Wallets are like time capsules, and for Baby Boomers, they often hold items that younger people simply don’t understand.

While Gen Z and Millennials rely on smartphones and digital apps, Boomers keep paper, plastic, and physical keepsakes that seem outdated or even risky today.

These wallet contents reveal a different era of technology, trust, and habits that are fading fast.

1. Checkbook

Paper checks feel like ancient artifacts to anyone who grew up with Venmo or Apple Pay.

Boomers often carry entire checkbooks, ready to write out payments at grocery stores or doctor’s offices. Younger generations rarely see checks outside of birthday cards from grandparents.

Banks now offer instant transfers, and most businesses prefer cards or digital payments.

Carrying a checkbook takes up space and requires manual record-keeping.

Yet for Boomers, checks represent control, proof of payment, and a familiar routine.

The ritual of writing a check, tearing it out, and recording the transaction feels trustworthy to those who grew up with it.

Younger folks find it slow and unnecessary in a tap-to-pay world.

2. Decades-Old Business Cards

Flip through a Boomer’s wallet and you’ll likely find business cards from the 1990s or early 2000s.

These cards feature fax numbers, outdated job titles, and companies that went bankrupt years ago.

They’re kept “just in case” someone needs that contact, even though LinkedIn and email have replaced business card exchanges.

Networking today happens digitally, with instant connections and searchable profiles.

Physical cards are rarely exchanged, and when they are, they’re quickly photographed or scanned.

Boomers, however, treat these cards like treasured relics of professional relationships.

The sentimental value outweighs practicality.

Each card represents a meeting, a deal, or a friendship that once mattered deeply.

3. Expired Medical Insurance Cards

Old insurance cards pile up in Boomer wallets long after coverage ends.

Even though healthcare providers now access insurance information digitally, these plastic cards remain tucked away.

Younger people simply show a digital card on their phone or let the doctor’s office look up their account.

Boomers worry that without the physical card, they won’t be able to prove coverage.

They remember when showing the card was mandatory and systems weren’t interconnected.

Holding onto expired cards feels like a safety net, even if it’s unnecessary.

The habit stems from decades of needing physical proof for everything.

Digital records feel less real and harder to trust for those who grew up with paper trails.

4. Handwritten Phone Number Lists

Folded scraps of paper listing phone numbers and addresses are common in Boomer wallets.

These handwritten backups exist even though smartphones automatically save and sync contacts across devices.

Younger people trust cloud storage and rarely memorize numbers anymore.

Boomers remember life before cell phones, when memorizing numbers or keeping written lists was essential.

Losing a phone meant losing all your contacts unless you had a backup.

That fear lingers, even with modern recovery options.

The paper list provides comfort and a sense of control.

It’s a tangible safety net in case technology fails, reflecting a time when analog methods were the only option available.

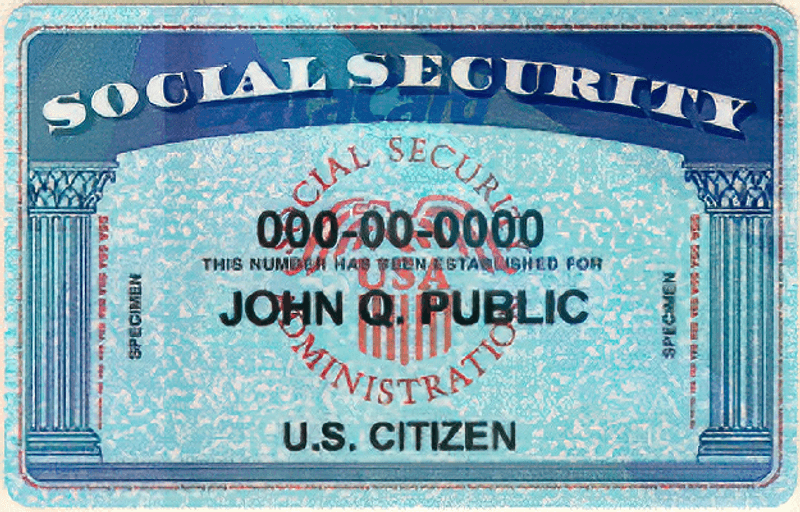

5. Laminated Social Security Card

Carrying a Social Security card is officially discouraged by the government due to identity theft risks.

Yet many Boomers have their cards laminated and stored in their wallets as if they’re essential ID.

Younger generations rarely carry theirs, knowing the number by heart or storing it securely at home.

The lamination itself damages the card and makes it invalid for official use.

Boomers treat it like a driver’s license, believing it’s needed for everyday situations.

In reality, most places only require the number, not the physical card.

This habit comes from an era when Social Security cards were used more frequently for identification.

Today, carrying it is a major security risk that older generations haven’t fully adapted to.

6. Rewards Cards for Defunct Stores

Blockbuster, Borders, Circuit City—these stores are long gone, but their loyalty cards remain in Boomer wallets.

Younger generations never experienced these retailers and can’t understand why anyone would keep a card for a business that closed over a decade ago.

Digital wallets and apps have replaced physical loyalty cards for most people.

For Boomers, these cards represent memories of shopping experiences and favorite hangouts.

They were once symbols of savings and rewards, carefully collected and guarded.

Letting go feels like erasing a piece of personal history.

The cards serve no practical purpose now, but they hold sentimental value that’s hard to throw away.

7. Emergency Cash in Odd Denominations

Two-dollar bills, old coins, and unusually large stacks of cash are common in Boomer wallets.

They keep this money “just in case” of emergencies, even though ATMs and credit cards are everywhere.

Younger people rarely carry cash, relying instead on digital payment methods that work almost anywhere.

The habit comes from growing up when cash was king and credit cards were less common.

Having physical money provided security and independence.

Odd denominations like $2 bills are kept as good luck charms or conversation starters.

For Boomers, cash represents freedom and preparedness.

It’s a tangible resource that doesn’t depend on technology or bank approval, offering peace of mind in uncertain situations.

8. Long-Unused Membership Cards

AAA, library, gym, and club membership cards from decades ago sit untouched in Boomer wallets.

These cards represent places they haven’t visited in years, yet they remain “just in case.”

Younger generations use digital memberships accessed through apps, with no need for physical cards.

Boomers remember when membership cards were the only way to prove you belonged.

Losing your card meant hassle and potential denial of service.

Even if they never use the membership, keeping the card feels safer than risking being caught without it.

Each card tells a story of past hobbies, commitments, or affiliations.

Throwing them away feels like abandoning those parts of their identity, even if they’re no longer active.

9. Handwritten Password Notes

Tiny folded scraps of paper listing usernames and passwords are tucked into Boomer wallets.

They trust these handwritten notes more than password managers or apps, despite the obvious security risks.

Younger people use encrypted digital tools that generate and store complex passwords automatically.

For Boomers, writing down passwords feels more secure because it’s physical and under their control.

They worry about forgetting login information or losing access to accounts.

The paper note provides reassurance, even if it’s easily lost or stolen.

This habit reflects discomfort with digital security tools and a preference for tangible records.

It’s a holdover from times when passwords were simpler and less critical to protect.

Comments

Loading…