12 Things You’re Overpaying For Every Month Without Realizing It

Most of us don’t splurge on purpose, yet our bank accounts still look like we’ve been living it up.

That’s because modern spending is designed to feel painless: one-click renewals, “free” trials that quietly convert, and tiny fees that hide in plain sight.

The problem isn’t always big, dramatic purchases—it’s the monthly costs you’ve normalized, forgotten, or assumed are non-negotiable.

When several of these sneak into your budget at once, you can end up overpaying hundreds of dollars a year without ever changing your lifestyle in a meaningful way.

The good news is that this kind of overspending is usually fixable with a few quick checks, a couple of calls, and a little courage to cancel what isn’t serving you.

Here are 12 monthly expenses that tend to quietly drain your money.

1. Streaming subscriptions you barely use

It’s easy to justify another streaming service because it’s “only” ten or fifteen dollars, especially when a new show everyone’s talking about drops.

Over time, though, those subscriptions stack up, and you may be paying for multiple platforms that offer similar content or sit untouched for weeks.

Many people also forget about add-on channels, higher tiers, and extra screens that quietly raise the bill.

A simple fix is to audit your subscriptions once a month by checking your bank statement and your app store subscriptions, then cancel anything you haven’t watched in the last 30 days.

If you struggle to let go, rotate services instead of keeping them all year.

Watching one platform for a month, canceling, and switching to another can keep your entertainment budget under control without feeling deprived.

2. Gym membership (or boutique fitness app) you’re not using consistently

A gym membership can feel like a responsible purchase because it’s tied to health, motivation, and your “future self,” but the monthly charge doesn’t care whether you actually show up.

If you’re going less than once a week, you’re likely paying far more per workout than you realize, and boutique fitness apps can create the same problem with ongoing fees.

Before you renew another month out of guilt, do a realistic cost-per-use check based on your last four weeks.

If the number makes you cringe, consider downgrading to a cheaper membership tier, buying a punch pass, or switching to a simple at-home routine that you’ll actually do.

You can also set a calendar reminder a few days before renewal so you choose intentionally instead of letting autopay decide for you.

3. Cell phone plan + add-ons

Phone bills have a way of creeping up because providers bundle “nice-to-haves” that sound practical in the moment.

You might be paying for unlimited data you don’t come close to using, premium streaming perks you forgot were included, or device insurance that overlaps with coverage you already have elsewhere.

On top of that, many plans quietly include fees for extra lines, hotspots, international add-ons, and financed devices that keep you locked into a higher monthly payment.

Start by checking your actual data usage in your phone settings, then compare it to what you’re paying for.

If you’re consistently under, a lower plan can save you immediately.

It’s also worth asking about loyalty discounts and removing insurance if you’ve built a small “phone repair fund” instead.

A twenty-minute review can shave real money off every month.

4. Home internet plan that’s faster than your household requires

Internet companies love selling speed upgrades because “faster” sounds like an instant quality-of-life improvement, but many households don’t actually need the top tier to stream shows, scroll social media, and hop on video calls.

If your bill is high, you may be paying for a plan built for heavy gaming, constant 4K streaming on multiple devices, or a large household with simultaneous work-from-home demands.

A helpful reality check is to ask yourself whether your internet regularly buffers or drops, or if it’s simply fine most of the time.

If it’s fine, you can probably downgrade without noticing.

You can also negotiate by calling and asking for promotional pricing, especially if you’ve been a customer for years.

Another overlooked issue is renting equipment; buying your own router can reduce monthly fees and often improves performance.

5. Car insurance

Many people assume staying with the same insurer is the safest and easiest option, but that convenience can come with a “loyalty tax.”

Rates can creep up over time without any major changes on your end, and you might miss out on new discounts you’d qualify for today.

It’s also common to pay for coverage levels that made sense years ago but don’t match your current car value, driving habits, or commute.

The best way to catch overpaying is to shop around at least once a year, even if you love your current company, because a quick comparison can reveal big differences.

Ask about bundling with renters or homeowners insurance, low-mileage discounts, and safe-driver programs if you’re comfortable with them.

You can also raise your deductible if you have an emergency cushion, which often lowers the premium without changing your day-to-day life.

6. Bank account fees

Bank fees are sneaky because they often feel small, predictable, and “just how it is,” which is exactly why they’re so profitable.

Monthly maintenance charges, out-of-network ATM fees, and overdraft-related costs can quietly pull money out of your account without offering much value in return.

Some people even pay for “overdraft protection” that still results in fees, while others get dinged because their balance dips below a minimum threshold they didn’t realize existed.

To stop overpaying, read the fee schedule for your checking account and compare it to your actual habits, then decide whether that account still fits your life.

Switching to a no-fee bank or credit union can be an immediate upgrade, and setting up alerts for low balances can prevent costly mistakes.

If you prefer your bank, ask if they can waive fees based on direct deposit or account history.

7. Delivery apps + “service fees” and memberships

Food delivery is marketed as a small convenience, but the true cost usually isn’t just the food.

Between service fees, delivery charges, tips, and menu markups, a meal can end up costing dramatically more than it would if you picked it up yourself.

Even membership programs that promise savings can become a trap if you order more often simply because it feels easier.

A smart way to spot overpaying is to compare the receipt total to what the same order would cost in-store, because seeing the difference in black and white can be eye-opening.

