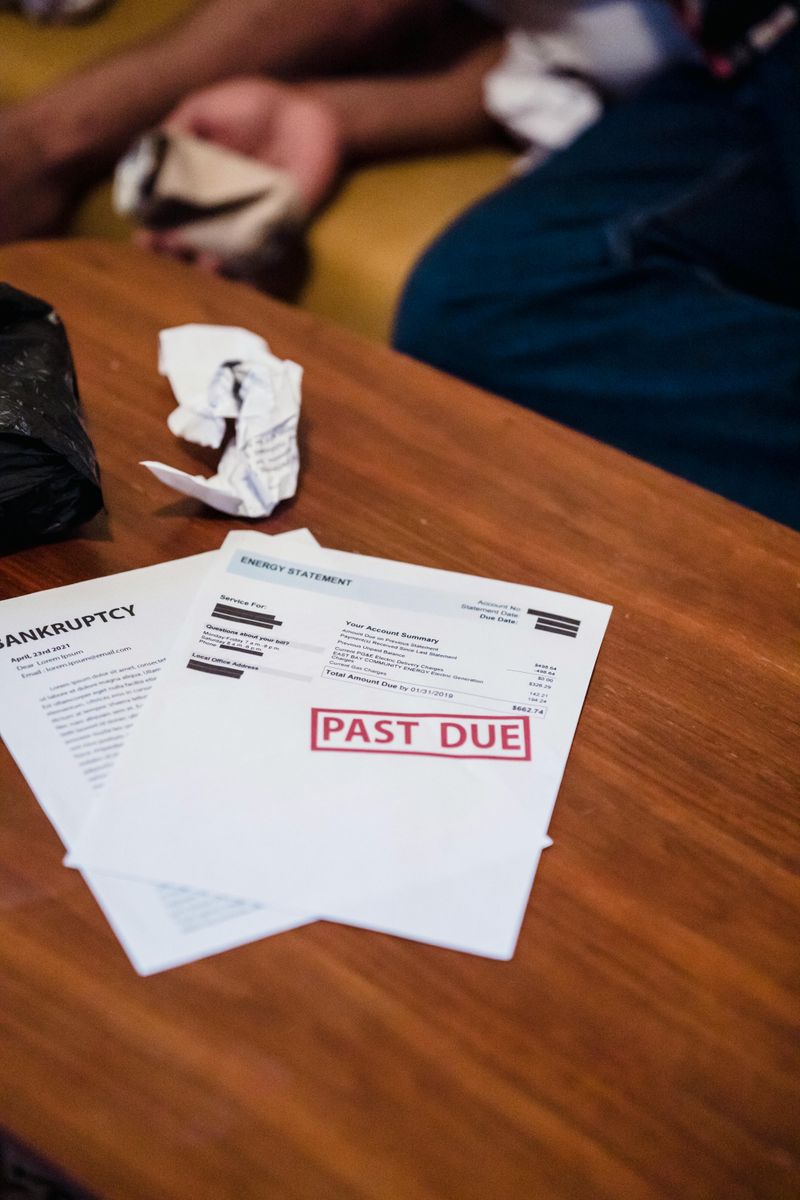

12 Debt Payoff Mistakes That Keep People Stuck for Years

Debt can feel like quicksand because the harder you struggle, the more stuck you seem to get.

A lot of people assume the problem is a lack of willpower, but most of the time it’s a strategy problem.

Small choices that look harmless in the moment, like paying the minimum or skipping a month “just this once,” can stretch repayment timelines from months into years.

The good news is that once you can spot the patterns that keep you trapped, you can replace them with habits that actually move the needle.

The goal isn’t perfection or deprivation; it’s building a system that makes progress unavoidable.

If you’ve been making payments but your balance barely budges, chances are you’re running into one of these common debt payoff mistakes without realizing it.

1. Only Paying the Minimums (and Calling It “Progress”)

Credit card companies are happy when you do the bare minimum because it keeps interest flowing in their direction.

