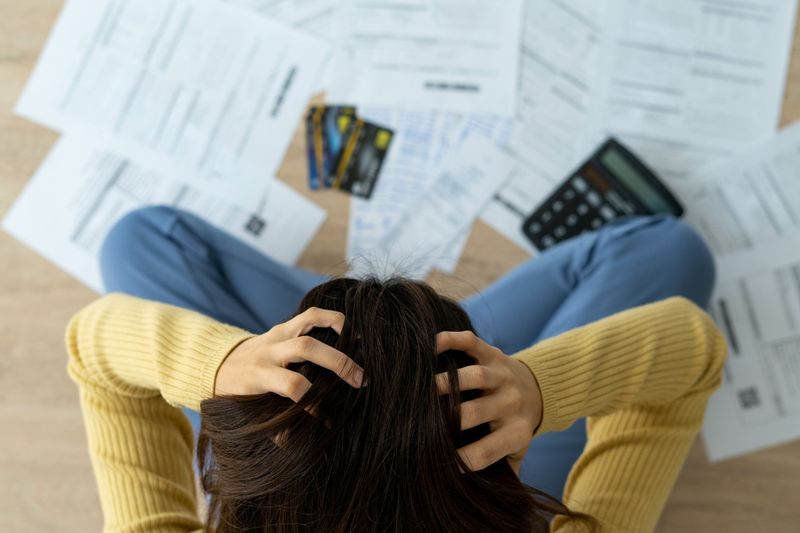

13 Mistakes That Lead to Maxed-Out Credit Cards

Credit cards can be helpful financial tools, but they often become financial nightmares when used carelessly. Many people find themselves drowning in credit card debt without realizing how they got there. Understanding the common traps that lead to maxed-out cards can help you avoid falling into these financial pitfalls and maintain a healthier relationship with credit.

1. Living Beyond Your Means

Ever notice how easy it is to swipe that card for things you can’t actually afford? When your spending regularly exceeds your income, you’re setting yourself up for disaster. Those fancy restaurant meals, designer clothes, or the latest tech gadgets might feel good in the moment, but they create a false reality.

The math is simple yet brutal: if you earn $3,000 monthly but consistently spend $3,500, that $500 gap doesn’t magically disappear. It accumulates on your credit card, growing larger each month with added interest. Even small overspending adds up—an extra $100 weekly becomes over $5,000 annually!

Many people fall into this trap after getting a raise or promotion, immediately upgrading their lifestyle without saving the additional income. This lifestyle inflation creates a dangerous cycle that’s hard to escape.

2. Making Only Minimum Payments

Those minimum payment amounts printed on your statement might seem like a reasonable option when money’s tight. After all, the credit card company offers it, so it must be okay, right? Wrong. Minimum payments are actually a clever trap designed to keep you in debt for years or even decades.

Take a $3,000 balance with a typical 18% interest rate and a 2% minimum payment. If you only pay the minimum each month, it will take over 30 years to pay off completely! During that time, you’ll pay about $7,000 in interest—more than double your original balance.

Meanwhile, credit card companies love customers who only make minimum payments. They’re the most profitable customers because they pay maximum interest while barely touching the principal amount owed.

3. Impulse Buying Without Tracking

That flash sale notification pops up on your phone, and suddenly you’re ordering something you never planned to buy. The dopamine rush of clicking “purchase” feels great until those impulse buys accumulate into a mountain of debt. Online shopping has made impulse buying dangerously convenient—just one click and it’s yours!

Most people don’t track these spontaneous purchases, making it easy to lose count. A $20 impulse buy might seem harmless, but multiply that by several times a week, and you’re looking at hundreds of dollars monthly. The worst part? Many impulse purchases end up unused or forgotten.

Without a system to track spending, these small charges create a snowball effect. By the time your statement arrives showing you’ve maxed out your card, it’s too late to undo those purchases you barely remember making.

4. No Emergency Fund Safety Net

Life throws unexpected curveballs—your car breaks down, your tooth cracks, or your water heater floods the basement. Without cash savings set aside specifically for these situations, your credit card becomes the default emergency plan. This creates a financial emergency on top of your original problem!

Emergency expenses are typically urgent and expensive. When you charge a $1,500 car repair to a card with 20% interest, that repair effectively costs much more if you can’t pay it off immediately. Plus, using up your available credit for emergencies leaves you without options for future unexpected costs.

Financial experts recommend having 3-6 months of expenses saved in an emergency fund. Without this buffer, even financially responsible people can quickly max out their cards when life happens, turning temporary setbacks into long-term debt problems.

5. Charging Everyday Essentials

Groceries, gas, utility bills—these necessary expenses seem perfect for earning those sweet credit card rewards. The problem starts when you’re using credit not for points but because your bank account is empty. Charging essentials creates a dangerous illusion that you’re managing financially when you’re actually falling behind.

Month after month, these basic living expenses add up quickly. A family spending $800 monthly on groceries and $200 on gas creates $1,000 in new credit card debt every month if they’re not paying it off. Unlike splurge purchases that you might regret, these essential expenses can’t simply be cut from your budget.

This pattern often signals a fundamental budget problem that needs addressing. When basic necessities consistently exceed your income, your credit card becomes a temporary solution to a permanent problem—until it maxes out.

6. Falling for Promotional Offers

“0% APR for 18 months!” “Sign up today and get $200 cash back!” These flashy promotions sound amazing, but they’re designed to encourage spending you wouldn’t otherwise do. Card issuers aren’t offering these deals out of generosity—they’re betting you’ll spend more than you planned and carry a balance past the promotional period.

Those balance transfer offers with zero interest seem like a smart move for consolidating debt. However, many people fail to read the fine print about transfer fees (typically 3-5% of the amount) or the sky-high interest rates that kick in when the promo ends. Even worse, some offers charge retroactive interest on the entire amount if you haven’t paid it off completely by the deadline.

