As is commonly understood, we, as citizens, must fulfill our civic obligation by contributing our equitable portion toward federal tax. However, these surtaxes only existed after the 16th President took office. Let us look at the rates of these surcharges during the tenure of different administrations.

Abraham Lincoln (1861-1865)

Due to the battle, Abraham Lincoln and his administration recognized the urgent need for substantial revenue to sustain the Union army. He charged cess for proceeds above $600. Individuals earning between $600-$10,000 paid 3%, and individuals with income above $10,000 contributed 5%.

Andrew Johson (1865-1869)

When Andrew Johnson succeeded Abraham Lincoln, little changed concerning the duty to be paid by the citizens. The residents continued to pay between 5% to 7.5% on wages from $600 to %10,000. Further, the administration generated additional revenue primarily from tariffs and excise duties.

Ulysses S. Grant (1869-1877)

Ulysses S. Grant stayed in office from 1869 to 1877, and during his initial years, the taxation system remained the same. However, his primary aim was to reduce the burden of the average American, and in 1872, he introduced a reformation. This change brought by him abolished the federal payments.

Rutherford B. Hayes (1877-1881)

From 1877 to 1893, U.S. nationals were exempt from making any remission to the government. As Ulysses G. Grant repealed the Revenue Act, other nation heads, like Rutherford B. Hayes, followed suit.

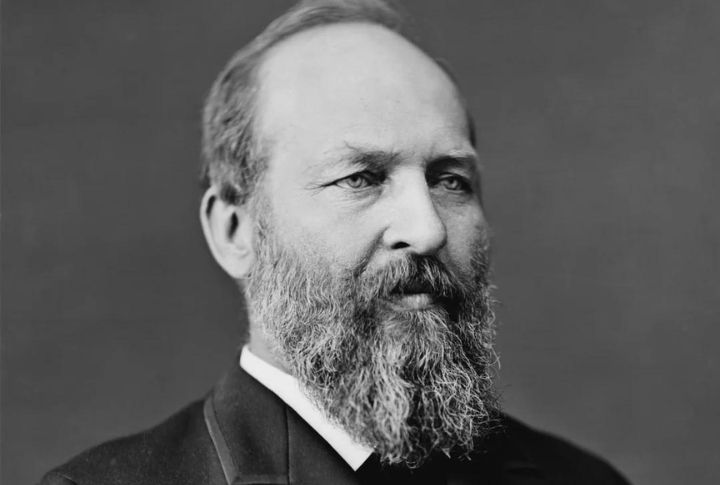

James Garfield (1881)

James Garfield’s presidency, which began in March 1881, was tragically cut short by an assassin’s bullet just four months into his term. During his time, the federal government relied heavily on other taxes like tariffs and excise to generate revenue rather than income taxes.

Chester A. Arthur (1881-1885)

When Arthur assumed the position under challenging circumstances, the nation was still reeling from the shock of his predecessor’s death. Like the former President, he did not reinstate income tax during his time in office.

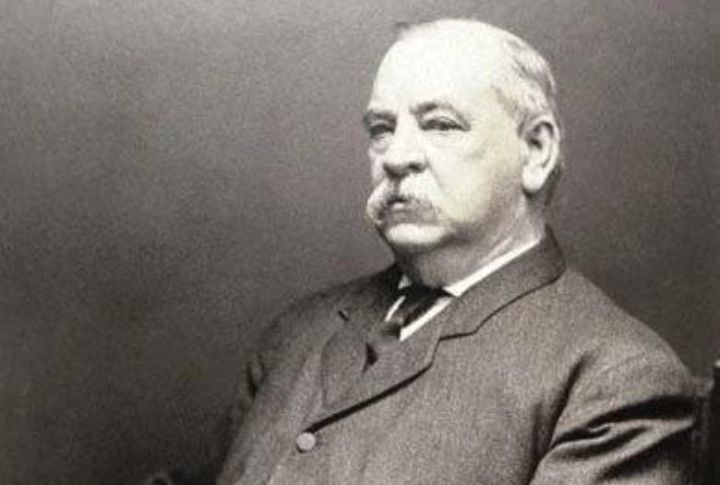

Grover Cleveland (1885-1889 & 1893-1897)

Grover Cleveland was the 22nd and 24th head of state and served for two non-consecutive terms. In 1893, he permitted a bill to take effect, introducing a 2% cost on individual gains exceeding $4,000 and corporate profits exceeding operating costs. This legislation was proclaimed unconstitutional by the Supreme Court in 1894.

