Most people make it a habit to hide their credit cards and try not to use them throughout the month. Wise people, however, use them for their everyday purchases on a regular basis. Those people, you’re thinking, are not wise; they’re in debt up to their eyeballs and they’re in such a state of financial trouble they cannot even begin to see a way out. What if we told you that is not necessarily the case? What if we told you that you could use your credit card every single month to create an actual, workable, realistic budget? You can; and we can tell you how. But first we have to make a few small disclaimers.

The first is that you cannot use your card to pay all your expenses and then just ignore the bill by paying the minimum amount due. No, you have to pay that balance in full each month so that you haven’t a balance left. Secondly, you cannot blindly spend. You have to make a budget and stick to it. All that using your credit card is going to do is make that easier for you. Tracking your spending is a breeze when you use a credit card to do it, and there is another bonus that you might not consider when you use your credit card excessively each month.

Getting Paid to Budget

Our favorite reason to use your credit card each month is to get paid to budget. That’s right; when you pay your mortgage, expenses, gas, utilities and groceries and everything else you pay for and buy each month with your credit card, you do something quite unique. You earn money that’s completely and utterly free. You get to get paid. Let’s say you have a cash back credit card (and many of them are cash back cards) that offers you 1% cash back on all your purchases. If you spend $3000 per month on this card to pay your expenses, you’ll earn $30 per month in free money. That’s not a lot, but that’s $360 per year that you can cash out at Christmas time and have to spend on gifts for loved ones.

What if that card offers 1% cash back on all purchases, but 5% cash back on certain purchases such as gas and groceries? Let’s just say that $1500 of your $3000 monthly spending consists of gas and groceries. That means you’ll earn 5% cash back on $1500, which is $75 per month in addition to the 1% cash back you’re earning on your other $1500 in expenses for another $15 per month. That’s $90 per month you’re being given to pay your expenses for a grand total of $1080 per year in FREE MONEY.

Are you interested in learning how to use your credit card to budget now? I thought so.

Research Cards

The most important thing to do is research cards, first and foremost. If you’re going to put this much cash on your card every month, you want one with a great reward system. Some prefer mileage or rewards, and others prefer their cash back methods. Find the card with the biggest cash back offer. Don’t worry so much about the interest rate; you’re not carrying a balance. You won’t pay interest. You need to find the card that will give you the most for your money. You might even find that you can locate a card that will track your spending by categorizing it for you so that you can more easily budget.

Another thought to consider; a charge card might be a better idea than a credit card for you. A charge card is one that allows you to charge what you want each month as long as it’s paid off in full each month. You have no option, which is great for those who aren’t sure they have the discipline to pay in full each month.

Track Your Spending for a Month

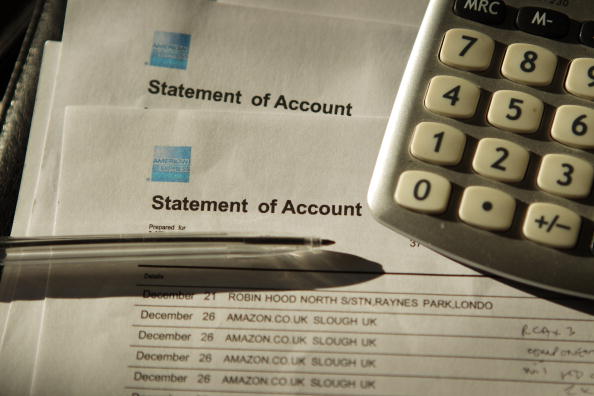

Let your credit card do the tracking for you. At the end of the month, sit down with your spouse and figure out what you’ve spent, where you’re spending it and how you can fix your budget. This is the time to notice where your money is going and how to better allocate your funds. For example, when you see that you spent $200 on coffee and lattes at Starbucks, you’re going to be horrified (and you’re going to see why your diet isn’t working like you thought it might). If you see that you spend $100 a week in lunches at restaurants, you’re going to be horrified.

This is not a fun process, and it’s going to require some discipline and change. The good news is that the first month is the most difficult. Once you get into the habit of either budgeting lunches or coffee or taking your own, you’re going to find it much easier to live this way in the future. The withdrawal is going to be tough, however.

Create Your Budget

Now you know where your money is going, so create a written budget. I like the idea of allocating funds for certain things and then not going over those. But you have to include every last detail of your spending. This means everything from gas to utilities to your water bill to your trash pick-up to your coffee stops. Once you are over-budget on those, you are done.

Stick to the Budget

The best way to stick to your budget is with a credit card. Why? Because you can see where your money is going and how much you’ve spent. You can pull up your credit card app and see how much you’ve spent on certain things throughout the month and how much is left over for you to spend. It’s simple and it’s effective; and the answers being right here without you doing any work to find them makes your life a lot simpler.

Pay that Card Off

This might be the 10th time I’ve said this in the past few paragraphs, but it bears repeating just one more time. You absolutely, positively cannot create a realistic budget with a credit card if you do not pay that card off in full every single month. EVERY. SINGLE. MONTH.

Photo by Peter Macdiarmid/Getty Images

Comments

Loading…