Many consumers open new cards for the bonuses without a strategy to pay off purchases, creating a dangerous cycle of card-hopping that ultimately leads to multiple maxed-out accounts.

7. The Multiple Card Juggling Act

Having several credit cards might make you feel financially sophisticated, but it often leads to trouble. Each new card increases your total available credit—and your potential debt. The average American with credit cards has four different accounts, making it incredibly easy to lose track of balances, due dates, and payment amounts.

Multiple cards create a false sense of financial flexibility. Maxed out one card? Just use another! This shell game masks the underlying problem of overspending while fees and interest accumulate across accounts. People often forget exactly how much they’ve charged on each card until statement shock hits.

The psychological impact is significant too. Research shows people spend more with credit cards than cash, and this effect multiplies with several cards. Each card represents a separate mental account, making it harder to feel the true impact of your combined spending until it’s too late.

8. Flying Blind Without a Budget

Imagine driving cross-country without a map or GPS—that’s essentially what you’re doing financially without a budget. When you don’t track income and expenses, spending decisions happen in a vacuum. That $50 dinner might seem affordable in isolation, but it could be your fifth restaurant meal this week!

Without clear spending boundaries, your credit card becomes the default decision-maker. The available credit balance—not your actual financial situation—determines what you can “afford.” This disconnection from financial reality is how people wake up one day to discover they’ve maxed out their cards without realizing they were even close to the limit.

A budget isn’t about restriction; it’s about awareness and intention. People who track their spending typically discover surprising patterns—like the $300 monthly coffee shop habit or subscription services they forgot they were paying for—that could be redirected to avoiding credit card debt.

9. Emotional Spending Triggers

Had a terrible day at work? A shopping spree might seem like the perfect pick-me-up. Feeling anxious about money? Ironically, spending more might temporarily soothe those feelings. Emotional spending—using purchases to manage feelings rather than to meet genuine needs—creates a particularly vicious debt cycle.

The relief from retail therapy is real but fleeting. The brain releases dopamine during the purchase, creating a temporary high. Unfortunately, this feeling quickly fades, often replaced by guilt or anxiety about the spending, which can trigger even more emotional purchases. Credit cards make this cycle especially dangerous by removing the immediate financial pain.

Common emotional triggers include stress, boredom, celebration, and even happiness. Recognizing your personal spending triggers is crucial. Many people don’t connect their maxed-out cards to their emotional state, but addressing the underlying feelings is often more effective than focusing only on the financial symptoms.

10. The Subscription Creep Effect

Remember signing up for that free trial that required your credit card “just in case”? Months later, you might still be paying for services you barely use or completely forgot about. Subscription services count on this oversight—their entire business model depends on automatic renewals that fly under your radar.

The average American spends $273 monthly on subscriptions, yet when asked to estimate, most guess they spend about half that amount. These small, regular charges—$9.99 here, $14.99 there—seem insignificant individually but collectively consume a substantial portion of your credit limit month after month.

Streaming services, meal kits, beauty boxes, gaming platforms, cloud storage, fitness apps—the subscription economy has exploded. Each service smartly prices itself to seem “too small to cancel,” creating a steady drain on your available credit that can eventually lead to a maxed-out card filled with services you barely remember subscribing to.

11. Buy Now, Pay Later Deception

“Split your purchase into 4 easy payments!” These modern layaway services have exploded in popularity, but they create a dangerous illusion of affordability. When a $400 purchase becomes “just $100 today,” it’s tempting to buy things you’d otherwise recognize as beyond your budget. The psychological trick is powerful—the full price gets mentally discounted.

Many consumers don’t realize these services often link directly to their credit cards for automatic payments. Miss a payment due to insufficient funds, and you’re hit with both BNPL late fees AND credit card overdraft fees. Plus, juggling multiple BNPL plans across different purchases makes it incredibly difficult to keep track of your total obligations.

The real danger comes from how these services encourage additional purchases. Research shows people spend 10-40% more when using BNPL options versus paying in full. This increased spending volume, combined with payment confusion, creates a perfect storm for maxed-out credit cards.

12. Interest Rate Blindness

That tiny percentage number printed on your credit card statement might seem like a minor detail, but it’s actually a debt multiplier. Many cardholders focus entirely on their credit limit while remaining oblivious to their interest rate—a costly mistake that can add hundreds or thousands to their balance.

At 18% APR (a common rate), a $5,000 balance grows by $75 in interest in just the first month! This interest compounds, meaning you pay interest on previous interest charges too. Without making significant payments above the minimum, your balance can actually grow each month despite never making new purchases.

Variable interest rates add another layer of risk. Many cards can increase your rate after a single late payment or if market rates rise. A manageable 15% APR can suddenly jump to 29.99%, dramatically accelerating debt growth and pushing you toward a maxed-out card faster than you’d expect.

13. Cosigning and Authorized User Risks

Adding your partner as an authorized user seemed like a helpful gesture. Cosigning for your college student’s first card felt like responsible parenting. Unfortunately, these well-intentioned decisions often lead to unexpected balance shocks when others have access to your credit.

Many people don’t establish clear spending boundaries when sharing credit. Without explicit conversations about spending limits or payment responsibilities, misunderstandings happen easily. The primary cardholder remains legally responsible for all charges—even ones they didn’t make or approve—which can quickly lead to a maxed-out card.

Relationship dynamics make these situations particularly tricky. Confronting a spouse about overspending or telling your child they’ve exceeded their limit can be uncomfortable, causing many people to avoid these conversations until the damage is done. Clear communication about spending expectations is essential whenever multiple people have access to the same credit line.

Comments

Loading…