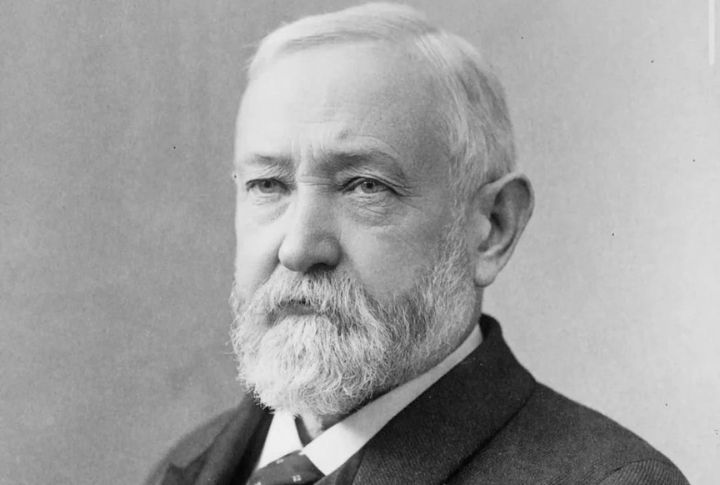

Benjamin Harrison (1889-1893)

Benjamin Harrison’s presidency is known for advocating protectionist economic policies, expansionist foreign policy goals, and efforts to promote civil rights. While excise taxes existed on specific goods produced or sold domestically, there were no charges on one’s income.

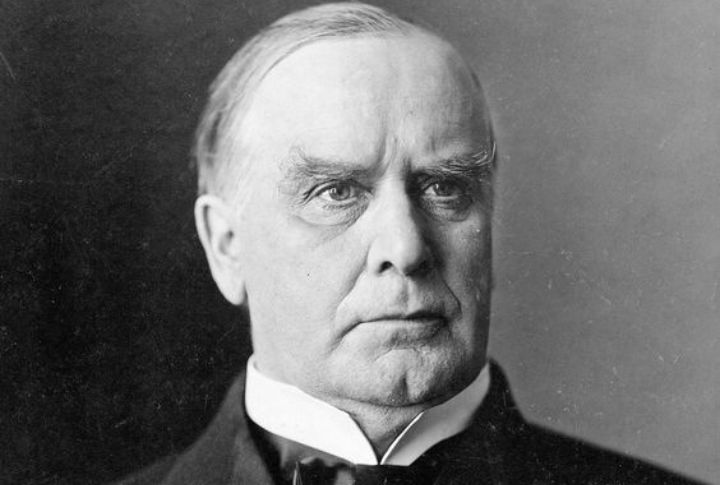

William McKinley (1897-1901)

As the Supreme Court came to the rescue of the ordinary men and declared the act of 1893 null and void, one was not obligated to give a portion of their remuneration. Thus, the government earned revenue from excise taxes on goods and commodities.

Theodore Roosevelt (1901-1909)

Harrison championed economic protectionism, expansionism, and civil rights. He supported and signed the McKinley Tariff Act of 1890, which raised tariffs on imported goods to foster economic growth instead of charging revenue on one’s earnings.

William Howard Taft (1909-1913)

William Howard Taft, the 27th President, led the nation from 1909 to 1913. Known for his distinguished legal career and commitment to public service, he pursued various domestic and foreign policies. Even during his tenure, the public had a respite from paying taxes on their incomes.

Woodrow Wilson (1913-1921)

When Woodrow Wilson took office, he signed the Revenue Act of 1913, which gave rise to the modern income tax. He introduced seven categories of taxpayers and imposed charges from 1% to 7% on various salaries. By 1921, an average American paid 4% to 73% as dues to the executive.

