13 Frugal Habits That Make a Big Difference Over Time

Small financial decisions we make every day can have a huge impact on our wallets over time. Developing smart money habits doesn’t mean living a life of sacrifice – it’s about making thoughtful choices that align with your priorities. These thirteen frugal habits might seem minor at first, but their compounding effect can transform your financial future.

1. Cook Meals at Home

Restaurants charge a premium for convenience and atmosphere. By preparing meals in your own kitchen, you’ll save hundreds of dollars monthly while gaining control over ingredients and portions. Batch cooking on weekends creates ready-to-eat options throughout the week when you’re tired or busy.

Many home cooks discover they actually prefer their own creations to restaurant versions once they develop basic skills. Start with simple recipes that use affordable ingredients and gradually expand your culinary repertoire. The satisfaction of creating delicious food while watching your savings grow makes this habit doubly rewarding.

2. Master the 24-Hour Purchase Rule

Impulse buying drains bank accounts faster than almost any other habit. When tempted by something unexpected, walk away and wait a full day before deciding whether to purchase it. During those 24 hours, ask yourself: Do I truly need this?

Will it meaningfully improve my life? Can I find it cheaper elsewhere? Often, the initial shopping excitement fades, revealing the item as unnecessary. For online shopping, leave items in your cart overnight. Many retailers will even send discount codes when they notice abandoned carts, potentially saving you money if you do decide to buy.

3. Embrace Library Resources

Modern libraries offer far more than just books. Members can borrow movies, music, video games, and even unusual items like tools, musical instruments, and baking equipment – all completely free. Many libraries provide free access to expensive subscription services for newspapers, magazines, and educational platforms.

The library’s digital apps let you borrow e-books and audiobooks without leaving home. Regular library visits also create no-cost family outings with storytimes, workshops, and community events. This single habit can save hundreds annually on entertainment while expanding your horizons and supporting a valuable community resource.

4. Perform Regular Maintenance

Neglect turns minor issues into major expenses. Regular maintenance of your home, car, appliances, and even clothing dramatically extends their lifespan and prevents costly emergencies. Simple routines like changing air filters, rotating tires, cleaning lint traps, and addressing small repairs immediately pay enormous dividends.

Maintenance schedules prevent forgetting critical tasks that protect your biggest investments. The financial math is compelling: a $30 oil change prevents a $3,000 engine replacement. A $100 appliance tune-up avoids a $1,000 emergency repair. This habit requires minimal time investment while delivering some of the highest returns among frugal practices.

5. Track Every Dollar Spent

Money awareness creates money wisdom. Tracking expenses reveals spending patterns you never noticed before, highlighting areas where cash mysteriously disappears. The simple act of recording purchases makes you think twice about unnecessary spending. Use a notebook, spreadsheet, or budgeting app – the method matters less than consistency.

Categories help identify your biggest spending areas. Many people discover they waste substantial amounts on forgotten subscriptions, convenience foods, or small impulse purchases. After a month of tracking, you’ll spot opportunities to redirect money toward what truly matters to you. This habit transforms your relationship with money by replacing vague anxiety with clear understanding.

6. Automate Savings First

Money vanishes when it sits in checking accounts. Setting up automatic transfers to savings and investment accounts on payday ensures wealth-building happens before spending does. The psychological advantage is powerful – you adapt to living on what remains rather than struggling to save leftovers.

Start with whatever percentage feels comfortable, even just 1-2%, then gradually increase it with each raise or debt you eliminate. This “pay yourself first” approach creates financial security without requiring daily willpower. Many people who implement this system report they barely notice the missing money while their savings grow steadily, providing both practical resources and priceless peace of mind.

7. Embrace Second-Hand Shopping

The moment new items leave the store, they lose substantial value while remaining functionally identical. Thrift stores, online marketplaces, and garage sales offer nearly-new items at dramatic discounts. Furniture, clothing, sports equipment, and electronics purchased second-hand often cost 70-90% less than retail.

Beyond savings, this habit reduces environmental impact by keeping useful items out of landfills. Successful second-hand shoppers develop an eye for quality and value, checking items carefully before purchasing. They also learn patience, waiting for the right item rather than settling for whatever’s available. This approach transforms shopping from mindless consumption to a satisfying treasure hunt.

8. Pack Lunches and Snacks

Convenience foods extract a heavy price from your wallet. The $12 workday lunch might seem reasonable until you multiply by 20 workdays – suddenly it’s a $240 monthly expense that could be reduced by 75% through home preparation. Keeping a stash of portable snacks prevents impulse purchases when hunger strikes unexpectedly.

Reusable containers and water bottles eliminate daily spending on disposable packaging and drinks. The quality advantage is significant too. Homemade meals typically contain better ingredients and appropriate portions. Many lunch-packers report feeling more energetic and focused compared to days when they eat restaurant meals, adding productivity benefits to the financial ones.

9. Cut the Subscription Bloat

Subscription services multiply quietly in the background of our financial lives. Many households pay for multiple streaming services, apps, magazines, and memberships they rarely use, creating a steady drain of $10-$20 charges that accumulate into hundreds monthly.

Conduct a subscription audit every few months. List everything that automatically bills you and honestly assess which services truly enhance your life. Consider rotating subscriptions rather than maintaining them simultaneously. For necessary subscriptions, regularly check for better deals or family sharing options. Many providers offer discounts for annual payments instead of monthly billing. This simple habit often identifies hundreds in annual savings for services you won’t even miss.

