12 Classic Rom-Coms That Are Actually Financial Horror Stories

Rom-coms sell us a glittery fantasy where everything works out in ninety minutes, including the money part that real life refuses to ignore.

The meet-cutes are charming, the outfits are perfect, and somehow nobody seems stressed about credit limits, rent increases, or the fact that weddings and lifestyle upgrades cost more than a heartfelt speech.

But if you watch closely, a lot of these “comfort” movies are basically cautionary tales in a tiara, showing how quickly romance can morph into financial pressure, power imbalances, and decisions made for vibes instead of stability.

This isn’t about ruining your favorites; it’s about rewatching them with a smarter lens.

Because if a relationship requires luxury spending, constant rescue, or pretending you’re someone else, the happy ending can turn into a budget nightmare fast.

1. Pretty Woman (1990)

A whirlwind transformation can feel romantic on screen, but the money story underneath this one is a loud warning about lifestyle inflation and dependency.

The film’s fantasy hinges on a wealthy partner upgrading someone’s life through shopping sprees, fancy hotels, and high-status experiences that are impossible to sustain without a massive income behind them.

It subtly teaches that confidence and social acceptance are purchased rather than built, which is a dangerous lesson if you’re prone to spending for validation.

The power dynamic is also hard to ignore, because the person with the money controls the environment, the options, and the pace of the relationship.

In real life, that can blur boundaries and make it harder to walk away.

The financial horror is the idea that love equals access, not partnership.

2. Confessions of a Shopaholic (2009)

Debt looks cute when it’s paired with designer shoes and a quirky soundtrack, but the plot is basically a case study in what happens when spending becomes a coping mechanism.

The main character’s relationship with money is driven by impulse, avoidance, and the false belief that a future windfall will magically erase today’s choices.

Credit cards become emotional support objects, and the consequences are delayed just long enough for viewers to forget how quickly balances snowball once interest gets involved.

The movie also shows how shame can trap people in secrecy, which is one of the fastest routes to worsening debt, because it prevents honest conversations and practical solutions.

Romantic validation doesn’t fix a broken budget, and career success is not a guarantee if habits stay the same.

The “horror” is how relatable the spiral feels.

3. Bridget Jones’s Diary (2001)

Modern dating anxiety is relatable, but the money habits in this story are a reminder that emotional chaos often comes with financial leakage.

Nights out, last-minute plans, comfort purchases, and the constant effort to look effortlessly put together can quietly drain your budget without you noticing until the month ends.

The film captures a lifestyle that feels normal and fun, yet it’s the kind of routine that makes saving feel impossible, especially when social pressure keeps you saying yes.

There’s also the sneaky idea that your personal reinvention has to be visible to others, which encourages spending on appearances instead of stability.

Even when you’re not buying luxury items, the frequency of “little treats” adds up fast.

The financial horror story here is a soft one: death by a thousand convenience choices disguised as self-care.

4. My Big Fat Greek Wedding (2002)

Family love is the heart of the movie, but the wedding economics are a classic example of how quickly expectations can hijack a budget.

When everyone has an opinion, the event stops being about what the couple can afford and turns into a performance designed to satisfy relatives, traditions, and social standing.

Costs multiply through guest lists, catering, venues, outfits, decorations, and the endless add-ons that seem small until they stack together.

The story also highlights how hard it is to say no when money becomes tangled with belonging, because declining a request can feel like rejecting your community.

In real life, that emotional pressure can lead to financing a wedding with debt, raiding savings, or delaying other goals like buying a home.

The horror is not the celebration; it’s the bill that follows you into married life.

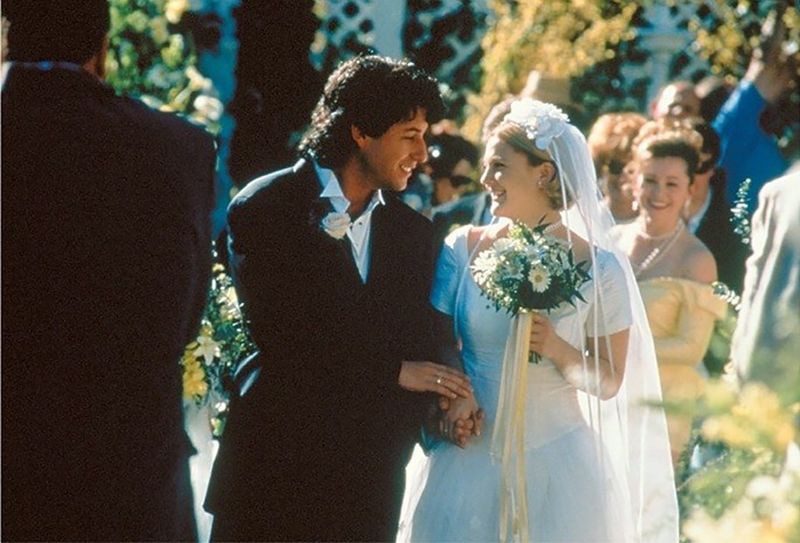

5. The Wedding Singer (1998)

Weddings are already expensive, and this movie reminds you that the most romantic day of your life is also a minefield of deposits, contracts, and nonrefundable decisions.

A big chunk of the plot hinges on a wedding that’s falling apart, which is exactly when financial risk becomes painfully real.