Warren G. Harding (1921-1923)

In times of despair, Warren G. Harding proved to be a savior for the health of the U.S. His strategies brought significant changes in every aspect, including contributions by the citizens. Harding lowered cess from 73% to 58%, all with the help of sound fiscal policies.

Calvin Coolidge (1923-1929)

Calvin Coolidge was in command from 1923 to 1929, and like his predecessor, he was keen on easing the pain of the locals in terms of their liability. Finally, in 1926, he could give effect to legislation that cut down federal costs to 25%.

Herbert Hoover (1929-1933)

Herbert Hoover had a challenging task when he came to power from 1929 to 1933. He was to stimulate the American economy and alleviate the discomfort of his people. Hoover passed an act of 1932 that raised the top marginal fee on income from 25% to 63%—a dramatic escalation intended to bolster federal coffers amidst plummeting revenues.

Franklin Roosevelt (1933-1945)

Upon assuming office, Franklin Roosevelt implemented bold reforms to address economic hardship and reshape the federal government’s role, including significant changes to federal taxation. He revised the regime and increased the duty to 79% on earnings exceeding $5 million—a dramatic departure from previous imposts.

Harry Truman (1945-1953)

Almost a century following Lincoln’s introduction of the federal duty on earnings, Harry Truman hiked revenue-raising efforts to unprecedented heights to finance warfare. The Revenue Act 1950 escalated the minimum toll to 20% and the top rate to 91%. As a result, even people with modest turnover contributed at least one dollar out of every five earned.

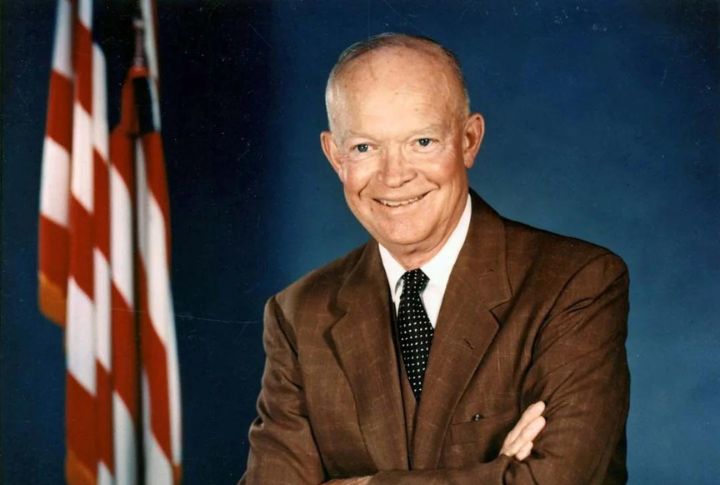

Dwight D. Eisenhower (1953-1961)

During the administration of Dwight D. Eisenhower, federal fees underwent several changes, primarily aimed at promoting monetary expansion and bolstering government funds. Singles falling in the category of high-earners had to shell out between 91% and 92%, whereas for corporates, it was up to 52%.

John F. Kennedy (1961-1963)

Although John F. Kennedy aimed at lowering fees on one’s earnings, his efforts could not materialize. His proposal to tax individuals between 14%-65% and corporations up to 47% remained a distant dream. Encumbrances on singles remained up to 92% and on corporate bodies up to 52% during Kennedy’s time.

Lyndon B. Johnson (1963-1969)

During Lyndon B. Johnson’s tenure, liability towards the government varied depending on remuneration levels and other factors. However, during his administration, one significant piece of legislation was the Revenue Act of 1964, which introduced substantial reductions towards cess for individuals and corporations from 91% to 70%.

