12 “Easy Money” Trends That Are Mostly Scams (And What to Do Instead)

In a world where a 30-second video can make a scheme look like a sure thing, “easy money” trends travel fast and fact-checking travels slow.

The problem is that a lot of these viral promises aren’t side hustles at all—they’re polished traps built on hype, hidden fees, stolen data, or unrealistic income claims.

If a pitch makes it sound effortless, instant, and nearly risk-free, that’s usually the biggest warning sign of all.

The good news is you don’t have to swear off earning extra cash entirely; you just need to recognize which trends are designed to profit from you and swap them for alternatives that actually build savings or income over time.

Below are 12 common “easy money” trends that are mostly scams, plus what to do instead if you want results you can trust.

1. “Get Paid to Like Videos” / “Watch-and-Earn” Apps

Scrolling apps that promise cash for watching clips often look harmless, but the math rarely works in your favor.

Many use high payout thresholds, endless “verification” steps, or a points system that quietly devalues your earnings right before you cash out.

Others collect personal data, track your behavior, and bombard you with ads, while the promised payouts stay just out of reach.

Even when people do get paid, it’s usually pennies for hours of attention, which is a terrible trade if you’re counting on real income.

Do instead: treat micro-earning as a bonus, not a paycheck.

Stick to reputable cashback and receipt apps with clear terms, cash out early and often, and put that money straight into a sinking fund for groceries, gas, or bills.

2. “AI Crypto Trading Bots” That Guarantee Daily Returns

Anything claiming guaranteed daily profits should set off alarms, because legitimate investing doesn’t work like a vending machine.

Many “AI bot” platforms are simply flashy dashboards designed to convince you to deposit more, while withdrawals are delayed, restricted, or blocked entirely.

Some operate like Ponzi schemes, paying early users with new deposits until the whole thing collapses.

Others push you to connect wallets or share sensitive information, which can lead to direct theft.

Do instead: if you’re interested in investing, focus on boring, proven strategies that are transparent about risk.

Build an emergency fund first, then consider diversified, low-fee index funds or a retirement account, and keep any crypto exposure small enough that losing it wouldn’t derail your finances.

3. “Drop-Shipping Is Passive Income—Start in 24 Hours”

The pitch makes it sound like you can throw up a store, sit back, and watch orders roll in, but drop-shipping is rarely passive and often punishing for beginners.

You’re competing with thousands of identical sellers, ad costs can eat your margins, and customer service becomes your full-time job when shipping delays and quality issues appear.

Returns, chargebacks, and angry reviews are common, and platforms can shut down stores that violate policies you didn’t even realize existed.

Do instead: choose a path where your effort directly translates into pay.

Service-based freelancing—writing, virtual assisting, design, editing, bookkeeping—can be started with minimal overhead and clear pricing.

It’s easier to build repeat clients, and you don’t have to gamble your budget on ads just to get your first sale.

4. Reselling “Secrets” and Flipping-Course Hype

When flipping is presented as a guaranteed shortcut to wealth, the real product is often the course, not the strategy.

Many reselling gurus cherry-pick rare wins, ignore fees and returns, and downplay how much time it takes to source inventory, photograph items, list them, pack shipments, and handle customer issues.

Some even encourage questionable tactics, like buying up clearance in ways that can backfire if demand isn’t there.

Do instead: learn with free resources and start small.

Pick one category you know well—kids’ clothes, home goods, collectibles—and test local demand through Facebook Marketplace or vetted platforms.

Track net profit after fees, shipping supplies, and your time so you can see what’s actually working, then scale only what consistently pays you.

5. “Amazon Automation Stores” / “We Run Your Store for You”

Paying someone to run an online store sounds like the ultimate hands-off income stream, but these “automation” offers are notorious for big upfront fees and vague deliverables.

Some operators use risky tactics that violate platform rules, which can get your account suspended while the “management” company shrugs and moves on.

Others inflate profit projections, show polished screenshots, and disappear once they’ve collected enough clients.

Even in legitimate setups, you still own the risk, the taxes, and the responsibility if something goes wrong.