Vendors usually require money up front, and cancellation policies are rarely forgiving, especially when emotions make it hard to think clearly.

Add in last-minute changes, replacement plans, and the temptation to “fix” stress with spending, and you have a recipe for budget chaos.

The film is sweet, but it accidentally teaches a real lesson: commitments made too early can be expensive to unwind.

The financial horror is how often people treat wedding planning like a vibe instead of a series of legal agreements with price tags attached.

6. 27 Dresses (2008)

Being the dependable friend looks noble, but the money reality is that constant participation in other people’s milestones can become a second job you’re paying for.

The main character’s life is built around saying yes, which means spending on dresses, shoes, travel, gifts, hair, makeup, and all the hidden costs that come with being “supportive.”

Even if each wedding seems manageable, the repetition makes it brutal, because your budget never gets a recovery season.

The film also captures something many people don’t admit: resentment grows when your time and money are treated like an unlimited resource.

Financial boundaries are part of emotional boundaries, and this story shows what happens when you don’t have either.

The horror angle is how easily generosity turns into obligation, and how quickly your own goals get pushed aside while you fund everyone else’s celebrations.

7. How to Lose a Guy in 10 Days (2003)

The plot is played for laughs, but it’s built on performative romance that requires constant effort and often expensive gestures.

Dating “experiments” in movies tend to involve fancy outings, big surprises, and emotionally dramatic moments that would be wildly inefficient in real life, especially if you’re trying to keep a stable budget.

There’s also an underlying message that love is something you prove through spectacle, which can make people feel like normal affection isn’t enough unless it comes with a receipt.

When relationships become a stage, spending becomes a prop, and that’s how people end up financing dates, gifts, or trips they can’t afford just to keep a partner interested.

The film’s charm hides a real warning about manipulation, not just emotionally but financially too.

The horror is how quickly “fun” turns into a lifestyle arms race.

8. You’ve Got Mail (1998)

The romance is cozy, but the economic backdrop is brutal if you’ve ever watched a small business struggle against a giant competitor.

The story is set around a beloved independent bookstore getting squeezed by a massive chain with more money, more marketing power, and more ability to wait out losses.

It’s presented as an inevitable shift, yet the financial horror is that one person’s love story is built on another person’s livelihood being dismantled.

The movie also normalizes the idea that a corporate takeover can still have a charming face, which is a dangerous lesson if you’re thinking about job security, business ownership, or the true cost of “convenience.”

In real life, that kind of imbalance affects rent, wages, and community health, not just profits.

The rom-com ending doesn’t pay the bills for the displaced dream.

9. Notting Hill (1999)

A relationship that crosses major income and fame boundaries sounds exciting, but it comes with invisible financial stress that the movie only lightly acknowledges.

When one person lives a normal life and the other operates in a world of security teams, publicists, travel, and constant movement, the lifestyle mismatch can become exhausting.

Even if the wealthier partner pays for many things, the less wealthy partner can still feel pressure to keep up socially, dress the part, and absorb disruptions that affect work and income.

The cost is not just monetary; it’s also in lost productivity and the emotional labor of managing an unequal dynamic.

This is how resentment starts, especially if money becomes a tool that sets the rules.

The financial horror story is the illusion that love automatically equalizes power, when the real world usually makes differences louder over time.

10. Four Weddings and a Funeral (1994)

The movie is charming, but the underlying lifestyle is an expensive carousel of formal events that would destroy the average person’s budget in a single season.

Attending multiple weddings is not just about showing up; it’s travel, accommodations, gifts, outfits, and time off work that quietly adds up.

When you’re part of a social circle that treats these events as routine, you can start spending like you have unlimited funds, even if your income doesn’t match the expectation.

There’s also the pressure to participate enthusiastically, because opting out can feel like risking friendships or missing important moments.

In real life, this leads to credit card float, savings withdrawals, or financial anxiety disguised as being “busy.”

The horror is that the calendar becomes a payment schedule, and your goals get postponed one RSVP at a time.

11. Legally Blonde (2001)

Reinvention is inspiring, but the money story behind this one is a reminder that major life pivots have real costs that don’t disappear just because you’re motivated.

Moving across the country, paying for school, buying supplies, and maintaining a polished image is expensive even before you factor in the opportunity cost of time and lost income.

The film makes it look effortless, yet most people can’t fund a dramatic restart without scholarships, savings, or support systems.

It also flirts with the idea that confidence comes from looking the part, which can encourage spending on aesthetics instead of long-term stability.

The lesson you can pull from it is useful, though: success is more sustainable when you build skills and credentials, not when you shop your way into belonging.

The financial horror is copying the glow-up without copying the plan.

12. Two Weeks Notice (2002)

Workplace boundaries are the quiet financial theme here, and it’s surprisingly relevant because burnout can lead to bad money decisions.

The story centers on a talented person being pulled into constant rescue mode for a wealthy employer, which creates a dynamic where time, energy, and career leverage are treated as disposable.

When your job becomes emotionally draining, you’re more likely to overspend for comfort, neglect long-term planning, or feel trapped because the paycheck seems tied to someone else’s needs.

The film romanticizes proximity to wealth as a shortcut to security, but that can blur the line between partnership and dependence.

In real life, relying on a powerful person’s favor is risky, because a single mood shift can change everything.

The horror isn’t the romance; it’s the idea that overfunctioning is a career strategy, when it usually just drains you.

Comments

Loading…