12 Movies That Secretly Teach Powerful Money Lessons Without Feeling Like Homework

Some films entertain you so well that you do not notice they are also rewiring how you think about money.

Instead of lectures about budgets and investing, these stories show real-life tradeoffs, messy mistakes, and smart pivots that feel relatable.

When characters are forced to stretch limited resources, negotiate for respect, or rebuild after setbacks, the financial lesson lands without the “personal finance” label.

The best part is that you can take the takeaway and apply it to your own paycheck, habits, and goals immediately.

From quiet reminders about emergency funds to bold examples of betting on yourself, each movie below offers a surprisingly practical blueprint for getting ahead.

Grab your watchlist, because these money lessons come with popcorn.

1. The Pursuit of Happyness (2006)

Watching a father fight for stability makes the value of cash flow feel painfully real.

The movie highlights how missed timing, unstable income, and one bad break can turn normal expenses into a crisis.

Instead of focusing on flashy wealth, the story keeps returning to survival decisions that add up, like transportation, food, and where you sleep.

It quietly teaches that an emergency fund is not a luxury, because it is the thin line between a setback and a spiral.

The biggest money lesson is that persistence matters, but systems matter too, because grit works best when paired with planning.

Use this section to show readers how to build “stability first” habits that protect the basics before chasing bigger dreams.

2. Julie & Julia (2009)

A personal project becomes a masterclass in how small daily effort can compound into real value.

The film shows how committing to consistent output builds skill, confidence, and a public track record people can recognize.

Even though the story is about cooking and writing, the underlying lesson is that side income often starts as a routine, not a revelation.

It also reinforces that you do not need expensive equipment to begin, because progress comes from repetition and feedback.

What looks like a hobby on day one can become a portfolio that opens doors later, especially when you document your work.

Frame this as a money lesson about low-cost skill-building, creating proof of work, and letting consistency do the heavy lifting.

3. Chef (2014)

A career reset turns into an unexpectedly practical guide to making money with fewer moving parts.

The story shows how simplifying your business can reduce stress and boost profit by cutting overhead and focusing on what customers actually want.

Instead of chasing prestige, the characters build momentum through approachable pricing, clear offerings, and a strong personal brand.

It also hints at the power of starting small, because a lean setup makes experimentation safer and mistakes less expensive.

The movie’s financial message is that freedom often comes from keeping fixed costs low and staying flexible when demand changes.

Use this section to connect the dots between reducing lifestyle inflation, building a “lean life,” and choosing sustainability over ego.

4. Moneyball (2011)

A team that cannot outspend rivals learns how to win by finding undervalued value others ignore.

The movie’s money lesson mirrors smart investing, because it rewards data, discipline, and patience over hype and tradition.

It shows how paying for “flash” can drain resources, while paying for measurable results creates a stronger foundation.

That idea translates cleanly to personal finance, where the best moves are often boring, consistent, and strategically unglamorous.

It also teaches readers to question default assumptions, because what everyone praises is not always what performs best over time.

Write this as a framework for choosing high-ROI skills, stable benefits, and long-term decisions that look plain but pay off loudly later.

5. Legally Blonde (2001)

A underestimated heroine proves that earning power grows when you invest in yourself with intention.

The film quietly reinforces that confidence, communication, and reputation can raise your income just as much as raw talent can.

It also shows the compounding value of education, mentorship, and persistence, especially when others assume you do not belong.

Rather than romanticizing quick money, the story frames success as preparation meeting opportunity at the right time.

The takeaway is that personal branding is not vanity when it helps you be taken seriously and paid accordingly.

Use this section to talk about the ROI of training, networking, and showing up professionally, even when you feel like an outsider.

6. The Martian (2015)

A survival situation turns budgeting into a life-or-death exercise in resource management.

The movie demonstrates how planning ahead, tracking what you have, and adapting fast can stretch limited supplies far longer than expected.

It also highlights the difference between panic decisions and strategic decisions, because calm problem-solving protects your future options.

The financial parallel is clear: an emergency fund and a plan help you stay rational when life gets chaotic.

Every small win builds the next win, showing readers that progress is often a series of practical choices, not one dramatic breakthrough.

Write this section as a lesson about resilience, contingency planning, and treating your money like a resource you measure and protect.

7. Little Women (2019)

A story about ambition and independence offers a timeless lesson about women and financial autonomy.

The film emphasizes how earning your own income changes what you can choose, tolerate, and walk away from.

It also explores the tension between creative fulfillment and financial security, showing that both matter and require honest tradeoffs.