Do instead: if e-commerce interests you, build skills before you outsource anything.

Start with a small product line you control, sell locally or through a simple storefront, and learn the basics of inventory, fulfillment, and customer service so you can spot bad partners and protect yourself.

6. “Digital Real Estate” Website Packages

Buying a pre-built site that supposedly earns “while you sleep” can feel smarter than starting from scratch, but many packages rely on inflated traffic claims or revenue that vanishes the moment the seller stops propping it up.

You might be handed a generic template, scraped content, or low-quality backlinks that can tank your site in search results.

In the worst cases, the “business” is built on stolen material or shady methods that create long-term problems for you, not the seller.

Do instead: build your own small platform where you understand every piece.

A simple niche blog, newsletter, or resource page can grow slowly and honestly through helpful content and consistent publishing.

Monetize with affiliate links you disclose, digital products you create, or lead generation for services you actually provide.

7. “Affiliate Marketing Systems” That Require a Pricey Course First

Affiliate marketing itself is real, but the viral “system” trend often turns it into a pay-to-play funnel.

The pitch usually pushes you to buy an expensive course, then teaches you to sell that same course or a similar bundle to others, which creates a cycle that benefits the people at the top.

Income claims tend to be based on best-case scenarios, and the “proof” is often screenshots without context, ad costs, or refunds included.

Do instead: do affiliate marketing the straightforward way.

Pick products you genuinely use, join reputable programs with clear terms, and build trust through content that helps people make informed decisions.

Focus on one channel—blog posts, Pinterest, TikTok, or YouTube—and treat it like a long game where credibility pays more than hype ever will.

8. Fake “Remote Job” Offers That Ask for Fees or Send a Check

Remote work is booming, which makes it a perfect hunting ground for scammers who impersonate real companies.

Common setups include asking for an “application fee,” pushing you to buy equipment from their “vendor,” or sending a fake check and instructing you to forward money elsewhere before the bank reverses it.

Other versions try to collect sensitive information like your ID or Social Security number under the guise of onboarding.

Do instead: protect yourself with a simple rule: legitimate employers never charge you to work.

Verify the company’s website and email domain, look up the recruiter on LinkedIn, and search the company name plus “scam” before sharing personal details.

If something feels rushed or secretive, slow down and walk away.

9. “Mystery Shopping” That Requires Paying to Activate Assignments

Mystery shopping is a real industry, but scam versions copy the language and prey on people who want flexible income.

They may ask you to pay for “training,” membership access, or a starter kit, then promise high-paying assignments that never materialize.

Another common tactic involves sending a check and telling you to buy gift cards as part of the “job,” which is actually a fake-check scam.

Do instead: if you want quick, flexible side cash, use platforms with transparent rules and public reputations.

Legit mystery shopping companies don’t require upfront payments, and they pay via clear methods after you complete verified work.

You can also explore user testing, local gig tasks, or temp shifts, which often pay more reliably without the same risk of getting played.

10. “Credit Repair” Shortcuts and “Debt Erase” Services for a Fee

The promise of instantly boosting your score or wiping debts clean is tempting when money feels tight, but many “repair” services charge hefty fees for steps you can do yourself—or they use tactics that can backfire.

Some dispute accurate information repeatedly, hoping the bureaus remove it due to volume, which is not a strategy you want tied to your financial record.

Others make illegal guarantees, encourage shady identity tricks, or collect your personal data while delivering little.

Do instead: focus on legitimate, boring fixes that actually move the needle.

Pull your credit reports, dispute errors properly, pay down utilization, and set up reminders for on-time payments.

If you need help, work with a nonprofit credit counselor who explains your options clearly and doesn’t promise miracles.