If you still want the convenience, set a monthly delivery budget and stick to it like a bill, or reserve delivery for genuinely hectic nights.

Choosing pickup instead of delivery can preserve the treat while cutting the most expensive fees out of the equation.

8. Coffee, drinks, or snacks bought out of habit

The daily routine purchases are the ones that don’t feel dangerous, because one latte or a quick snack seems harmless in the moment.

The problem is consistency: spending five to ten dollars a day becomes a monthly bill that rivals utilities, especially if it includes extra stops for bottled drinks, bakery items, or “just something small” at the checkout line.

Habit spending also tends to happen when you’re rushed, tired, or stressed, which means it can sneak past your logical brain.

A helpful reset is to calculate what you spent last month by checking card transactions and adding it up honestly, without judgment, so you’re working with real numbers.

If you want to cut back without feeling deprived, choose a specific limit, like coffee out twice a week, and make the at-home version feel satisfying with a nicer creamer or a reusable cup you love.

9. Grocery spending due to waste and convenience buys

Grocery bills can climb even when you’re trying to be careful, because the biggest leaks aren’t always the items you buy—they’re what you throw away or replace.

Food waste happens when produce spoils, leftovers get ignored, or you buy duplicates of ingredients you already have because you didn’t check first.

Convenience buys also show up in the form of pre-cut fruit, single-serve snacks, and last-minute “quick dinners” that cost more than planned meals.

To stop overpaying, start with one simple habit: plan a few meals around what you already have in the fridge and pantry before you shop.

Keep a running list of what needs to be used up, and schedule one “use-it-up” night each week to clear leftovers.

You’ll also save money by choosing store brands, buying whole ingredients, and skipping impulse purchases near the checkout aisle.

10. Subscription boxes (beauty, snacks, “self-care,” meal kits)

Subscription boxes are fun because they feel like a gift you send to yourself, and the marketing makes it seem like you’re getting a deal.

Over time, though, they can turn into a monthly charge that delivers items you didn’t specifically choose and may not even use, especially if your tastes change or your cabinets fill up.

Meal kits can have the same issue when the cost per serving ends up higher than normal groceries, even if they reduce decision fatigue.

A simple way to evaluate whether you’re overpaying is to look at your last few deliveries and ask how many items you genuinely loved, finished, or would buy again at full price.

If the answer is “not many,” pause or cancel without guilt.

You can also switch to a cheaper cadence, share with a friend, or replicate the experience by budgeting a small amount for items you pick intentionally.

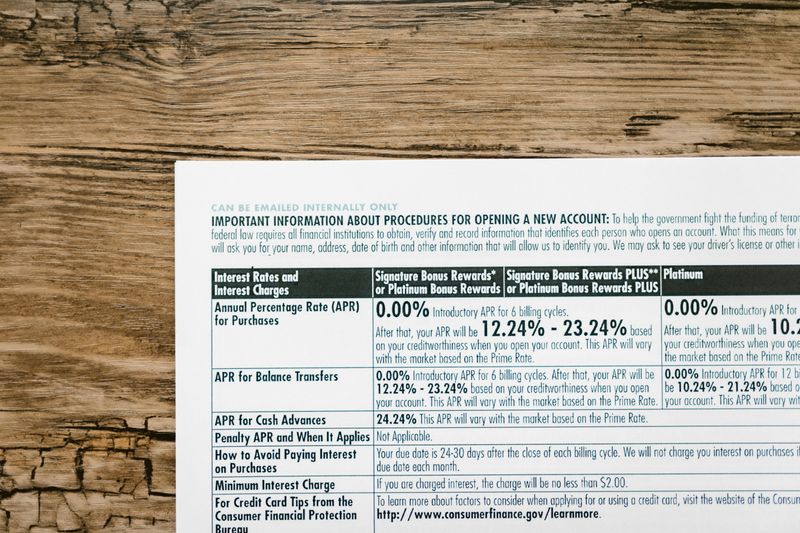

11. Credit card interest and “just this once” balances

Carrying a balance often starts with one “temporary” month, and then it becomes a quiet routine where interest keeps you paying more for the same purchases.

Even if the balance isn’t huge, the interest charges can make everyday spending more expensive than you realize, especially when you’re only paying the minimum.

It can also snowball because interest reduces how much of your payment actually goes toward the principal, making the payoff feel slow and discouraging.

The most effective monthly fix is to focus on one card at a time and pay more than the minimum wherever possible, because that’s what actually reduces interest over time.

If your rate is high, consider calling the issuer to request a lower APR, or explore a 0% promotional balance transfer if you can pay it off within the promo window.

Setting up automatic payments above the minimum can prevent backsliding when life gets busy.

12. Renters/homeowners policies and coverage overlap

Insurance is one of those “set it and forget it” expenses, which is exactly why people overpay for years without noticing.

Your policy might include coverage you don’t need, deductibles that don’t fit your financial situation, or assumptions based on an old living arrangement.

It’s also common to miss discounts for bundling renters or homeowners insurance with auto coverage, or to carry overlapping protection when certain items are already covered elsewhere.

To make sure you’re not paying extra every month, review your policy annually and confirm that your coverage amounts still match your current belongings and lifestyle.

Ask your insurer to re-quote with different deductibles and updated information, and request a discount review because companies don’t always apply new deals automatically.

If you’ve never compared providers, getting a few quotes can reveal whether you’re paying more than the market rate for the same level of protection.

Comments

Loading…