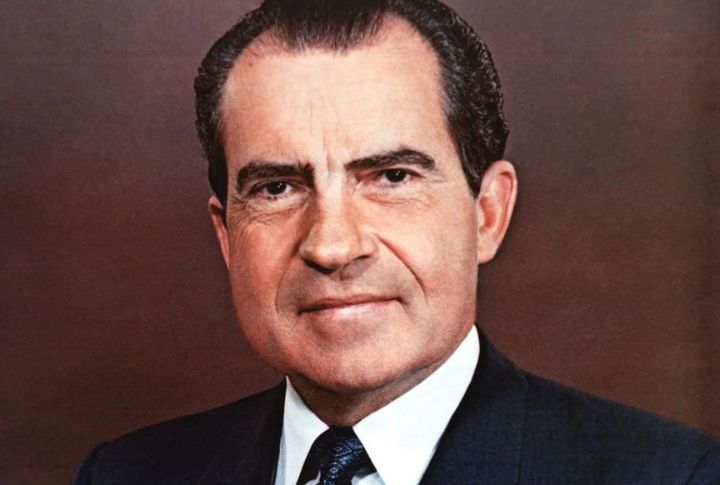

Richard Nixon (1969-1974)

Compared to his predecessors, Richard Nixon did not bring about any consequential amendment in revenue policies. The average American continued to pay unprecedented levels of money, reaching up to 70% to the ministry. By this system, individuals with high yields were subject to higher tax rates.

Gerald Ford (1974-1977)

Leading the nation in times of financial instability was a challenging task for Gerald Ford. Therefore, despite understanding the necessity to reduce pressure on U.S. nationals, he could only be of a bit of help. Even during Ford’s presidency, people had no choice but to give up on 70% of their wages.

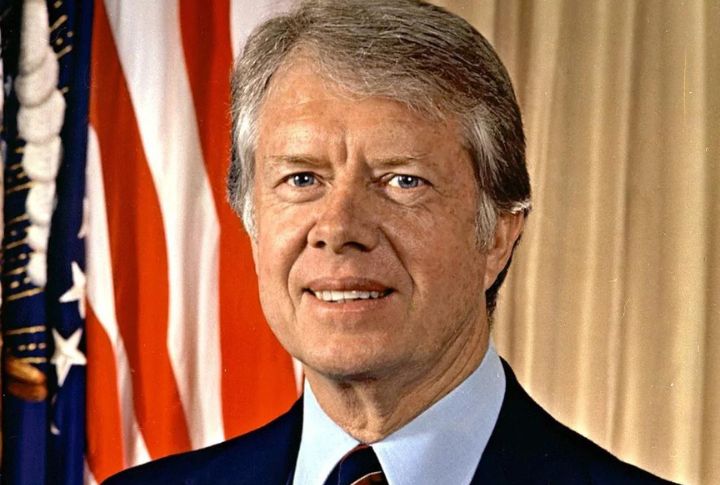

Jimmy Carter (1977-1981)

Jimmy Carter had good intentions when he suggested a deduction in surtaxes. Unfortunately, he did not realize he had an uphill task of managing the finances of the United States during his tenure. So, despite Carter’s best efforts, the middle class and affluent continued to pay dues up to 70%.

Ronald Reagan (1981-1989)

Ronald Reagan stands out as a chief of the United States as he was deeply dedicated to reducing the burden on taxpayers. The reforms he put forth notably decreased contributions from 70% to 50%. Subsequently, in 1986, Reagan signed the Tax Reform Act, further lowering it to 28%.

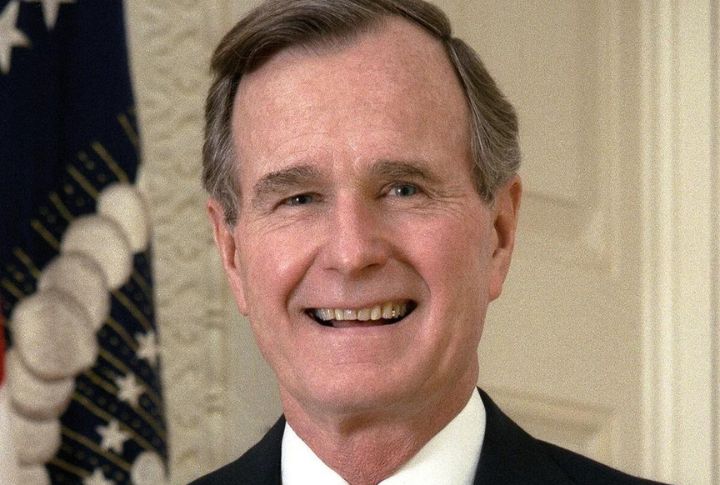

George H.W. Bush (1989-1993)

When George H.W. Bush took the reigns of the state, its debt stood larger than he imagined. To tackle the financial situation, this bureaucrat had no choice but to escalate the contributions made by the public and body corporates, resulting in surtax soaring at 31%.