When you pay only the minimum, most of your money often goes toward interest instead of reducing the balance, which can make your payoff date feel endlessly far away.

You might see your statement drop a little, then jump right back up after interest posts, and that cycle is incredibly discouraging.

A better approach is to treat the minimum as the starting line, not the finish line, and add a consistent extra amount on top.

Even an additional $25–$100 can dramatically change the timeline when you apply it every single month.

If your budget is tight, aim for one “minimum-plus” payment per month and increase it whenever you get breathing room.

2. Not Knowing Your Exact Numbers

Debt becomes scarier and harder to tackle when it’s vague, which is why so many people avoid looking too closely.

If you don’t know your balances, interest rates, minimums, and due dates, you’re essentially trying to drive with a foggy windshield.

That lack of clarity makes it easy to underpay, miss dates, or choose the wrong debt to focus on, and those errors cost real money over time.

Set aside one focused hour to write down every balance, APR, minimum payment, and payment due date, then total it all up.

The moment you see it clearly, you can build a strategy instead of reacting emotionally.

A simple spreadsheet or notes app works fine, as long as it’s accurate.

Once your numbers are real, your plan can be real too.

3. Ignoring Interest Rates When Choosing What to Pay First

It’s common to throw extra money at whichever bill is most annoying or whichever lender calls the most, but that approach is rarely the fastest.

High-interest debt grows like a weed, and if you don’t target it, it keeps stealing your progress behind the scenes.

Paying off a low-interest loan while a 24% credit card balance sits untouched may feel satisfying, but it can cost you months or even years in extra interest.

Consider using the avalanche method, where you pay minimums on everything and put every extra dollar toward the highest APR first.

Once it’s gone, you roll that payment into the next highest rate.

If motivation is an issue, you can still blend strategy and psychology by keeping one small “quick win” while prioritizing the expensive debt overall.

4. Using Balance Transfers Without a Payoff Strategy

A 0% balance transfer can be a lifesaver, but it can also become a trap if it’s treated like a magic reset button.

People move debt to a promo card, feel temporary relief, and then stop pushing aggressively because the interest isn’t biting yet.

The problem is that the promo period ends, and if the balance is still there, you can be hit with a high APR and fees that undo your progress.

Before transferring anything, calculate what you’d need to pay each month to finish before the promo expires, and treat that number like a non-negotiable bill.

Also, avoid running up the old card again, because that creates two balances instead of one.

The transfer only helps if it comes with a clear timeline and disciplined follow-through.

5. Closing Cards in a Panic (Instead of Fixing the Habit)

After a stressful debt wake-up call, it’s tempting to slam every credit account shut and promise yourself you’ll never use plastic again.

The intention is understandable, but the bigger issue usually isn’t the existence of the card, it’s the spending pattern behind it.

Closing accounts can also reduce your available credit and potentially hurt your utilization ratio, which may impact your credit score.

More importantly, a closed card doesn’t teach you how to manage spending, so the habit may just move to another outlet, like buy-now-pay-later or overdrafts.

A calmer approach is to keep the accounts open but remove easy access by deleting saved cards online and storing the physical card somewhere inconvenient.

Then focus on building a spending plan that prevents reliance on credit in the first place.

6. Treating Windfalls Like Free Money

Extra money has a funny way of disappearing, especially when you’ve been stressed for a long time and feel like you “deserve” a break.

Tax refunds, bonuses, gifts, and side-hustle surges often get spent on upgrades and treats, even though they could shave months off a payoff plan.

The problem isn’t enjoying life; it’s missing the rare opportunity to make a big dent in your balance without changing your day-to-day budget.

Decide ahead of time what percentage of any windfall will go toward debt, and commit to it before the money hits your account.

A simple rule like “half to debt, half to goals or fun” keeps it realistic while still pushing you forward.

Windfalls are momentum boosters, but only if you use them intentionally.

7. Not Building a Starter Emergency Fund

Trying to pay off debt with no cash cushion is like walking a tightrope without a net.

The first unexpected expense, whether it’s a car repair, a prescription, or a last-minute flight, pushes people right back onto credit cards.

