Money troubles can sneak up on anyone, but smart people know how to stay one step ahead. Paying certain bills early might seem like giving away your cash too soon, but it actually helps you save money and avoid stress.

Some bills come with special rewards for early payments, while others can cause big problems if you pay them late. Learning which bills to prioritize can make your financial life much easier and keep more money in your pocket.

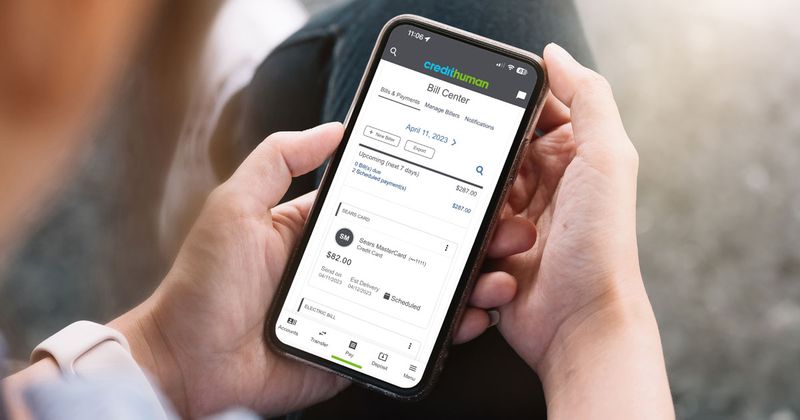

1. Credit Card Bills

Credit cards can be your best friend or worst enemy, depending on how you handle them. Paying your credit card bill early helps you avoid expensive interest charges that can pile up fast.

When you pay early, you also improve your credit score because it shows you’re responsible with money. Banks love customers who pay on time, and they might even increase your credit limit as a reward.

Early payments also give you more available credit to use for emergencies. Plus, you won’t have to worry about forgetting the due date and getting hit with late fees that can cost $25 or more.

2. Mortgage Payments

Your house payment is probably your biggest monthly expense, making it super important to handle correctly. Paying your mortgage early each month protects you from late fees and keeps your home safe from foreclosure.

Many mortgage companies offer a grace period, but why risk it? Early payments also help you build equity in your home faster, which means you own more of it sooner.

Some lenders even offer small discounts for customers who consistently pay early or set up automatic payments. Every extra dollar you put toward your mortgage principal saves you money on interest over the life of the loan.

3. Utility Bills

Nobody wants to sit in the dark or go without heat because they forgot to pay the electric bill. Utility companies are quick to shut off service for late payments, sometimes with just a few days notice.

Paying utilities early ensures you never face disconnection fees, which can cost $50 to $200 to restore service. Many utility companies also offer budget billing programs for customers with good payment histories.

Early payment gives you peace of mind knowing your basic needs are covered. Some companies even offer small discounts for early or automatic payments, helping you save a few dollars each month on essential services.

4. Auto Loans

Car payments might feel like a burden, but paying them early can actually save you thousands of dollars over time. Auto loans charge interest daily, so every early payment reduces the total interest you’ll pay.

Banks report your payment history to credit bureaus, and early payments boost your credit score significantly. A better credit score means lower interest rates on future loans for cars, homes, or other big purchases.

Plus, paying off your car loan early means you own your vehicle outright sooner. This eliminates monthly payments and lets you drop expensive collision coverage if you choose, saving even more money each month.

5. Insurance Premiums

Insurance might seem like money you’ll never get back, but paying premiums early prevents your coverage from lapsing. Driving without insurance can result in fines, license suspension, and huge costs if you cause an accident.

Many insurance companies offer discounts for customers who pay their entire policy upfront instead of monthly. These discounts can save you 5-10% on your total premium costs.

Early payment also ensures continuous coverage, which insurance companies reward with loyalty discounts. Gaps in coverage can increase your rates significantly, so staying ahead on payments keeps your costs low and your protection intact.

6. Student Loans

Student loans can follow you for decades, but early payments can cut that time significantly. Federal student loans offer various repayment options, and paying extra toward the principal balance reduces your total interest costs.

Early payments also improve your debt-to-income ratio, making it easier to qualify for mortgages or other loans. Some employers even offer student loan repayment assistance as a benefit.

Paying ahead gives you flexibility during tough financial times since you’ll have credits built up. Many loan servicers allow you to skip payments if you’re ahead, providing a safety net when you need it most without damaging your credit.

7. Rent Payments

Rent is usually due on the first of each month, but paying a few days early can earn you serious brownie points with your landlord. Good relationships with landlords lead to better maintenance response times and easier lease renewals.

