12 Frugal Living Tips That Don’t Involve Extreme Couponing

Living frugally doesn’t have to mean spending hours clipping coupons or chasing down every weekly sale. In fact, some of the most powerful money-saving strategies are simple, sustainable habits that help you take control of your finances without sacrificing quality of life. Whether you’re looking to build your savings, reduce waste, or just be more intentional with your income, these twelve practical tips can help you stretch every dollar further. No gimmicks, no coupon binders—just smart, everyday moves anyone can start using right now.

1. Automate Your Savings First

Pay yourself before anything else. Set up an automatic transfer to a high-yield savings account the moment your paycheck hits. You won’t miss what you don’t see.

This simple habit builds savings effortlessly while ensuring your future needs are prioritized. Out of sight, out of mind, and your nest egg grows.

Consider it a painless way to secure financial peace of mind without the daily grind of budgeting.

2. Embrace the Power of Meal Prepping

Cut back on food waste and dining out by preparing meals in bulk. It saves time, reduces impulsive spending, and ensures you use what’s already in your pantry.

Meal prepping can transform your kitchen into a hub of efficiency and creativity. It encourages mindful eating and health-conscious decisions.

Planning meals ahead eliminates the guesswork, making weekday dinners a breeze and weekends an opportunity to experiment.

3. Buy Generic Over Name Brands

From medications to pantry staples, store-brand products often have the same ingredients for a fraction of the price.

Switching to generics can significantly cut grocery bills without sacrificing quality. Many companies use the same manufacturers for both name brands and generic products.

This switch is a savvy shopper’s secret weapon, making every dollar stretch further without compromising your lifestyle.

4. Use the 30-Day Rule for Purchases

When tempted to splurge, wait 30 days. If you still want or need the item after the wait, go ahead. Often, the urge disappears.

This method not only curbs impulse buying but also promotes thoughtful spending. It’s a pause that refreshes your perspective on what truly matters.

Practice patience, and your wallet will thank you, adding more discernment in your purchasing choices.

5. Declutter and Sell Unused Items

Turn forgotten belongings into cash. Selling unused clothes, electronics, or furniture online is a quick way to pad your savings.

Decluttering not only clears space but also offers a fresh start, turning clutter into opportunity. It’s a therapeutic exercise that rewards you financially.

Embrace minimalism, reduce waste, and give your old items a second chance to shine in someone else’s home.

6. Unplug Energy Vampires

Electronics that remain plugged in suck electricity even when not in use. Unplug or use smart power strips to lower utility bills.

This small step can lead to significant savings over time and contributes to a more sustainable lifestyle. Every unplugged device counts.

By controlling energy consumption, you can make a positive impact on both your wallet and the planet.

7. Implement a “No-Spend” Challenge

Pick a day, week, or even a month to spend only on essentials. It builds mindfulness around spending and helps you reset financial habits.

This challenge can be a fun and eye-opening experiment in your spending behavior. It forces creativity and resourcefulness.

By focusing on necessities, you discover the joy of simple living and the satisfaction of saving.

8. Switch to a Library Card

Skip Kindle purchases and audiobook subscriptions. Libraries offer free access to thousands of books, e-books, and more.

Getting a library card opens a world of knowledge and entertainment without spending a dime. Libraries are a treasure trove for avid readers.

Supporting local libraries also fosters community engagement and lifelong learning opportunities.

9. Cut the Cord on Cable

Streaming services can replace expensive cable packages without sacrificing entertainment. Even free options like Pluto TV or Tubi offer diverse content.

By cutting the cord, you reduce monthly expenses and gain flexibility in viewing preferences. It’s a modern way to enjoy television.

This switch is the future of media consumption, offering convenience, variety, and savings all in one package.

10. Practice DIY Repairs

From sewing buttons to fixing leaky faucets, learning basic DIY saves hundreds a year in service calls and replacements.

DIY projects build confidence and skill, transforming chores into rewarding accomplishments. The internet is a vast resource for handy tutorials.

Each repair is an opportunity to learn and grow, making your home a testament to your ingenuity.

11. Rethink Gift-Giving

Make thoughtful, homemade gifts instead of expensive purchases. Baked goods, crafts, or even a handwritten letter can be more meaningful and cost-effective.

Rethinking gift-giving can revive the joy of personal connection and creativity. It’s the thought and effort that counts.

Expressing love through personalized gifts strengthens relationships and saves money simultaneously.

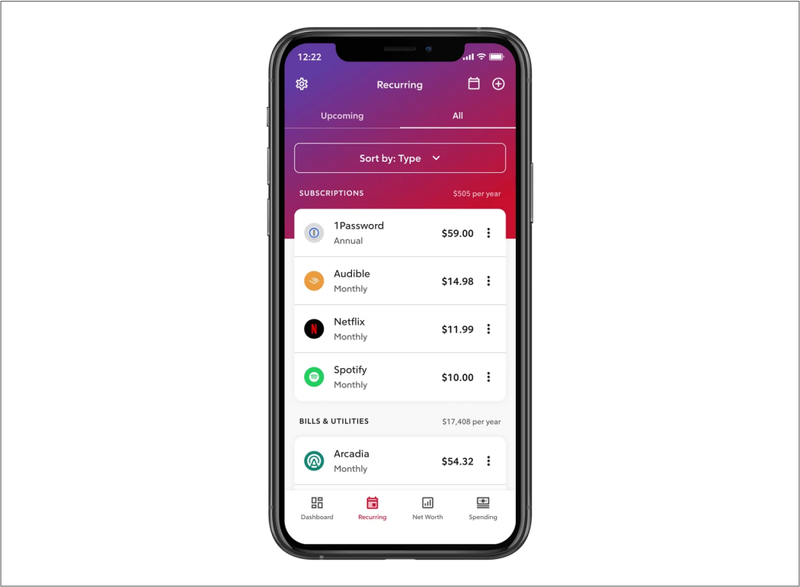

12. Downsize Subscriptions

Audit all your recurring subscriptions. Cancel anything you haven’t used in the last 30 days—from fitness apps to mystery boxes.

Regularly assessing subscriptions ensures you only pay for what adds real value to your life. It’s easy to lose track of those small, recurring expenses.

Downsizing subscriptions can free up funds for more meaningful experiences and financial goals.

Comments

Loading…