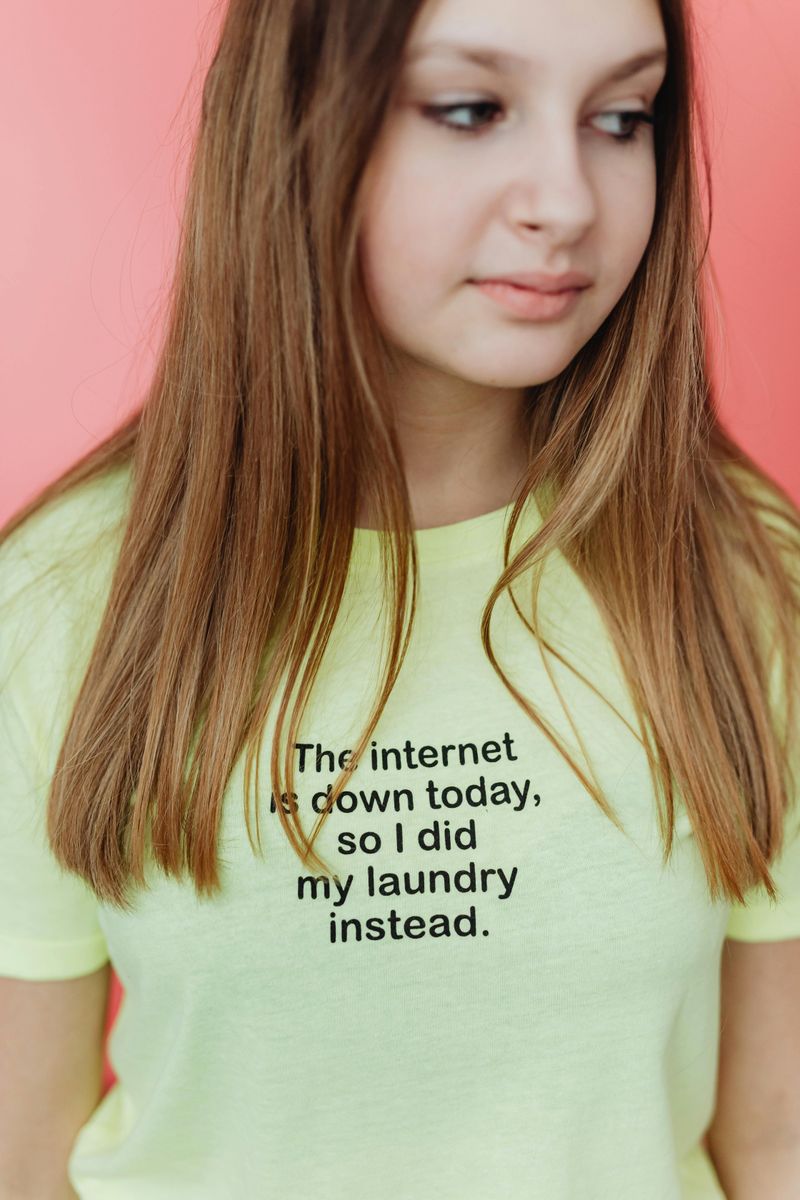

11. “Print-on-Demand Makes $10K a Month With Zero Work”

Print-on-demand can be a real business model, but the “effortless” trend leaves out the hardest parts: standing out, understanding demand, and driving traffic without burning money on ads.

Many beginners end up copying what’s already selling, which can lead to trademark issues or listings getting taken down.

Others underestimate production timelines, customer expectations, and the reality that your margins shrink quickly once fees and promos are involved.

Do instead: treat POD like a creative side business, not a slot machine.

Build original designs around a niche you understand, research keywords, and focus on organic traffic sources like Pinterest or SEO.

Start with a few strong listings, watch what converts, and refine your products based on data instead of hype.

12. High-Ticket Coaching Scripts That Sell the Dream

Not all coaching is a scam, but “high-ticket” trends often rely on pressure sales, vague promises, and income claims that sound like guarantees.

The playbook usually emphasizes selling confidence and aspiration rather than clear outcomes, and it can quietly shift into a recruit-and-resell culture where the biggest earners are the ones teaching others to sell coaching.

If you can’t clearly explain what you’re getting, what the timeline is, and what happens if it doesn’t work, you’re not buying a plan—you’re buying hope.

Do instead: if you want to monetize expertise, package something specific and measurable.

Offer a defined service, create a small course with a narrow result, or sell a workshop that solves one problem well.

Clarity builds trust, and trust builds income.

Comments

Loading…