Some landlords offer small discounts for early rent payments, especially if you pay the entire year upfront. Late rent payments can result in eviction proceedings, which damage your credit and rental history.

Early payments also help you budget better since you know your biggest expense is handled first. This reduces stress and helps you plan the rest of your monthly spending more effectively.

8. Phone Bills

Your phone is probably essential for work, family, and emergencies, making timely payments crucial. Phone companies are quick to suspend service for late payments, sometimes within just a few days of the due date.

Paying early helps you avoid reconnection fees and service interruptions that can affect your job or personal life. Many carriers offer autopay discounts of $5-10 per month for customers who set up automatic payments.

Early payments also help you qualify for phone upgrade programs and better plan options. Carriers prefer customers with good payment histories and may offer exclusive deals or waive activation fees for reliable customers.

9. Internet Bills

Internet service has become as essential as electricity for most people, especially those who work from home or attend school online. Paying your internet bill early prevents service disconnection that could disrupt work or education.

Many internet providers offer small discounts for customers who enroll in automatic payment programs. These savings might only be a few dollars per month, but they add up over time.

Early payment also helps you avoid late fees and reconnection charges, which can be expensive. Some providers require deposits from customers with poor payment histories, so staying current keeps your account in good standing and avoids these extra costs.

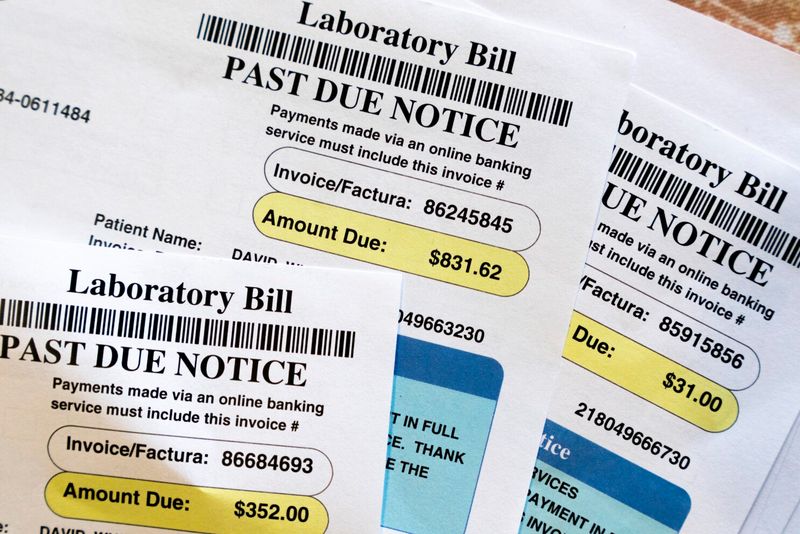

10. Medical Bills

Medical bills can be confusing and expensive, but paying them early can sometimes earn you discounts. Many healthcare providers offer payment plans or reduced rates for patients who pay their bills quickly.

Unpaid medical bills can be sent to collections, which seriously damages your credit score for years. Early payment prevents this and keeps your credit report clean for future loan applications.

Some medical offices offer cash discounts if you pay at the time of service or within a short period. These discounts can be significant, sometimes 10-20% off your total bill, making early payment a smart financial move.

11. Tax Payments

Nobody likes paying taxes, but paying them early can save you from penalties and interest charges that add up quickly. The IRS charges both failure-to-file and failure-to-pay penalties that can be expensive.

Early tax payments also help you avoid the stress of last-minute filing and potential errors that come with rushing. You’ll have more time to gather documents and claim all available deductions.

If you owe money, paying early prevents interest charges that compound daily. Some taxpayers even make estimated payments throughout the year to avoid owing a large amount at tax time, making their financial planning much easier.

12. Childcare Bills

Childcare costs can be enormous, but paying early ensures your child’s spot remains secure. Many daycare centers have waiting lists and prefer families who pay consistently and on time.

Some childcare providers offer discounts for families who pay weekly or monthly in advance. These savings can be significant given how expensive quality childcare has become in most areas.

Early payment also helps you budget better since childcare is often one of the largest family expenses. Knowing this cost is covered early in the month gives you peace of mind and helps you plan other expenses more effectively.

13. Subscription Services

Streaming services, gym memberships, and other subscriptions might seem small, but late payments can result in service cancellation and reactivation fees. Paying these bills early ensures uninterrupted access to services you rely on.

Many subscription services offer annual payment discounts that can save you 10-20% compared to monthly payments. These savings add up significantly over time, especially if you have multiple subscriptions.

Early payment also helps you avoid the hassle of having to re-enter payment information or deal with account holds. Some services even offer exclusive content or features to customers who maintain good payment histories.

Comments

Loading…