Then you’re not only stuck again, you’re paying interest on the emergency too.

A small emergency fund doesn’t have to be huge to be powerful; even $500–$1,000 can stop the constant backsliding.

Build it before you go full speed on extra debt payments, or build it alongside your plan by setting aside a small amount each paycheck.

The point is to break the cycle where every surprise becomes new debt.

When emergencies stop turning into balances, your payoff progress finally has room to breathe.

8. Stopping Payments the Moment Life Gets Stressful

Debt payoff plans often collapse during tough seasons because people assume it’s all-or-nothing.

One bad month turns into skipped payments, late fees, and growing balances, and then shame makes it harder to restart.

The truth is that consistency matters more than intensity, especially when your life is chaotic.

If money is tight, switch to a “minimums plus a little” plan rather than quitting entirely, or temporarily reduce your extra payment while keeping everything current.

Many lenders also offer hardship options that can lower payments or reduce interest if you ask early, before you fall behind.

Staying engaged, even at a lower level, keeps the plan alive and prevents damage that takes months to repair.

Progress during hard times is still progress, and it protects your future self.

9. Relying on Motivation Instead of Automation

Motivation is great when it shows up, but it’s unreliable as a long-term financial strategy.

If your plan depends on remembering to make extra payments or feeling inspired every month, you’ll eventually hit a week where you’re busy, tired, or overwhelmed, and the payment won’t happen.

Automation removes that decision fatigue and turns progress into the default.

Set minimum payments on autopay to protect your credit and avoid fees, then schedule a separate automatic transfer for your extra payoff amount right after payday.

Even if the extra payment starts small, it builds consistency and makes your budget predictable.

You can always adjust upward when your income increases, but the core system stays the same.

When your plan runs without constant effort, it’s much harder to fall off track.

10. Keeping Subscriptions and Small Leaks Because “It’s Only $10”

Small expenses feel harmless because they don’t hurt in the moment, but they quietly drain the exact money you need for faster payoff.

A few streaming services, app subscriptions, convenience fees, and impulse snacks can add up to hundreds per month without you noticing.

Then you wonder why there’s never anything left to throw at your balance.

Instead of trying to cut everything, audit your “tiny leaks” and choose a handful to eliminate for 60–90 days.

That short time frame makes it feel doable, and you can funnel the savings directly into an extra debt payment.

The key is making the trade-off visible by immediately applying the freed-up cash to your debt, not letting it blend into spending.

When the small leaks stop, your payoff plan finally has fuel.

11. Not Negotiating or Exploring Lower-Interest Options

A lot of people assume their interest rate is fixed, but lenders often have options that never get used because customers don’t ask.

You can sometimes request an APR reduction on a credit card, set up a hardship plan, or negotiate a lower payment temporarily without wrecking your progress.

Depending on your situation, consolidation loans or refinancing can also reduce the amount of interest you’re paying, which speeds up your timeline dramatically.

The mistake is continuing to pay premium interest year after year when there may be a path to cheaper debt.

Call your lender, be polite but firm, and ask what programs exist for lowering your rate or payment.

If you’re considering consolidation, compare total costs, fees, and the payoff timeline rather than focusing only on the monthly payment.

Lower interest is a tool, not a shortcut, but it can make your plan far more effective.

12. Paying Off Debt Without Changing the Spending System

Some people manage to pay off debt through a burst of extreme discipline, only to end up right back where they started.

That happens when the payoff is treated like a temporary challenge rather than a permanent shift in how money is managed.

If you don’t address the behavior that created the balances, whether it’s emotional spending, lack of budgeting, or relying on credit to cover basics, the same pressures will eventually recreate the debt.

Build a spending system while you pay things down, such as a simple weekly budget check-in, category limits, and a plan for irregular expenses.

It also helps to create “rules” for future credit use, like paying in full weekly or using cash for certain categories.

Debt freedom isn’t just about hitting zero; it’s about staying there.

When the system changes, the results stick.

Comments

Loading…