Autopay seems like the ultimate convenience—until it quietly chips away at your bank balance. While scheduling bills to pay themselves can help you avoid late fees, it also creates a dangerous out-of-sight, out-of-mind relationship with your finances.

Many people don’t realize they’re being charged for things they no longer use, subscriptions they meant to cancel, or bills with unexpected errors until it’s too late. In some cases, autopay can even result in overdrafts or missed opportunities to renegotiate or shop around for better rates.

To stay in control of your money, it’s important to know when not to let automation take over. These 13 bills are best handled manually—here’s why.

1. Gym Memberships

Cancelling a gym membership can often feel like an Olympic sport in itself. These facilities are notorious for their tricky cancellation processes and hidden fees. Even after you’ve made the decision to stop attending, autopay could continue to charge you for months if you’re not careful.

These charges sneakily come out of your account, sometimes long after you’ve last tossed a gym bag over your shoulder. Some gyms even require in-person cancellations or written notices, making autopay a risky option.

To avoid unwanted debits, make sure you have a clear understanding of your gym’s cancellation policy. Be proactive in monitoring your account.

2. Subscription Services (Streaming, Apps, Magazines)

Have you ever found a magazine you didn’t know you subscribed to in your mailbox? Subscription services can easily be forgotten, especially when autopay keeps them running in the background. It’s not uncommon to lose track of various streaming services, apps, and magazines.

These services can drain your account because they often renew automatically. Autopay removes the mindful decision to continue with the service or not.

Avoid this by regularly checking your subscriptions. Evaluating which ones you truly use and enjoy can save you from unnecessary charges and free up your resources.

3. Insurance Premiums (Especially Annual Ones)

Insurance premiums often change, sometimes without you even noticing. Autopay might lead you to overlook these changes, resulting in paying more than necessary. Reviewing your premiums manually gives you the chance to compare different insurance options.

Suppose new deals or discounts are available; you’d miss them with autopay. It’s wise to assess your coverage and ensure it still fits your needs before each renewal.

By approaching insurance premiums with vigilance, you can make informed decisions that best suit your financial plan and avoid overpaying.

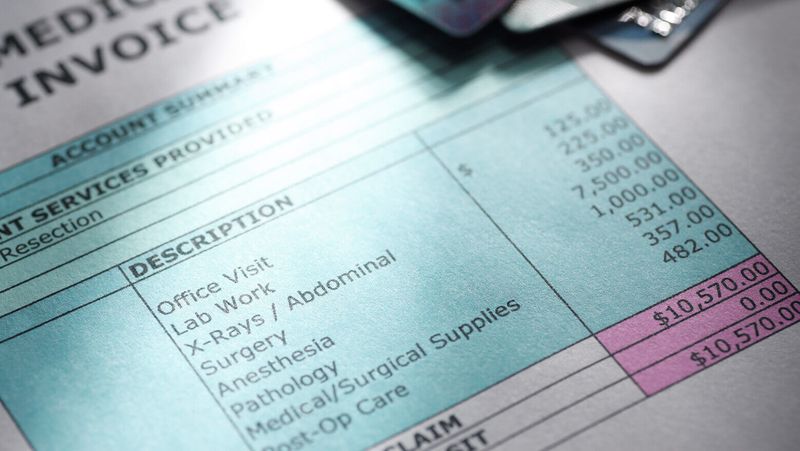

4. Medical Bills

Medical bills are known for containing errors. These can range from incorrect charges to pending insurance adjustments. Autopay could lead you to pay for something that should have been covered by insurance or was billed incorrectly.

By manually reviewing these bills, you ensure that you’re only paying what is truly owed. It also allows you to catch billing mistakes and dispute them if necessary.

Having a careful approach can save you from unnecessary financial stress and ensure your healthcare costs are accurate and fair.

5. Utility Bills with Fluctuating Rates

Utility bills can surprise you when rates fluctuate due to seasonal changes or unexpected usage spikes. Imagine setting your electricity bill to autopay just as a heatwave hits and your air conditioning runs non-stop.

Suddenly, you’re faced with a much higher bill than anticipated, potentially causing overdrafts or budget issues. By reviewing these bills manually, you can plan and adjust your usage accordingly.

Keeping an eye on your utility usage helps you avoid the shock of a high bill and ensures you’re not caught off guard by unexpected charges.

6. Credit Card Payments

Paying only the minimum on your credit card can keep you in a perpetual cycle of debt. Autopay for the minimum amount might offer convenience but at the cost of accumulating interest.

By manually paying your credit card bill, you can control your spending and aim to pay in full. This approach supports better financial habits and saves you from the burden of growing debt.

Taking charge of your credit card payments actively encourages more responsible spending and financial independence.

7. Mobile Phone Bills

Mobile phone bills can inflate with roaming charges, extra data fees, or unexpected add-ons. Autopay means accepting whatever charge appears without question, which can be risky.

Taking the time to review your bill allows you to spot any unusual charges and address them with your provider. This way, you maintain control over your expenses.

Being proactive with your mobile bill ensures you’re not overpaying and that your charges reflect your actual usage and agreements.

8. Buy Now, Pay Later Installments

The allure of buy now, pay later can be tempting, but these plans often come with tight schedules and hefty late fees. Autopay might sound convenient, but it doesn’t guarantee your account is always ready for deductions.

By managing these payments manually, you can ensure your account is funded before each installment is due, avoiding any unpleasant surprises.

This strategy helps you keep track of your spending and avoid falling into debt traps associated with missed payments.

9. Parking Tickets or Traffic Violations

Parking tickets and traffic violations can be disputed, but autopay takes away your chance to review or challenge any mistakes. If you believe a ticket was issued in error, it’s crucial to address it before paying.

This manual process not only allows you to contest the ticket but also ensures fairness in municipal charges. Autopay could lead to unnecessary payments and missed opportunities to correct errors.

Staying engaged with these charges helps preserve your rights and avoid unjust penalties.

10. Streaming Bundles or Intro Offers

Introductory offers and bundles often lure you in with low prices but rise significantly after the trial period. Autopay can lock you into these increased rates without you realizing it until it’s too late.

By manually monitoring your subscriptions, you can decide whether to continue or cancel before the rate hike.

This approach keeps you in control of your streaming expenses and ensures you’re paying for what you truly enjoy and use.

11. Home Services (Landscaping, Cleaning, Pest Control)

Home services like landscaping, cleaning, and pest control can vary in charge by visit or service. Autopay might lead to duplicate charges or payments for unsatisfactory work.

Paying manually allows you to verify the quality and accuracy of each service performed. You can ensure that the charges match the work completed.

This careful approach to home services helps maintain your property while managing your budget effectively.

12. Student Loans (Variable Interest or Forgiveness Eligibility)

Student loans often have variable interest rates or potential forgiveness options. Autopay can prevent you from adjusting your strategy based on changes in policy or personal circumstances.

By handling these payments manually, you remain flexible and can adapt to new opportunities, like changes in interest rates or forgiveness programs.

This proactive method ensures you’re making the most of your repayment plan and optimizing your financial future.

13. Private School or Childcare Tuition

Private school and childcare tuition can vary by month or semester, making it essential to stay involved in the billing process. Autopay might lead to incorrect payments or unaccounted changes in fees.

Manually reviewing and paying these bills ensures that you are charged correctly and that the services meet your expectations. It provides an opportunity to address any discrepancies promptly.

This vigilant approach protects your investment in education and childcare by ensuring transparency and accuracy in billing.

Comments

Loading…