Negotiation and control over your work appear as quiet forms of power, especially when society tries to set your price for you.

The money lesson is that independence is built through skills, contracts, and boundaries, not just dreams.

Use this section to discuss fair pay, owning your work, negotiating terms, and why self-respect and financial planning belong in the same conversation.

8. Joy (2015)

An invention storyline becomes a surprisingly useful warning about protecting your interests while building something new.

The movie shows how quickly other people will try to profit from your idea, your labor, or your trust if you do not set boundaries early.

It highlights persistence, but it also highlights paperwork, because patents, contracts, and clear ownership are part of getting paid.

The most powerful lesson is that believing in yourself is important, but verifying details is what prevents heartbreak and financial loss.

It also reinforces that setbacks do not mean failure, because many successful ventures look messy before they look impressive.

Write this section as a guide to side-hustle protection, smart partnerships, and the unglamorous steps that keep your success from being stolen.

9. The Secret Life of Walter Mitty (2013)

A gentle adventure reminds viewers that intentional spending can be more satisfying than automatic consumption.

The film contrasts routine comfort with meaningful experiences, showing how one brave choice can reset what you value.

It also nudges viewers to question lifestyle inflation, because “more stuff” rarely delivers the feeling we think it will.

The money lesson is not about spending nothing, but about spending deliberately on what aligns with your real goals.

When your choices reflect your priorities, saving stops feeling like deprivation and starts feeling like direction.

Use this section to talk about mindful spending, creating a “joy budget,” and choosing purchases that support the life you actually want.

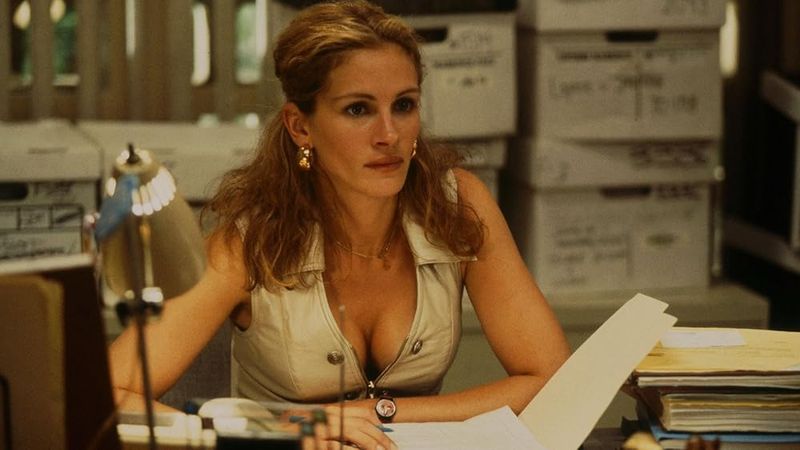

10. Erin Brockovich (2000)

A determined outsider demonstrates how self-advocacy can directly change your income and security.

The movie shows that competence alone is not always rewarded automatically, because you often have to demand recognition and fair compensation.

It also highlights the power of learning on the job, building expertise fast, and becoming too valuable to ignore.

The financial lesson is that negotiation is not pushy when it is grounded in results and responsibility.

It reminds readers that confidence can be built through preparation, because knowledge makes your ask stronger and your boundaries clearer.

Write this section as encouragement to negotiate raises, track your wins, and stop treating fair pay as something you have to “earn permission” to request.

11. Catch Me If You Can (2002)

A charming con story doubles as a practical lesson in why skepticism protects your wallet.

The movie makes it obvious how easily people trust confidence, credentials, and a good narrative, even when the facts are thin.

That translates to modern money pitfalls like fake job offers, too-good-to-be-true investments, and scams that exploit urgency.

It also shows how emotional needs can cloud judgment, which is why scammers often target stress, loneliness, or desperation.

The core money lesson is to verify before you commit, especially when someone pushes you to act fast.

Use this section to give readers actionable habits like double-checking links, freezing credit if needed, and pausing when a deal feels rushed.

12. The Intern (2015)

A workplace story about reinvention quietly argues that stability comes from systems, not constant hustle.

The film shows how long-term success depends on habits, relationships, and support, because burnout is expensive in both money and opportunity.

It also reinforces that learning never stops, and that staying adaptable can extend your earning years and widen your options.

The money lesson is that sustainable work beats short bursts of productivity that leave you depleted and inconsistent.

When you build routines that protect your energy, your career becomes steadier and your finances become easier to manage.

Write this section as a reminder that longevity is a strategy, and that the best financial plan includes rest, mentorship, and a life you can maintain.

Comments

Loading…