Bill Clinton (1993-2001)

Bill Clinton aimed to provide respite to low-income households and middle-class groups. On August 10, 1993, he enacted the Omnibus Budget Reconciliation Act. This ruling established a payment bracket of 36% to 39.6% for high-earning singles within the top 1.2% of wage earners. Additionally, businesses had to pay 35% as tolls.

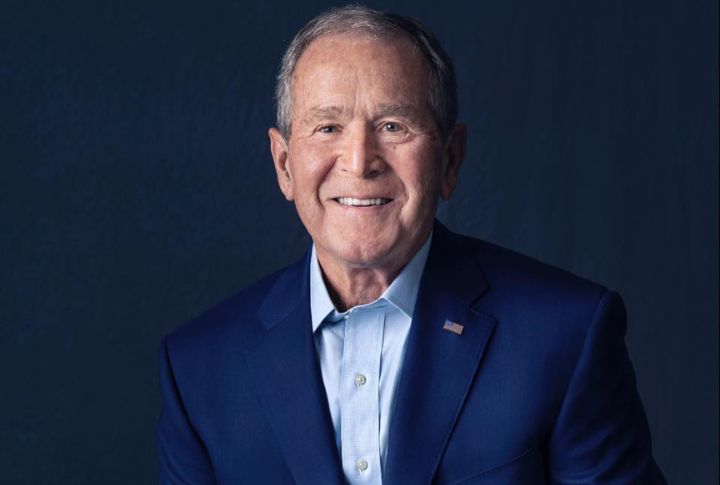

George W. Bush (2001-2009)

Learning from his father’s experience, George W. Bush fulfilled his pledge to reduce encumbrances on the people of the United States. The Economic Growth and Tax Relief Reconciliation Act 2001 lessened impositions to 35%. Additionally, the government levied a novel surcharge of 10% on the wealth of $6,000 drawn by persons.

Barack Obama (2009-2017)

In 2016, Barack Obama revealed a scheme to generate more revenue for the state. The various measures included plans to raise tariffs on investments. Through this action, he made the higher salaried groups pay charges up to 39.6%.

Donald Trump (2017-2021)

As soon as Donald Trump came to power, he enacted the Tax Cuts and Jobs Act, initiating extensive alterations to the code. The various brackets from 39.6%, 33%, 28%, 25%, and 15% were lowered to 37%, 32%, 24%, 22%, and 12%, respectively. The lowest range remained at 10%, and the 35% remained unchanged.

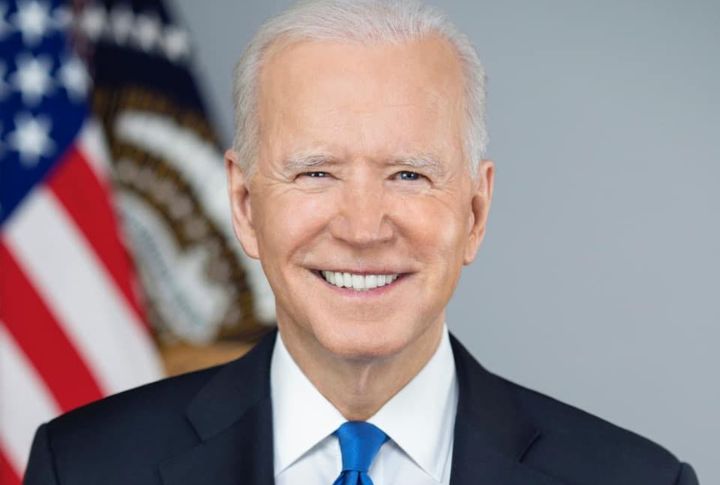

Joe Biden (2021-Present)

The presidency of Joe Biden brought with it a renewed focus on surtax policy. His proposals could not materialize, and the taxation rates implemented during Donald Trump’s term have continued.

Comments

Loading…