your score significantly, even if you can’t pay off everything.

11. Partner with a Financial Advisor

Professional guidance becomes increasingly valuable as your finances grow more complex. Look for fee-only advisors who work as fiduciaries, legally obligated to put your interests first rather than selling products for commissions.

Even self-directed investors benefit from occasional professional check-ins. A good advisor spots blind spots in your planning and provides objective feedback during emotional market swings when many make costly mistakes.

Consider starting with a one-time financial planning session if ongoing advisory relationships seem expensive. Many advisors offer standalone planning meetings that provide a professional roadmap you can implement yourself.

12. Invest in Your Health

Healthcare costs rank among Americans’ biggest financial burdens. Preventive health habits like regular exercise, proper nutrition, and stress management significantly reduce lifetime medical expenses while increasing earning potential through fewer sick days.

Mental health deserves equal attention. Financial stress often creates a destructive cycle where money worries cause poor decisions that create more money problems. Tools like meditation apps or occasional therapy sessions can improve both mental and financial wellness.

Sleep quality directly impacts financial decision-making. Studies show sleep-deprived people make riskier financial choices and struggle more with impulse purchases. A consistent sleep schedule is a surprisingly effective money management tool!

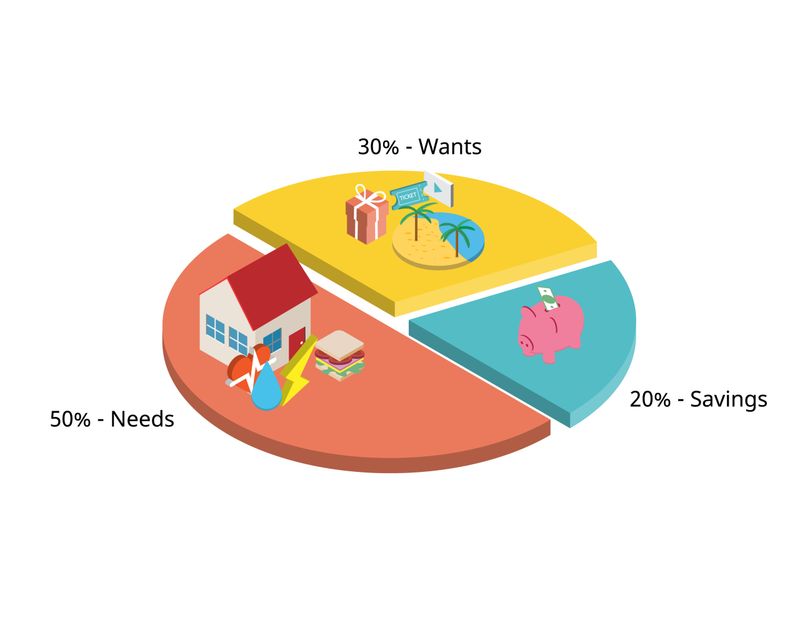

13. Apply the 50/30/20 Rule

Simple frameworks make budgeting less overwhelming. The 50/30/20 rule suggests allocating 50% of take-home pay to necessities (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

Adjust these percentages based on your location and goals. High-cost cities might require 60% for needs, while aggressive debt payoff might temporarily push the savings/debt category to 30% by reducing wants to 20%.

This approach balances current enjoyment with future security. You don’t deprive yourself completely of pleasures today, but you consistently build financial strength for tomorrow through the dedicated savings percentage.

Comments

Loading…