10. Learn Basic DIY Skills

Professional services come with hefty price tags. Learning to handle simple home and car maintenance, basic clothing repairs, and furniture restoration saves substantial money while building useful life skills. Free tutorials online make learning accessible to everyone. Start with simple projects like unclogging drains, hemming pants, or painting rooms.

Each successful project builds confidence for tackling more complex tasks. Beyond immediate savings, DIY skills provide long-term security and satisfaction. The ability to solve problems independently reduces stress during emergencies and creates a sense of accomplishment. Many people discover hidden talents and even develop hobbies that bring joy along with financial benefits.

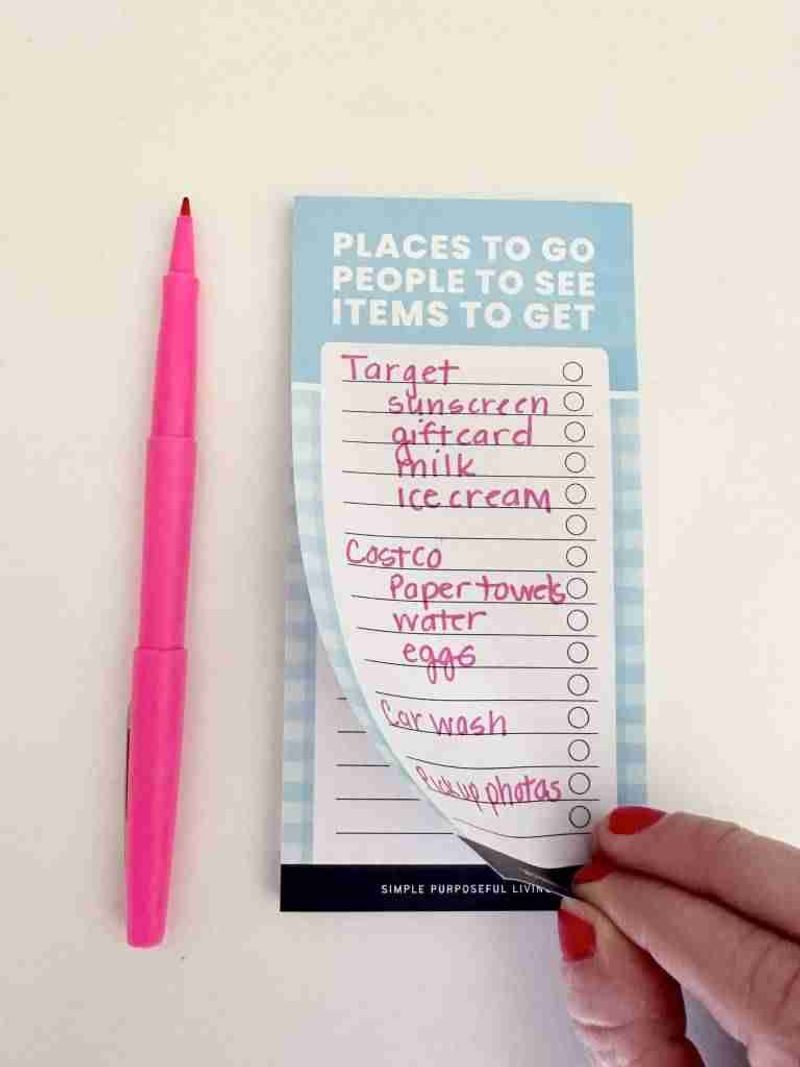

11. Plan Errands Strategically

Haphazard errand-running wastes both fuel and time. Clustering tasks by location and planning efficient routes can cut transportation costs significantly, especially as fuel prices rise. Maintaining a running list of needed items prevents multiple trips for forgotten essentials. Combining errands with your regular commute further reduces unnecessary driving.

Many strategic planners designate specific errand days rather than making impulsive trips. This habit delivers benefits beyond savings. Reduced driving means less vehicle wear and maintenance, lower environmental impact, and more free time. The mental clarity from organized planning often leads to better purchasing decisions and less impulse buying during each stop.

12. Cultivate Free Hobbies

Entertainment expenses add up quickly. Developing interests that cost little or nothing provides lasting enjoyment without ongoing costs. Walking, reading library books, community sports, and creative pursuits like writing or drawing require minimal investment.

Nature-based activities like hiking, birdwatching, or stargazing offer rich experiences completely free. Many communities provide free concerts, museum days, and cultural events if you know where to look. These activities often deliver deeper satisfaction than expensive entertainment because they involve active participation rather than passive consumption. Many free hobbies also build skills, community connections, and physical health – benefits you’d normally pay professionals to help you achieve.

13. Celebrate Progress, Not Purchases

Our culture encourages buying things to mark achievements or provide emotional comfort. Shifting celebrations away from shopping toward experiences creates meaningful memories without accumulating stuff. Replace shopping rewards with activities that align with your values – outdoor adventures, creative projects, or quality time with loved ones.

When gifts are appropriate, consider consumables, handmade items, or contributions to something the recipient is saving for. This mindset shift transforms special occasions from budget-busting events to opportunities for genuine connection. People who adopt this habit often report deeper satisfaction with celebrations and holidays, finding that meaningful interactions leave longer-lasting positive feelings than even the most exciting purchases.

Comments

Loading…